Market Report Plastics - August 2012

Information about the market for plastics is being presented by:

bvse - Bundesverband Sekundärrohstoffe und Entsorgung e.V.

1. The market for primary plastics

Standard plastics prices have declined for the third time in a row. However, the purchasing restraint shown by processors in the preceding months has also subsided, which has led to the price decline being less considerable than expected. This is because processors had already speculated on the price decline for quite a while. Hence, there was an unusually high number of purchase orders in July, a lot of which soon had to be rejected. To date, the demand for plastics has been largely satisfactory during the summer break. Stock levels on the processors’ part are still low because only part of the purchase enquiries accumulated can be fulfilled. The considerable purchasing demand for standard plastics has continued in August, which is likely to lead to the stabilisation of the prices attained this month. Some experts even expect prices to rise slightly, not least because of the renewed and considerable increase in mineral oil prices.

In July the following standard plastics prices declined by 80 €/t to 180 €/t. Hence, the average price of the ten types of plastics listed in EUWID was 1227 €/t, which means it has fallen by 118 €/t compared to the preceding month. The following prices were listed in the EUWID Price Watch for July: LDPE film grade 1090 - 1150 €/t, LLDPE film grade 1090 - 1170 €/t, HDPE injection moulding 1180 - 1220 €/t, HDPE blow moulding 1180 - 1220 €/t, PS crystal clear 1340 - 1400 €/t, PS high impact 1460 - 1530 €/t, PP homopolymer 1170 - 1230 €/t, PP copolymer 1220 - 1280 €/t, PVC tube grade 1080 - 1120 €/t and PVC film/cables 1180 - 1220 €/t. PET is following the trend set by the other standard plastics. During the first days of July, PET prices slumped, but consolidated and stabilised again in the second half of July. The developments in PET prices are running parallel to those in the listings for its precursors, which declined by 95 €/t for paraxylene and by 40 €/t for ethyleneglycol at the beginning of July. Experts expect PET prices to consolidate in August.

2. The market for secondary plastics

Interesting developments are becoming evident on the plastics markets: many processors were hoping for a longer summer break to subject their production facilities to thorough reviews, as was indicated by the price decline that had occurred over the preceding months. But then, in the second half of July, the decrease in primary goods caused purchasers to submit a considerable number of enquiries. This, in turn, had an immediate impact on the secondary markets: while the prices of bale goods declined, recyclates soon attained stable or even rising prices again. The considerable slump in the demand for plastics expected to occur during the summer break thus did not fully materialise. At present it is not possible for the majority of plastics recyclers to increase their stock levels in order to offset market fluctuations. However, the majority of plastics recyclers have been able to have a short-term summer break in July or August.

The decrease in bale good prices can also be explained by the fact that exports to China are faltering, and that despite the increase in the dollar exchange rate. The strict export regulations of the People’s Republic of China are still having an impact. Exports to Hong Kong are becoming more difficult. The export requirements of the People’s Republic of China can only be met by sufficiently good quality grades.

According to a report published by the ki-Kunststoffinformation online magazine in June 2012 approximately 15 million tons of plastics wastes of Chinese origin were recycled within the country itself . This is considerably more than the average amount of 9.2 million tons, attained over the past five years. In addition to the imports of recyclates and regranulates, amounting to 8.4 million tons, a total of 23 million tons in secondary materials was available on the domestic market.

According to the July Price Watch, EUWID and plasticker showed price reductions in the majority of the standard plastics listed. The average price decreases quoted by EUWID, amounting to 25 €/t, are lower than those listed by plasticker, which amount to 64 €/t on average. However, the previews indicate that standard plastics markets are likely to stabilise in August.

2.1 EUWID Price Watch

It was highly interesting to observe the EUWID price quotes for used plastics in July: on the one hand, they showed the price declines mentioned above; on the other hand, they revealed a considerable purchasing demand in the second half of July. Above all, this is true of PE and PP. In addition, certain quotes, such as those for PS, have held their own. Even PVC prices are largely stable. Furthermore, the average price changes, amounting to 25 €/t, are relatively low, in particular, if compared to the price reductions in primary plastics. In some cases, only part of the listings have changed, namely those at either the upper or the lower price limit.

