Market Report Plastics - September 2012

Information about the market for plastics is being presented by:

bvse - Bundesverband Sekundärrohstoffe und Entsorgung e.V.

1. The market for primary plastics

The boom in the demand for standard plastics, caused by the price reductions granted in July, led to immediate price rises in August, which are likely to continue in September and October. Early on in July and August, the goods stopped being supplied at favourable prices. Plastics producers were unable to carry out the purchase orders accrued; in addition, they expected prices to rise as a result of the increasing precursor prices. This shows that there is a considerable demand for plastics among plastics processors. However, due to the high price levels, purchase orders can only be placed to a limited extent – and only to meet the existing demand. Plastics prices are expected to go up again in September and October as a consequence of the developments in precursor prices, which have now attained a very high level again.

Suprisingly, prices were not expected to rise to the extent indicated by EUWID in the August Price Watch, cf. www.euwid-recycling.de. Standard plastics prices increased by 70 €/t to 250 €/t in August. Hence, the average price of the ten types of plastics listed in EUWID is 1,392 €/t, which means it increased by 165 €/t compared to the preceding month. The following prices were listed in the EUWID Price Watch in August: LDPE film grade 1330 – 1400 €/t, LLDPE film grade 1300 – 1400 €/t, HDPE injection moulding 1380 - 1420 €/t, HDPE blow moulding 1380 - 1420 €/t, PS crystal clear 1480 - 1550 €/t, PS high impact 1610 - 1690 €/t, PP homopolymer 1320 - 1430 €/t, PP copolymer 1370 - 1480 €/t, PVC tube grade 1150 -1190 €/t and PVC film/cables 1250 -1 290 €/t. PET for packaging was also quoted at a markedly higher price in the August Price Watch of the online portal ki-Kunststoff Information. The developments in PET quotes are in line with the price increases in its precursors. In August 2012 standard plastics prices, with the exception of PET, attained the previous year’s level again.

The prices quoted by EUWID for technical plastics decreased in August. According to the EUWID Price Watch published in August, prices fell considerably, namely by 90 €/t on average. The declining prices are explained by a decrease in demand and a sufficient supply.

As far as technical plastics are concerned, only PMMA was able to maintain its price level – all other technical plastics dropped by 50 €/t to 200 €/t. The following prices were listed in the EUWID Price Watch for August: PMMA crystal clear 25000 - 2600 €/t, ABS natural 1850 -2000, ABS white/black 1950 - 2100, ABS mixed colours 2550 - 2850, PC crystal clear 2650 -2800 €/t, PC GF 2950 - 3100 €/t, POM natural 1950 - 2150 €/t, PA 6 natural 2350 - 2550 €/t, PA 6 black 2350 - 2550 €/t, PA 6 GF reinforced 2700 - 2800 €/t, PA 66 natural 3000 - 3100 €/t and PA 66 GF 3100 - 3200 €/t.

In the next few months the demand for technical plastics will probably increase. In addition, precursor prices are likely to reduce the further price decline in technical plastics in the months to come. Nevertheless, some experts expect technical plastics prices to fall further in the third and fourth quarters.

2. The market for secondary plastics

The prices quoted by EUWID and plasticker point to a consistent trend towards stability in standard plastics prices. The price drop indicated by the July Price Watch ground to a halt. The price rises originating in the primary market have not yet affected the secondary market. August proved to be a largely stable month; however, demand is reported to have risen considerably in September.

The news of the export trade with the Far East is still exciting: for instance, there are destatis reports on a considerable increase in export numbers for the first quarter of 2012.

In the first quarter of 2012, 484,400 t of recovered plastics were exported to the People’s Republic of China and to Hong Kong – compared to 452,500 t in the preceding year. Some exporters still do not seem to understand that exports to China are subject to strict border controls - both in the export harbours and at the import checkpoints in Hong Kong. Imports to Hong Kong via the People’s Republic of China have been made considerably more difficult. This is also documented by import figures to Hong Kong: imports have declined significantly from 135,400 t for the last six months of 2011 to 95,000 t for the first six months of 2012. China has put in place new requirements for the quality grades, which are now checked accordingly.

2.1 EUWID Price Watch

The price quotes for recovered plastics published by EUWID do not reflect the price rises occurring in the primary market. In August prices changed only slightly compared to July: the price shifts in post-user PE and post industrial PP were only marginal, while the quotes for post industrial PE, PS and PVC held their own.

PE: The majority of price changes occurred in post-user PE. However, the price changes are marginal, with price rises ranging between 10 €/t and 30 €/t and price decreases between 10 €/t and 20 €/t. Hence, the prices of post-user PET are reported to have changed as follows: LDPE shrink film natural (E40) 400 - 480 €/t, LDPE shrink film mixed colours (E49) 220 - 280 €/t, film transparent natural < 70 µm 370 - 410 €/t, film transparent mixed colours < 70 µm 70 - 135 €/t, LDPE farm film b/w > 70 µm 30 - 60 €/t, mixed film 98/2 380 - 410 €/t, mixed film 90/10 240 - 290 €/t, mixed film 80/20 230 - 250 €/t and HDPE-hollow bodies mixed colours (C29) 120 - 220 €/t.

