Market Report Plastics - November 2011

Information about the market for plastics is being presented by:

bvse - Bundesverband Sekundärrohstoffe und Entsorgung e.V.

1. The market for primary plastics

The Occupy Coalition for Action (Aktionsbündnis Occupy) deserves tremendous respect for being a reminder to those in charge of the financial economy who are speculating to the detriment of the real economy. The virtual financial economy has been diverging far from its original task of supporting the real economy. While the financial speculations currently taking place are nearly exempt from any legal regulations, values, moral attitudes and responsibility, the real economy is subject to a number of regulations relating to tax, finance, the economy and labour legislation. It should be noted that companies not only provide jobs to white-collar and blue-collar workers; notwithstanding all the regulations, they also generate a large part of a country’s revenue from taxes.

The speculative bubbles are ultimately causing problems for European countries with a higher debt, which can now no longer be financed by the financial markets. Hence, it is not surprising that central economic parameters are indicating economic decline for the fourth quarter of 2011. In Germany, the foreign demand for goods is decreasing. However, the GfK Group indicates stable end-consumer behaviour for October. In June 2011, the plastics processors‘ turnover was reported to have risen by 2.4 %, and in May the growth in turnover amounted to 5.6 %.

The mood in the standard plastics markets deteriorated again in October. There was a low demand for plastics from the production and processing industries. The prices of standard plastics went down again in October. The average price of the ten types of plastics listed by EUWID below was 1304 €/t. Hence, the plastics price fell short of the previous month’s quote by 28 €/t. In October, the following prices were listed in the EUWID Price Watch: LDPE film grade 1330 - 1370 €/t, LLDPE film grade 1220 - 1280 €/t, HDPE injection moulding 1250 -1300 €/t, HDPE blow moulding 1250 -1300 €/t, PS crystal clear 1290 - 1350 €/t, PS-high impact 1360 - 1500 €/t, PP homopolymer 1280 - 1370 €/t, PP copolymer 1330 - 1420 €/t, PVC tube grade 1150 - 1190 €/t and PVC film/cables 1250 - 1290 €/t.

PET is not the only material to show the market behaviour described above. In October, the price of PET was quoted at 1570 – 1630 €/t and thus increased by 25 €/t on average. The rise in PET prices, which is accompanied by abundant supply, is explained by the renewed price rises in PX paraxylene and MEG monoethylene glycol. However, the PET prices are expected to slightly decline again by the end of this year.

In October, the considerable global supply of technical plastics led to price reductions. The high demand for technical plastics continues because they are used for high-tech products, which are in great demand without there being an alternative. According to the EUWID Price Watch for October, the prices of technical plastics fell short of the previous month’s quote by 50 €/t to 200 €/t. Only PMMA held its own. The EUWID Price Watch shows the following prices for technical plastics: PMMA crystal clear 2560 - 2700 €/t, ABS natural 1850-2050, ABS white/black 1950 - 2150, ABS coloured 2550 - 2900, PC crystal clear 2800 - 3000 €/t, PC GF 3100 - 3300 €/t, POM natural 2400 - 2500 €/t, PA 6 natural 2550 - 2750 €/t, PA 6 black 2550 - 2750 €/t, PA 6 GF reinforced 2900 - 3000 €/t, PA 66 natural 3200 - 3300 €/t and PA 66 GF 3300 - 3400 €/t. Experts still expect the markets to change – among other things, through new production capacity and the decline in demand during the winter. Nevertheless, the demand for technical plastics is generally assessed as being high both in the fourth quarter of 2011 and in the first quarter of 2012.

2. The market for secondary plastics

In retrospect, the majority of plastics processors and plastics recyclers already now assess the years 2010 and 2011 as satisfactory and positive throughout. However, additional insolvencies are also reported to have occurred in the plastics recycling industry. The secondary plastics markets are assessed as slightly calmer and more relaxed in the fourth quarter now, whereas the previous months are considered to have been overheated. During the summer break of 2011, the majority of plastics recyclers continued to produce unabatedly. If possible, processors want to reduce the great amount of overtime hours accumulated during the Christmas period. This is why there is talk of having a longer maintenance break at the end of this year.

Even October and November are assessed as being favourable by the majority of plastics recyclers. Recyclates are selling well in the plastics markets. The market situation is gradually getting back to normal. The plastics recyclers are now focusing on various strategies again; for instance, they are supplying purchasers in more remote areas, the product portfolio is being adjusted, the first stocks are being replenished, incoming and outgoing plastics grades are being reviewed.

The measures announced by the People’s Republic of China as early as in April 2010 to regulate exports will now take effect around the end of 2011: plastics exports to Hong Kong and from there to the People’s Republic of China will be made even more difficult, the illegal transport of plastics to the People’s Republic of China via Vietnam will no longer be allowed, and there will be further measures to check the information on quality standards provided in the transport documents. These measures are aimed at improving the direct transfer of the high-quality plastics materials required in each case to the recycling centres in the People’s Republic of China, as indicated.

2.1 EUWID Price Watch

EUWID reported on a consolidated and stable market for valuable plastics in October, too. At the same time, however, they indicated numerous one-sided price reductions. The majority of price reductions have affected standard plastics in the high-end range. On average, the 19 prices in question were reduced by 21€/t each. Nevertheless, price setting for secondary plastics is still largely independent of the considerably higher price reductions in primary plastics. EUWID expects the November prices to hold their own or to decrease slightly.