PE: PE has the largest number of price changes. The prices of some select post-industrial wastes have changed by 20 €/t, whereas the quotes for post-user goods are inconsistent. The prices of four post-user PE grades have even risen. As far as PE post industrial is concerned, bale goods and regrind are quoted at: HDPE mixed colours 470 -650 €/t, HDPE natural 650 - 750 €/t, LDPE mixed colours 490 - 600 €/t, LDPE natural 650 - 700 €/t, LDPE film mixed colours (K49) 230 - 290 €/t and LDPE natural (K40) 440 - 530 €/t. There have been more considerable price changes in post-user PE: LDPE shrink film natural (E40) 400 - 470 €/t, LDPE shrink film mixed colours (E49) 220 - 260 €/t, film transparent natural < 70 µm 350 - 380 €/t, film transparent mixed colours < 70 µm 70 - 120 €/t, LDPE farm film b/w > 70 µm 40 - 60 €/t, mixed film 98/2 350 - 385 €/t, mixed film 90/10 230 - 275 €/t, mixed film 80/20 220 - 240 €/t, HDPE hollow bodies mixed colours (C29) 120 - 240 €/t, HDPE regrind from crates colour-separated 620 - 730 €/t and HDPE regrind from crates mixed colours 520 - 630 €/t. It should be noted that the average price reduction in HDPE hollow bodies is 50 €/t. The quotes for film transparent natural and mixed film have risen by 20 €/t to 30 €/t.

All quotes for PP have decreased, and that by 25 €/t on average. The quotes have changed as follows: film mixed colours (K59) 120 - 280 €/t, film natural (K50) 330 - 430 €/t, homopolymer mixed colours 430 - 650 €/t, homopolymer natural 620 - 770 €/t, copolymer mixed colours 450 - 650 €/t and copolymer natural 620 - 770 €/t. The PP markets are markedly calmer than the PE markets. The demand for PP has been stagnating in the summer months.

The favourable developments in the building industry are still having a stabilising effect on PS prices, even though the pressure from virgin materials was still rather high in July. According to the July listings, the PS markets for recyclates are still stable. This situation is not even expected to change in August.

PVC prices are also reported to be stable, despite there being a relatively low turnover. Even PVC prices have been stabilised by the favourable developments in the building industry. The price pressure exerted by primary goods on PVC is the lowest in this respect.

According to the July Price Watch, the quotes for used and disposable PET bottles were reduced for the third time in a row in July, namely by 80 €/t on average for PET transparent and by 60 €/t for PET coloured. EUWID quoted the following prices for used and disposable bottles: PET transparent 330 - 380 €/t and PET mixed colours 150 -190 €/t. Thus, the considerable purchase prices of PET bottles have now finally stabilised. In addition, beverage consumption is higher during the summer months, which has led to there being a higher amount of PET on offer in Europe. Furthermore, exports of bottle materials to the Far East are faltering. PET processors continue to show purchasing restraint since they are speculating on further price declines.

2.2 plasticker price index

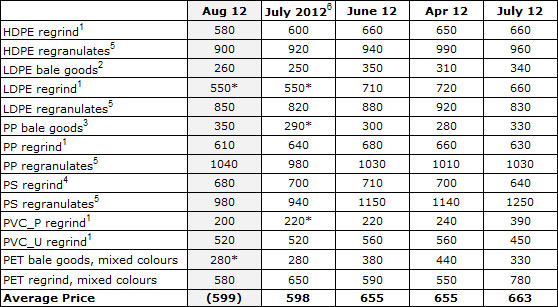

Due to the market changes predicted we are going to present the current listings derived from plasticker of 14 August 2012 below – both for standard plastics, cf. Table 1, and for technical plastics, cf. Table 2. However, the prices quoted merely reflect the preliminary quotes rather than the final listings. They show that standard plastics prices, as published by plasticker, have stabilised in August. As opposed to this, technical plastics prices are likely to decline, namely by 50 €/t.