In the case of PP, the quotes for film have increased slightly by 15 €/t on average: film mixed colours (K59) 130 - 300 €/t and film natural (K50) 330 - 450 €/t. The PP market continue to be stable. According to processors, there is a sufficient or even satisfactory demand for PS. However, the quotes held their own in August. The demand for PVC was very restrained during the summer break. The prices of PVC will probably change only marginally in September and October, too.

There is still the most controversy over PET prices and their quotes. During the summer months, the supply of beverage bottles increased significantly. Some PET recyclers are showing some restraint in regard to production, depending on the purchase prices listed. According to the August Price Watch, the prices of used and returnable PET bottles nearly held their own relative to the preceding month. The following prices are now quoted for used and returnable PET bottles by EUWID: PET 320-380 €/t and PET mixed colours 150 -190 €/t.

2.2 plasticker price index

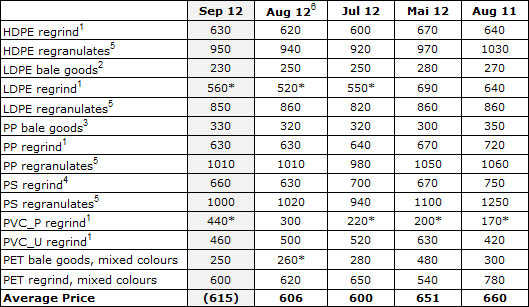

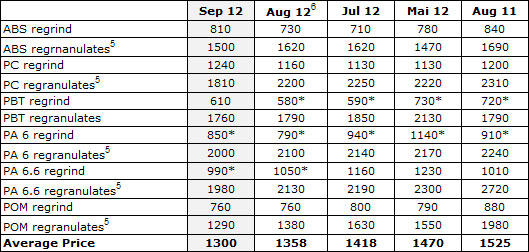

Due to the market changes predicted, the current listings derived from plasticker of 13 September 2012 will be presented below for the fourth time in a row – both those for standard plastics, cf. Table 1, and those for technical plastics, cf. Table 2. However, the prices quoted merely reflect an interim situation rather than the final September listings. They show that standard plastics prices, as published by plasticker, have stabilised in September. As opposed to this, technical plastics prices are likely to decline, namely by 58 €/t on average.

Standard plastics: The August quotes, which attained 606 €/t on average, are in line with those of July (with 600 €/t on average). The July and August demand for standard plastics slightly declined as a result of the summer break. Nevertheless, business can be assessed as having been satisfactory or even good for plastics recyclers during the summer break. The August Price Index shows price reductions of 10 €/t to 70 €/t und price rises of 20 €/t to 80 €/t. According to plasticker, the following price quotes changed by more than +/- € 40/t compared to the previous month: PS regrind -70 €/t, PS regranulates +80 €/t and PVC_P-regrind +80 €/t.

The first forecast of the current September quotes, whose final listings cannot be published until October, indicates that prices are likely to consolidate further. The average price will probably amount to 615 €/t. The demand for standard plastics will increase compared to August.

Table 1: Prices of standard plastics in plasticker, quoted in €/t

*: Supply figures too low to attain statistical significance; 1: equivalent to the grade “post-industrial, mixed colours”; 2: equivalent to K49; 3: equivalent to K59; 4: equivalent to “standard, mixed colours”; 5: equivalent to the grade “regranulates, black”, 6: forecast (likely to be amended by additional quotes)

Technical plastics: The average values reveal the gradual price decline in technical plastics. In August the prices of technical plastics increased by 60 €/t on average compared to the previous month. The August Price Watch shows two increases of 20 €/t and 30 €/t each as well as nine reductions of 10 €/t to 250 €/t each. On the whole, demand has decreased since the second quarter. According to plasticker, the following price quotes changed by more then +/- 70 €/t in August: PA6 regrind – 150 €/t, PA 6.6 regrind – 110 €/t and POM regranulates – 250 €/t.

The first forecast of the current September quotes, whose final listings cannot be published until the beginning of October, shows further price reductions, namely by 58 €/t on average. The supply figure for September is comparable to that for August.

Table 2: Prices of technical plastics in plasticker, quoted in €/t

5: equivalent to the grade „regranulates, black“. 6 forecast (likely to be amended by additional quotes)

No guarantee for any of the prices. All EUWID prices are quoted ex works. As a rule, the prices quoted refer to quantities in excess of 20 tons. The monthly quotes for secondary plastics, which are updated on an hourly basis, can be calculated using the price lists that are derived from the quotations published in the raw material exchange plasticker. The prices listed in this index are quoted with reservation - as the majority of the quotes submitted are not necessarily equivalent to the sales prices. Furthermore, plasticker does not distinguish between the following grades: transparent, mixed colours or colour-separated. Therefore, the information provided by plasticker may indicate different market behaviour than the prices quoted by EUWID.