Market Report Plastics - June 2011

Information about the market for plastics is being presented by:

bvse - Bundesverband Sekundärrohstoffe und Entsorgung e.V.

1. The market for primary plastics

Even though the economic news is still favourable, economic development has been slowing down in the second quarter, as reported by the German daily newspaper Sόddeutsche Zeitung in week 25. According to the business climate index of the German Institute for Economic Research (Institut fόr Wirtschaftsforschung, Ifo), the general mood in the German economy has, surprisingly, further improved. As the Ifo Institute announced, the index rose by 0.3 points to 114.5 points. The Ifo index has now attained the highest level since reunification. The German central bank (Bundesbank) expects total growth in Germany to reach 3.1 per cent.

There is still a high level of demand for plastics in all areas of trade and industry. The markets for standard plastics have come to show a sufficient supply, which is used by buyers to speculate on falling prices. Even raw material prices have now exceeded their previous peak levels. In May both precursors and plastics showed price consolidation. In June there has been a trend towards falling plastics prices for the first time. Even mineral oil prices have attained more realistic assessments; in week 25 mineral oil was quoted at USD 108/barrel. On top of all that, the world of politics is now acting concertedly by supplying the markets with part of the strategic oil reserves. As a consequence, mineral oil prices have declined, namely to USD 104/barrel.

Even in May the EUWID Price Watch for standard plastics showed stable quotes, which are in line with those of the previous month. The price rises and price decreases were balanced in May. Thus, the average price of the ten types of plastics listed below was 1,500 /t. The price changes ranged between +/- 10 /t and +/- 20 /t. LDPE film grade 1550 - 1610 /t, LLDPE film grade 1440 - 1500 /t, HDPE injection moulding 1440 - 1480 /t, HDPE blow moulding 1440 - 1480 /t, PS crystal clear 1540 - 1560 /t, PS high impact 1630 - 1660 /t, PP homopolymer 1530-1630 /t, PP copolymer 1600 - 1700 /t, PVC tube grade 1230 - 1280 /t and PVC film/cables 1320 - 1370 /t. The consolidation of PET prices continued in May, too. PET for packaging was quoted at 1620 - 1720 /t and thus fell short of the previous month's price by 80 /t on average. The quotes for PET are expected to further decline.

The European markets for standard plastics proved to be stable in May. However, over the past two weeks in June the plastics markets have been shifting, showing marked price decreases. There are new hopes for the summer break; from July the markets are likely to consolidate. A price decline is thus likely to occur in July and August. Technical plastics are still in great demand. Therefore, their prices are expected to remain stable in 2011.

2. The market for secondary plastics

Over the past two weeks in June there has been a trend reversal in the prices for standard plastics. The peak levels of the price rises for input materials have been exceeded. The markets are shifting, i.e. the prices of input material are falling from one week to the next. The plastics processors are postponing their purchases to be able to take advantage of further price decreases. Experts expect the prices in the secondary markets to fall as a result of the decline in virgin material prices The secondary markets are shifting more considerably than the primary markets. The prices of standard plastics are expected to further consolidate or even rise during the summer break. The situation of technical plastics is predicted to remain largely unchanged, i.e. there will be stable markets.

The export trading volume has been rather low in the first half of 2011, compared to the previous years. In May and June the demand from the Far East for plastics grades has continued to be on the decline. However, to date the export figures published by DESTATIS for the first quarter of 2011 for waste plastics sold to the Far East have shown no more than a slight decline in exports to the People's Republic of China, Hong Kong and the Netherlands (departure ports), namely of 10,000 t. In absolute numbers, the export trading volume of plastics with the Far East fell from 246,472 t (first quarter of 2010) to 236,470 t (first quarter of 2011). There are some indications of a change in the Far East markets: recyclates from the Far East are being offered in the Single European Market for the first time.

2.1 EUWID Price Watch

EUWID reports on market stabilisation at a high level for May. The EUWID Price Watch shows some price rises in standard plastics, namely of 5 /t to 30 /t. There are also some reports on price reductions, namely of 10 /t to 30 /t.

The quotes for PE post-industrial have increased: HDPE mixed colours 235-330 /t, LDPE film grade mixed colours (K49) 240 - 340 /t and LDPE film grade natural (K40) 420 - 590 /t. The price rises and price decreases in post-user PE grades are largely balanced. The May quotes changed as follows: LDPE shrink film grade natural (E40) 470 - 550 /t, LDPE farm film b/w (B41) 30 - 70 /t, mixed film (80/20) 150 - 180 /t, mixed film (90/10) 200 - 220 /t, mixed film (98/2) 300 - 340 /t, HDPE regrind from crates colour-separated 650 - 830 /t and HDPE regrind from crates mixed colours 600 - 720 /t.

