Market Report Plastics - April 2011

Information about the market for plastics is being presented by:

bvse - Bundesverband Sekundärrohstoffe und Entsorgung e.V.

1. The market for primary plastics

The clusters of the political factors (Japan, Middle East, Far East, change in energy politics) and economic factors (mineral oil price, demand, precursors, production quantities, production oligopolies, trade flows, warehousing) that influence plastics production and plastics processing are extremely complex at present. And yet, in total the individual factors clearly indicate an increase in the demand for standard plastics and technical plastics, which, however, leads to further price rises. For instance, the mineral oil price has been increasing almost continuously since the beginning of this year: in week 16 it was quoted at USD 122/barrel. To date, the curve for mineral oil quotes has been running parallel to the one for 2008, which peaked at USD 145/barrel in July 2008. The mineral oil prices are causing precursor prices to increase, which then, in turn, boost the prices of plastics. The increase in the demand for plastics in spring has further pushed the prices up. It is above all the automotive industry and the building sector that show an increase in the demand for plastics. The still existing global supply shortages, caused by plant shut-downs and plant failures, are having an additional price-boosting effect

Standard plastics have reached record highs: this is the fifth price rise in a row. In March the average price quoted by EUWID for the ten types of plastics listed below was 1,496 /t. This price thus exceeded the previous month's by 54 /t. The quotes for PE and PP increased by 70 /t on average; the prices of PS and PVC rose by 30 /t each. The following prices are quoted for the ten types of standard plastics in the EUWID Price Watch: LDPE film grade 1550 - 1610 /t, LLDPE film grade 1470 - 1530 /t, HDPE injection moulding 1380 -1450 /t, HDPE blow moulding 1400 - 1470 /t, PS crystal clear 1610 - 1640 /t, PS high impact 1690 - 1740 /t, PP homopolymer 1500 - 1600 /t, PP copolymer 1550 - 1650 /t, PVC tube grade 1200 - 1250 /t and PVC film/cables 1290 - 1340 /t. The prices of PET also continue to rise: In March PET for packaging was quoted at 1700 - 1800 /t, thus exceeding the previous month's quote by 90 /t.

The end of the current market situation is not yet in sight: the supply shortages are still accompanied by a considerable demand. The prices of standard plastics and technical plastics are likely to further rise in May, too. As a result of the increased purchase prices, the processors are currently not storing larger plastics quantities in their warehouses, even though this would stabilise the markets.

2. The market for secondary plastics

The great demand from the primary market continues to boost the secondary markets. There is still a high demand for plastics from recycling. However, steadily rising input prices are making it difficult for plastics recyclers and plastics processors to attain appropriate profit margins. Recyclates are still selling well in the markets. Compared to virgin materials, regrind, regranulates and regenerates/compounds are quoted at favourable prices. Plastics are now also separated from waste streams that have previously been less frequently used. Even the amount of film processed in the EU domestic market has increased by now. With the majority of markets being volatile at present, the warehouse capacities in the plastics chain, which includes collecting, sorting and processing companies, are currently not being expanded. The prices of standard plastics and technical plastics are likely to further rise in April and May.

The demand from the Far East for plastics grades from Europe has not yet attained the previous months' level in April, either. Therefore, the supply situation in the domestic market is improving. Furthermore, reclyclers import plastics from abroad. In other European countries outside of Germany, there is a rising trend towards accepting plastics as valuable substances, which leads to the separate collection of and increased trading in plastics in these areas.

2.1 EUWID Price Watch

In March the EUWID Price Watch also showed marked price rises in secondary plastics. On top of that, considerable price differentiations can be observed, i.e. the upper and lower price caps are, in part, expanded in various ways. The price rises range from 10 /t to 160 /t for all standard plastics. The price estimates for export film have slightly decreased, namely by 5 /t to 30 /t.

As far as PE post industrial is concerned, the March Price Watch indicates price increases of 56 /t for regrind. Bale goods remained more or less stable. The following prices were quoted: HDPE mixed colours 550 - 700 /t, HDPE natural 650 - 850 /t, LDPE mixed colours 500 - 650 /t, LDPE natural 650 - 800 /t and LDPE-film grade mixed colours 230 - 300 /t and LDPE-film grade natural 450 - 550 /t.

The post-user PE grades ultimately show nearly stable prices, i.e. both slight price rises (10 /t to 30 /t) and slight price reductions (5 /t to 20 /t). Export film is quoted at a slightly lower price because the demand from the Far East is on the decline. The quotes for regrind from crates have gone up by 20 /to to 30 /t. In March the prices changed as follows: LDPE shrink film mixed colours (E49) 230 - 300 /t, film transparent natural < 70 ΅m 340 - 370 /t, mixed film (80/20) 170 - 210 /t, mixed film (90/10) 225 - 255 /t, HDPE hollow bodies mixed colours (C29) 200 - 350 /t, HDPE regrind from crates colour-separated 620 - 820 /t and HDPE regrind from crates mixed colours 580 - 670 /t.

PP: In plastics processing, there is an increasing number of material shifts from PE towards PP. The PP markets are undergoing change: the increased virgin material prices and the considerable demand for primary and secondary materials are having an impact here. There is a shortage of PP in post-industrial and post-consumer goods. The price of PP post-industrial has gone up by 38 /t on average: film mixed colours (K59) 130 - 330 /t, film natural (K50) 350 - 500 /t, homopolymer mixed colours 450 - 700 /t, homopolymer natural 60 - 800 /t, copolymer mixed colours 450 - 700 /t and copolymer natural 600 - 800 /t.

