Market Report Plastics - February 2012

Information about the market for plastics is being presented by:

bvse - Bundesverband Sekundärrohstoffe und Entsorgung e.V.

1. The market for primary plastics

The German economy is still booming, and that in all economic sectors, as was indicated by the ifo Institute, Universität München (Munich University), in its information on the business climate in January. This trend is also responsible for the good to very good demand for plastics. Above all, the demand for technical plastics has increased markedly. The plastics stocks are now also being replenished to enable purchasers to benefit from the currently favourable prices to the greatest possible extent. The precursor prices have risen, which is hardly surprising, considering the inflated mineral oil prices. In February and March, the plastics prices are likely to rise further.

In January 2012 there was considerable demand in the standard plastics markets. There was a particularly marked price increase in the precursor “styrene”; which was matched by the immediate price rises in PS. Thus, the average price of the ten types of plastics listed by EUWID was 1296 €/t. Hence, the plastics price exceeded the previous month’s quote by 43 €/t. With the exception of PVC, the prices of all standard plastics rose. The quotes for PS are reported to have increased markedly, namely by 120 €/t. In January the following prices were listed in the EUWID Price Watch: LDPE film grade 1290 - 1350 €/t, LLDPE film grade 1200 -1270 €/t, HDPE injection moulding 1250 - 1300 €/t, HDPE blow moulding 1250 - 1300 €/t, PS crystal clear 1370 - 1420 €/t, PS high impact 1490 - 1540 €/t, PP homopolymer 1250 - 1300 €/t, PP copolymer 1300 - 1350 €/t, PVC tube grade 1100 - 1140 €/t and PVC film/cables 1200 - 1240 €/t. In January PET followed the trend of the other plastics. Thus, in December 2011 PET was quoted at 1470 – 1600 €/t, i.e. its price had increased by 75 €/t on average. The price rises in PET are due to the precursor prices, cf. PS. There is a considerable supply of PET in the European markets.

2. The market for secondary plastics

January started with a considerable demand for all types of standard plastics. While the trend towards higher prices was well reflected by plasticker, the quotes in the EUWID Price Watch held their own. However, the price decline that had occurred in December ground to a halt. Apart from the considerable domestic demand, there were also plenty of purchasing enquiries from the Far East. Processors replenished their stocks again, which were reduced in December as a result of an unexpectedly high demand. The demand for recyclates is now expected to be high in the first quarter. The demand in February will probably be slightly lower than it was in January. However, according to some reports the number of purchasing orders will increase in March. The demand situation has been varied during the winter break. While some plastics recyclers have made arrangements for a longer maintenance break, many plastics recyclers have been producing nearly to full capacity since 6th January. The prices are likely to rise slightly in February and they will probably increase considerably in March.

2.1 EUWID Price Watch

According to EUWID, the prices held their own in January 2012. Hence, it is not necessary to discuss the current market situation in greater detail. Only the prices of post-user PE are reported to have risen slightly: the price of film transparent natural < 70 µm has increased by 10 €/t in the upper range, i.e. it is quoted at 300 – 345 €/t. The PP markets have stabilised. According to EUWID, the prices have held their own. There is a continuous trend towards using PP as a substitute for certain PE grades. As a result of the holidays, the amounts of hollow bodies are expected to be relatively high in January and February. The demand for PS in particular continues to be considerable. The influence of the winter break can hardly be noticed here. The demand for PVC has been on the decline as a result of the winter. The number of windows that have been replaced during the cold winter period has decreased. The markets for post-user PET have held their own, too, and the price decline in PET has ground to a halt. In winter, the amounts of bottles in the domestic markets are lower than at any other time of year. In February, the prices that have increased as a result of the rise in the primary plastics prices are likely to affect the secondary markets.

2.2 plasticker price index

In January 2012, plasticker showed a trend towards higher prices in respect to 12 of the 14 standard plastics listed, with price increases ranging between 30 €/t and 110 €/t. 12 of the total of 14 plastics listed increased by 59 €/t on average. However, the price LDPE regranulates fell by 40 €/t. The low supply figure for regrind from PVC_P made it impossible to ensure correct price setting. The quotes for PVC_P seemed to have bottomed out at 140 €/t at that time. Despite the Chinese New Year’s celebrations the supply figure quoted in plasticker was quite considerable in January compared to the previous months. According to plasticker the following price quotes changed by more than +/- 40 €/t: LDPE regrind + 100 €/t, PP regrind +60 €/t, PP regranulates +100 €/t, PS regranulates +110 €/t und, PET bale goods +70 €/t. The first forecast of March, based on the February quotes, suggests that business will be weaker. The price level attained in January has stabilised in February.

Table 1: Standard plastics prices according to plasticker, quoted in €/t.

*: Supply figures too low to attain statistical significance; 1: equivalent to the grade “post-industrial, mixed colours”; 2: equivalent to K49; 3: equivalent to K59; 4: equivalent to “standard, mixed colours”; 5: equivalent to the grade “regranulates, black”.

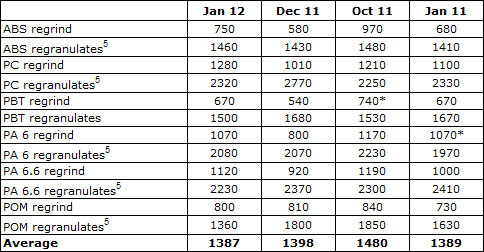

Technical plastics are quoted at varied prices according to plasticker. As far as technical plastics are concerned, regrind shows a trend towards higher prices, whereas regranulates show a tendency towards falling prices. Regrind: the price rises range from 10 €/t to 270 €/t. Regranulates: while the prices of ABS and PA 6 have increased by 10 €/t to 30 €/t, those of PC, PBT, PA 6.6 and POM have decreased by 140 €/t to 450 €/t. The January demand can be assessed as having been considerable despite the winter break and the Chinese New Year celebrations. The first forecast of March, based on the February quotes, shows a trend towards slight price rises in all technical plastics. Next month, there will be a considerable demand for technical plastics, too.

Table 2: Technical plastics prices according to plasticker; quoted in €/t.

No guarantee for any of the prices. All EUWID prices are quoted ex works. As a rule, the prices quoted refer to quantities in excess of 20 tons. The monthly quotes for secondary plastics, which are updated on an hourly basis, can be calculated using the price lists that are derived from the quotations published in the raw material exchange plasticker. The prices listed in this index are quoted with reservation - as the majority of the quotes submitted are not necessarily equivalent to the sales prices. Furthermore, plasticker does not distinguish between the following grades: transparent, mixed colours or colour-separated. Therefore, the information provided by plasticker may indicate different market behaviour than the prices quoted by EUWID.