PP: The PP markets have been recovering again after the interventions in the PP secondary markets were temporarily terminated. Larger amounts of PP are now being sold in the markets. EUWID shows price rises again for May, namely in: film grade mixed colours (K59) 200 - 350 /t, homopolymer mixed colours 480 - 720 /t and copolymer mixed colours 480 - 720 /t. The PP quotes are reported to have fallen in June.

The price of PS post-industrial proved to be stable in May. In May only the quote for high impact white slightly changed: 700 - 950 /t.

PVC: Both the PVC post-industrial and the PVC windowframe regrind prices consolidated at a high level in May. There were one-sided price increases in a few grades, which mostly did not exceed 20 /t. In May the quotes for post-industrial changed as follows: PVC_U mixed colours 480-600 /t and tube grade mixed colours 430 - 600 /t. Windowframe regrind was quoted at: windowframe regrind white 630 - 750 /t, windowframe regrind mixed colours 480 - 600 /t and single-shade white 730 - 870 /t. These price rises were a result of the great demand from the construction industry.

PET post user: The PET market is shifting rapidly. For instance, on the one hand the falling virgin material prices are having an impact on the secondary markets; on the other hand, the volume outflow to the Far East is still on the decline. Furthermore, the demand for PET rises during the summer months as a result of the increased demand for beverage bottles. In May the EUWID quotes were on the decline for the first time in months, i.e. they decreased by 70 /t for PET transparent and by 50 /t for PET coloured. Thus, the following quotes were listed for PET: PET transparent 550 - 640 /t and PET mixed colours 400 - 460 /t. Experts expect the PET prices to further decrease in July and August.

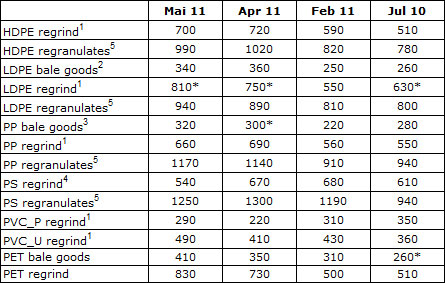

2.2 plasticker price index

The plasticker quotes for May showed price consolidation. The price rises, which ranged between 30 /t and 80 /t, and the price reductions, which ranged between 20 /t and 120 /t, were largely balanced. According to plasticker, the following price quotes changed by more than +/- 40 /t: LDPE regrind +60 /t, LDPE regranulates +50 /t, PS regrind -130 /t, PS regranulates -50 /t, PVC_P regrind +70 /t, PVC_ U regrind +80 /t, PET bale goods mixed colours -60 /t and PET regrind mixed colours -100 /t. The forecast of the prices quoted in June shows that the quotes for May have held their own.

Table 1: Prices of standard plastics in plasticker, quoted in /t

*: Supply figures too low to attain statistical significance 1: equivalent to the grade "post-industrial, mixed colours"; 2: equivalent to K49; 3: equivalent to K59; 4: equivalent to "standard, mixed colours; 5: equivalent to the grade "regranulates, black"

Technical plastics are still at an all-time high. In May, they were quoted at markedly higher prices again in the plasticker price index. These price rises ranged between 50 /t and 400 /t. However, the price of PA6 regrind decreased by 140 /t. The following price quotes changed by more than 70 /t: ABS regranulates 130 /t, PC regrind 70 /t, PC regranulates 80 /t, PBT regranulates 80 /t, PA 6.6 regranulates 400 /t and POM regranulates 260 /t. The first forecast of the June quotes shows price consolidation for technical plastics at a high level.

Table 2: Prices of technical plastics in plasticker, quoted in /t

*Supply figures too low to attain statistical significance

The monthly quotes for secondary plastics, which are updated on an hourly basis, can be calculated using the price lists that are derived from the quotations published in the raw material exchange plasticker (cf. www.plasticker.de). The prices listed in this index are quoted with reservation - as the majority of the quotes submitted are not necessarily equivalent to the sales prices. Furthermore, plasticker does not distinguish between the following grades: transparent, mixed colours or colour-separated. Therefore, the information provided by plasticker may indicate different market behaviour than the prices quoted by EUWID.

The EUWID price quotes refer to bale goods or regrind. The given prices were quoted for business transactions between sorting plants or sales agents or the processing industry, as the case may be. As a rule, the prices refer to quantities in excess of 20 t ex works. The prices attainable in trade can differ considerably from the indicated price range in both directions, depending on the grade of the type of plastic material quoted. The abbreviations used for some grades refer to the list of waste plastics published by the German Federal Association for Secondary Raw Materials and Waste Management (bvse)/Bureau of International Recycling (BIR).