Market Report Plastics - January 2012

Information about the market for plastics is being presented by:

bvse - Bundesverband Sekundärrohstoffe und Entsorgung e.V.

1. The market for primary plastics

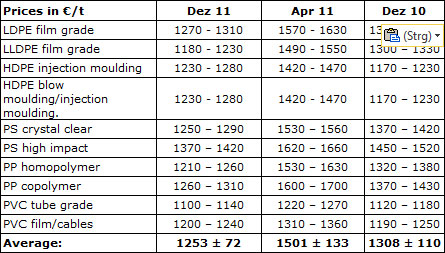

In retrospect, plastics production and plastics processing proved to be drivers of the economy in 2011. On the whole, plastics were in great demand. Peak prices were, above all, caused by the limited availability of plastics materials as well as by high precursor prices. The quotes for standard plastics went up until April and started declining again in September – after a sustained period of high demand from April to August. The 2011 December quotes were below those of December 2010. Table 1 represents a selection of months that illustrate the trend in price developments described above. Table 2 shows the developments in technical plastics, which rose until June and subsequently fell again. The 2011 December quotes are equal to those of December 2010 within the standard deviation.

Table 1: Comparison of EUWID quotes for standard plastics; prices quoted in €/t.

The December 2011 markets for standard plastics were restrained or, at best, consolidated. The price decline observable starting in August slowed down. There were expert reports on inconsistent purchasing behaviour. It was particularly gratifying to see that the first tendencies towards stabilisation became noticeable. Plastics producers attempted to adapt their production to the estimated demand of the plastics processors. With the exception of PS, the prices of all standard plastics decreased again in December. Hence, the average price of the ten types of standard plastics listed by EUWID was 1253 €/t. Thus, the plastics price fell short of the previous month’s quote by 17 €/t. However, the price decline slowed down markedly. PET followed the trend of the other plastics materials. For instance, PET was quoted at 1400 – 1520 €/t in December 2011, which means that its price fell by 40 €/t on average. There is still a considerable supply of PET in the European markets. And yet, PET producers expect prices to rise again in the first quarter of 2012. The January market is estimated to be balanced with respect to supply and demand. The plastics processors’ demand is likely to increase from January, which will probably cause the plastics prices to stabilise again.

The prices of technical plastics are also reported to have decreased further in December 2011; they declined by 50 €/t to 300 €/t or by 122 €/t on average. Only the quote for PA held its own. On the whole, there is a high demand for technical plastics; however, processors drew on their warehouse stocks in December and thus, they placed very few orders. In January, the demand is expected to rise again, which is likely to stabilise prices.

Table 2: Comparison of EUWID quotes for technical plastics; prices quoted in €/t.

2. The market for secondary plastics

2011 can be assessed as having been a rather successful year for plastics recyclers. Recyclates were in great demand on a national, European and international scale throughout the whole year. Primary were very advantageously supplemented by recyclates. The plastics markets for recyclates continued to improve their image. The prices quoted on the markets for standard plastics were high from April to September. Purchasers were particularly interested in recyclates from technical plastics, which attained record prices from May to September. However, high input prices had a negative impact on plastics recycling and processing. In addition, the insolvencies registered in 2010 and 2011 unsettled the remaining processors and recyclers. The European plastics markets got increasingly independent of the export trade with the Far East, where orders are now placed selectively, i.e. according to price and quality. The European domestic markets gained more and more in importance as a result of the exchange of processing input and recyclates.

Both the prices of standard plastics and those of technical plastics are reported to have declined again in December 2011. Market participants speculated on a further price decrease. This led to a rise in sales offers, which, in turn, pushed the prices down. Surprisingly, there was still a relatively high demand for plastics in December, which was met from warehouse stocks to the largest possible extent. According to recent estimates, the demand for recyclates is likely to rise in January. Furthermore, the Chinese New Year’s celebrations/Spring Festival will be held from 22nd to 28th January. Hence, the length of the winter break is being watched attentively.

2.1 EUWID Price Watch

According to EUWID, the price quotes for 28 of a total of 36 standard plastics have declined again, namely by 22 €/t. Hence, the developments in the prices of secondary plastics have followed the changes in the primary markets. According to expert reports, there were unexpected additional orders for recyclates in December, which caused the prices to stabilise to a certain extent.

PE post industrial: The prices of PE post industrial declined by 10 €/t to 50 €/t in December. Regrind fell by 20 €/t to 50 €/t, and the quotes for bale goods were lower by 10 €/t to 30 €/t. The following prices were quoted in December: HDPE mixed colours 470 - 650 €/t, HDPE natural 600 - 770 €/t, LDPE mixed colours 470 - 600 €/t, LDPE natural 620 - 770 €/t, LDPE-film grade mixed colours (K49) 220 - 310 €/t and LDPE film grade natural (K40) 410 - 510 €/t. As far as post-user PE is concerned, the prices of shrink film and HDPE regrind from crates have decreased. The quotes have changed as follows: LDPE shrink film natural (E40) 400-480 €/t, LDPE shrink film mixed colours (E49) 210 - 270 €/t, transparent mixed colours <70 μm 60-115 €/t, LDPE farm film b/w > 70 μm (B41) 30 - €/t, HDPE regrind from crates, colour-separated 600 - 770 €/t and HDPE regrind from crates, colour-separated 550 - 660 €/t. The demand for PE is likely to rise steadily over the first quarter of 2012.