PS: In March the PS markets reached record highs. The price increases in the primary markets as well as the considerable demand in the secondary markets (post-consumer goods and post-industrial waste) led to marked price rises. The quotes for PS post-industrial went up by 50 /t to 160 /t or by 82 /t on average: standard mixed colours 500 -700 /t, standard crystal clear 600 - 850 /t, standard white 600 - 850 /t, high impact mixed colours 600 - 800 /t, high impact black 630 - 830 /t and high impact white 700 - 1000 /t. High impact white attained 1000 /t in the upper price range. The continuous upward trend in the demand for PS is likely to lead to further price rises in April and May.

PVC: Some PVC prices went up in March, too. Slight price rises can be reported for post-industrial waste: PVC-U mixed colours 450 - 550 /t and tube grade mixed colours 400 - 550 /t. Windowframe regrind was quoted at: white 600 - 720 /t, mixed colours 450 - 550 /t and single-shade white 700 - 840 /t. The boom in the construction industry will stabilise or further boost PVC prices in April and May.

PET post user: The prices of used PET bottles continue to rise. Each beverage bottle collected is valuable, which is why it is termed "the golden PET bottle". The following will help to illustrate this: "post-consumer PET bale goods", which only consist of colour-separated and baled beverage bottles, have attained or even exceeded the prices of regrind from post-industrial waste made of PET, PP or PVC. This shows impressively that there has been a well-established and continuously optimised collection system for non-returnable, returnable and recyclable PET for years - even alongside the system for the collection of returnable glass bottles. The drawback is that the PET market is hopelessly overheated. There is still the danger of PET recycling in Europe coming to an end. This is why the existing processing capacities are being reduced. The virgin material prices, which are still rising, enable PET recyclers to continue plastics processing as long as they can pass on the increased prices to the recyclates. There are speculations as to whether the wild price increases in PET have ground to a halt. PET processors are trying to stabilise the markets by means of imports.

In March the EUWID quotes for PET transparent and mixed-coloured PET went up by 60 /t and 90 /t. The prices of used and disposable PET bottles are still climbing from one peak to the next. The following prices were quoted: PET transparent 580 - 650 /t and PET mixed colours 390 - 470 /t. According to some reports, there have, in part, been agreements for the sale of PET bottles worth 700 /t or more.

2.2 plasticker price index

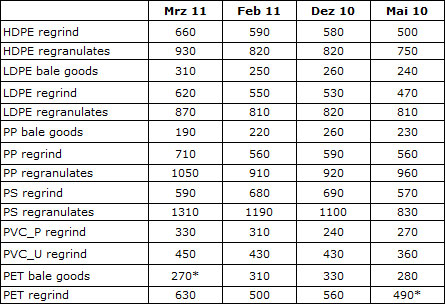

The plasticker price index for standard plastics showed markedly higher prices in March than in the previous month. The price reductions that occurred in February came to an end. The forecast of the April Price Watch shows marked price rises again in this area, too. In March the prices went up by 20 to 140 /t. However, PP bale goods decreased by 30 /t, whereas PS regrind went down by 90 /t. According to plasticker, the following price quotes changed by more than + 40 /t in March 2011: HDPE regrind +70 /t, HDPE regranulates +110 /t, LDPE bale goods +60 /t, LDPE regrind +70 /t, LDPE regranulates +60 /t, PP regrind +50 /t, PP regranulates +140 /t, PS regranulates +120 /t and PET regrind by +130 /t.

Table 1: Prices of standard plastics in plasticker, quoted in /t

*Supply figures too low to attain statistical significance

In the March price index, technical plastics were quoted at markedly higher prices, too. The price increases ranged from + 20 /t to + 320 /t. Only PA 6.6 was quoted at a lower price - both as regrind (-10 /t) and as regranulates (- 260 /t). The forecast of the April quotes indicates a further price increase. February's price reductions have been more than offset by the increases that have occurred in March and April. According to plasticker, the following price quotes changed by more than +70 /t in March 2011: ABS regrind +240 /t, PC regrind +130 /t, PC regranulates +320 /t and PA 6 regrind +130 /t.

Table 2: Prices of technical plastics in plasticker, quoted in /t

*Supply figures too low to attain statistical significance

The monthly quotes for secondary plastics, which are updated on an hourly basis, can be calculated using the price lists that are derived from the quotations published in the raw material exchange plasticker (cf. www.plasticker.de). The prices listed in this index are quoted with reservation - as the majority of the quotes submitted are not necessarily equivalent to the sales prices. Furthermore, plasticker does not distinguish between the following grades: transparent, mixed colours or colour-separated. Therefore, the information provided by plasticker may indicate different market behaviour than the prices quoted by EUWID.

The EUWID price quotes refer to bale goods or regrind. The given prices were quoted for business transactions between sorting plants or sales agents or the processing industry, as the case may be. As a rule, the prices refer to quantities in excess of 20 t ex works. The prices attainable in trade can differ considerably from the indicated price range in both directions, depending on the grade of the type of plastic material quoted. The abbreviations used for some grades refer to the list of waste plastics published by the German Federal Association for Secondary Raw Materials and Waste Management (bvse)/Bureau of International Recycling (BIR).