Standard plastics: The price cuts in the amount of 45 €/t, predicted for the July quotes, were even exceeded in the final monthly stock listing: the July price index shows price reductions of 57 €/t on average. In July the price decreases ranged between 10 €/t and 160 €/t. Only the price of PET regrind exceeded these values by 60 €/t. The July supply figure was comparable to that for the first four months, i.e. it stabilised. Just as a reminder: in June an extraordinarily high number of bids and quotes was registered by plasticker. At this point, it is not yet possible to discern a slump in demand during the summer break. According to plasticker, the following quotes changed by more than +/- 40 €/t compared to the preceding month: HDPE regrind -60 €/t, LDPE bale goods -100 €/t, LDPE regrind -160 €/t, HDPE regranulates -60 €/t, PP regranulates -50 €/t, PS regranulates -110 €/t, PET bale goods -100 €/t und PET regrind +60 €/t.

The first forecast of the current August quotes, whose final listings will, however, not be published until September, shows price consolidation. The demand for standard plastics will probably be equivalent to that for the preceding month.

Table 1: Prices of standard plastics in plasticker, quoted in €/t

*: Supply figures too low to attain statistical significance; 1: equivalent to the grade “post-industrial, mixed colours”; 2: equivalent to K49; 3: equivalent to K59; 4: equivalent to “standard, mixed colours”; 5: equivalent to the grade “regranulates, black”, 6: forecast (likely to be amended by additional quotes)

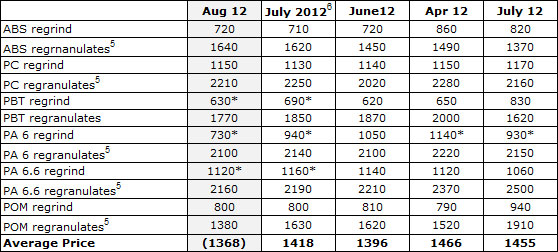

Technical plastics: The price slump that occurred between May and July did not continue in July, when technical plastics prices stabilized. In the plasticker price index for July, the plastics prices quoted exceeded those for the previous month by 22 €/t on average. The respective price changes were nearly offset on average, which means that price rises ranged between 10 €/t to 230 €/t and price decreases lay between 10 €/t to 100 €/t. This shows that prices are determined individually by the specific demand for plastics rather than by an overall downward market trend. A satisfactory demand for technical plastics can also be discerned for the summer break. Even during the summer break technical plastics are in great demand . According to plasticker, the July quotes changed by more than +/- 70 €/t for: ABS regranulates +170 €/t, PC regranulates +230 €/t and PA 6.6 regrind -110€/t.

The price slump predicted did not materialise in July! However, the first forecast of the current August quotes, whose final listings cannot be published until the beginning of September, shows a marked decline in prices, namely by 50 €/t on average. The supply figure for August is comparable to that for the first four months, i.e. it has stabilised. At this point, it is not yet possible to discern a slump in the demand for technical plastics during the summer break.

Table 2: Prices of technical plastics in plasticker, quoted in €/t

5: equivalent to the grade „regranulates, black“. 6 forecast (likely to be amended by additional quotes)

No guarantee for any of the prices. All EUWID prices are quoted ex works. As a rule, the prices quoted refer to quantities in excess of 20 tons. The monthly quotes for secondary plastics, which are updated on an hourly basis, can be calculated using the price lists that are derived from the quotations published in the raw material exchange plasticker. The prices listed in this index are quoted with reservation - as the majority of the quotes submitted are not necessarily equivalent to the sales prices. Furthermore, plasticker does not distinguish between the following grades: transparent, mixed colours or colour-separated. Therefore, the information provided by plasticker may indicate different market behaviour than the prices quoted by EUWID.