As regards PP markets, post-industrial fell by 23 €/t on average in December. Hence, the following PP prices were quoted in December: film grade mixed colours (K59) 150 - 300 €/t, film grade natural (K50) 320 - 450 €/t, homopolymer mixed colours 420 - 650 €/t, homopolymer natural 600 - 750 €/t, copolymer mixed colours 450 - 660 €/t and copolymer natural 600 - 750 €/t. Subsequent to the Christmas and New Year’s celebrations, experts expect the prices to be reduced in January because the amounts of hollow bodies have increased.

In December, PS prices fell moderately, which is also due to the building activity in winter. The quotes for PS only decreased in the top price range. Thus, the prices were reduced by no more than 9 €/t on average. The following prices were quoted in December: standard mixed colours 500 - 660 €/t, standard crystal clear 600 - 800 €/t, standard white 600 - 800 €/t, high impact mixed colours 600 - 660 €/t, high impact black 600 - 700 €/t and high impact white 700 - 840 €/t.

The prices of PVC are reported to have decreased more markedly: The quote for PVC post industrial fell by 33 €/t on average: PVC_P transparent 400 - 510 €/t, PVC_P mixed colours 350 -450 €/t, PVC_U mixed colours 420 - 560 €/t and tube grade mixed colours 400 - 540 €/t. The average price decrease in PVC windowframe regrind is 8 €/t: windowframe regrind white 620 - 720 €/t, windowframe regrind mixed colours 460 - 580 €/t and windowframe regrind single-shade white 700 - 820 €/t. Surprisingly, the quotes for certain grades in the PVC markets have fallen markedly since October. The PVC grades are instable and hardly benefit from the building activity in winter.

Post-user PET: The PET market is volatile – bottle prices continue to be on the decline. In addition, the low-cost virgin materials are pushing the prices of used beverage bottles down. At present, there is a sufficient supply of PET bottles in the national market and in the EU Single Market. In addition, some PET processors have arranged to have a longer winter break, which is why the demand for bottles continues to be low. There is only a low demand for mixed-coloured grades. The recyclers are filling their warehouses with high-quality plastics grades. The export trade in PET bottles with the Far East is stagnating. In December 2011, the EUWID quotes decreased again, i.e. those for PET transparent fell by 40 €/t and those for PET coloured dropped by 75 €/t. The following EUWID prices are now quoted for used and disposable PET bottles: PET transparent 340 - 400 €/t and PET mixed colours 180 - 230 €/t. At the collection points, there are hopes for a further rise in PET virgin material prices, which will probably push up the prices of used bottles, too. However, in January the PET bottle prices attained in December are more likely to stabilise.

2.2 plasticker price index

The developments of standard plastics in the course of 2011 can be seen from the comparison of standard plastics in Table 3. In May the quotes reached the highest level, and they fell again from month to month starting in June. The 2011 December quotes are below those of December 2010. The developments in the quotes for technical plastics, see Table 4, are characterised by a price dip until March. From April to November the prices of technical plastics were at a high level, but in December 2010 they fell short of those quoted in December 2010.

In December 2011 the standard plastics stocks were sold out. This can be concluded both from the price reductions and from the considerable supply quantities, which caused the prices to fall by 100 €/t on average. The price reductions range between 10 €/t and 280 €/t. Only PVC_P regrind attained a price increase of 110 €/t, and LDPE regrind held its own. The first forecast of the January quotes indicates rising prices, even though the supply quantities have decreased markedly – the downward plunge has ground to a halt.

Table 3: Prices of standard plastics in plasticker, quoted in €/t

*: Supply figures too low to attain statistical significance; 1: equivalent to the grade “post-industrial, mixed colours”; 2: equivalent to K49; 3: equivalent to K59; 4: equivalent to “standard, mixed colours”; 5: equivalent to the grade “regranulates, black”.

The prices of technical plastics dropped considerably in December. They were sold out before the winter break, too. December was characterised by considerable supply quantities, with price reductions ranging from 10 €/t to 290 €/t. Plastics prices decreased by 174 €/t on average. Only PC regranulates were able to hold their own and even increased by 170 €/t. On the one hand, the first forecast of the January quotes shows that the prices of regranulates are on the decline again, even though the supply quantities have been reduced considerably compared to December. On the other hand, the price of regrind has risen, which shows that the markets are very inconsistent.

Table 4: Prices of technical plastics in plasticker, quoted in €/t

5: equivalent to the grade “regranulates, black”.

No guarantee for any of the prices. All EUWID prices are quoted ex works. As a rule, the prices quoted refer to quantities in excess of 20 tons. The monthly quotes for secondary plastics, which are updated on an hourly basis, can be calculated using the price lists that are derived from the quotations published in the raw material exchange plasticker. The prices listed in this index are quoted with reservation - as the majority of the quotes submitted are not necessarily equivalent to the sales prices. Furthermore, plasticker does not distinguish between the following grades: transparent, mixed colours or colour-separated. Therefore, the information provided by plasticker may indicate different market behaviour than the prices quoted by EUWID.