The quotes for PE post-industrial have decreased: LDPE natural 650 - 820 €/t, LDPE film grade mixed colours (K49) 240 - 340 €/t and LDPE film grade natural (K40) 450 - 560 €/t. Even PE post user was quoted at a lower price: LDPE shrink film natural (E40) 450 - 520 €/t, transparent natural <70 μm 320 - 365 €/t, transparent mixed colours <70 μm 70 - 120 €/t, LDPE farm film b/w > 70 μm (B41) 30 - 75 €/t, mixed film (90/10) 220 - 250 €/t, mixed film (80/20) 190 - 220 €/t, HDPE regrind from crates, colour-separated 630 - 830 €/t and HDPE regrind from crates, mixed colours 600 - 710 €/t.

The demand for PP was stable in October, too. The trend towards PP continues for packaging, styrofoam and in the construction industry (i.e. for pipes). The processors and recyclers are provided with sufficient input at stable prices. There are very different grades of PP regrind in the market, whose prices are then also assessed accordingly. There were price reductions of 380 – 500 €/t in film natural (K50) and of 630 – 820 €/t in homopolymer mixed colours.

Despite the considerable price decreases of 75 €/t in PS primary goods, PS secondary goods have held their own. PS is in very great demand at all levels. Supply is meanwhile largely balanced. High-impact white is now quoted at 700 – 870 €/t, and its price is even lower in the top-end range, namely by 80 €/t. Apart from the areas of packaging and vehicle construction, as well as electrical and electronic appliances, the PS market is also dependent on the building sector.

The prices of PVC have held their own. PVC pipes have lost market share, whereas HDPE has gained significantly in this respect. The demand for PVC is expected to change, depending on the economic activity in the building sector. The building measures taken during the winter have had a stabilising effect on the demand for PVC over the past few years.

PET post user: Surprisingly, some preform and bottle producers are trying to gain a foothold in PET recycling themselves – which is very astounding! In the event of such mergers, the conflict of interests between recyclers and bottle producers, which is currently still having a positive impact, will cease to exist. However, the conflicts resulting from mergers are likely to cause problems for bottle producers in the near future.

There is still a sufficient demand for PET regrind globally. European recyclers have shortened the length of their work shifts to offset the decline in demand. German PET processors can purchase a sufficient supply of materials at favourable prices in other European countries. This is increasing pressure on the German bottle prices. Furthermore, there are reports on a decline in enquiries from the Far East. In October, the EUWID quotes decreased by 20 €/t again. The following prices are now quoted for used and disposable PET bottles: PET transparent 420 - 480 €/t and PET coloured 300 - 350 €/t. To date, the price rises in the primary markets have not had any impact on the average bottle quotes mentioned here. Experts expect the prices of PET bottles to fall further.

2.2 plasticker price index

The demand for standard plastics was still considerable in October. The prices quoted in the plasticker price index are inconsistent; however, ultimately the price decreases prevail. These price reductions vary between 20 €/t and 100 €/t, and the price rises range between 20 €/t and 80 €/t. In October, LDPE bale goods were quoted at the lowest price in 12 months, and PS regranulates dropped to the lowest quote in 15 months. While PVC_U reached an all-time high at 570 €/t, the prices of PVC_P, which is being traded at 180 €/t, slumped considerably. According to plasticker, the following price quotes changed by more than +/- 40 €/t: LDPE-regrind -60 €/t, PP regranulates -60 €/t, PS regranulates -100 €/t, PVC-P regrind -80 €/t, PVC-U regrind +50 €/t and PET bale goods mixed colours +80 €/t. The forecast of the November Price Index shows price stabilisation at the level attained, as well as indicating a good demand.

Table 1: Prices of standard plastics in plasticker, quoted in €/t

*: Supply figure too low to attain statistical significance; 1: equivalent to the grade post-industrial, mixed colours; 2: equivalent to K49; 3: equivalent to K59; 4: equivalent to standard mixed colours; 5: equivalent to the grade “regranulates, black”

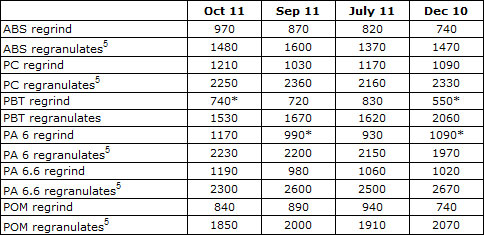

Technical plastics have been in great demand in October and November. The plasticker price index for October showed inconsistent quotes for technical plastics. Ultimately, the price decreases prevailed here as well. The following can be said about the price variations: the prices of regrind have been rising, whereas those of regranulates have been falling. ABS, PC and PA reached record highs in the October Price Watch. The price increases ranged between 20 €/t and 180 €/t, and there were price decreases of 50 €/t to 300 €/t. The following quotes changed by more than 70 €/t in October: ABS regrind +100 €/t, ABS regranulates -120 €/t, PC regrind +180 €/t, PC regranulates -110 €/t, PBT regranulates -140 €/t, PA 6 regrind +180 €/t, PA 6.6 regrind +110 €/t, PA 6.6 regranulates -300 €/t and POM regranulates -150 €/t. The first forecast of the November quotes shows price stabilisation or even price rises!

Table 2: Prices of technical plastics in plasticker, quoted in €/t

All EUWID prices are quoted ex works. As a rule, the prices quoted refer to quantities in excess of 20 tons. The monthly quotes for secondary plastics, which are updated on an hourly basis, can be calculated using the price lists that are derived from the quotations published in the raw material exchange plasticker. The prices listed in this index are quoted with reservation - as the majority of the quotes submitted are not necessarily equivalent to the sales prices. Furthermore, plasticker does not distinguish between the following grades: transparent, mixed colours or colour-separated. Therefore, the information provided by plasticker may indicate different market behaviour than the prices quoted by EUWID.