Market Report Plastics - November 2012

Information about the market for plastics is being presented by:

bvse - Bundesverband Sekundärrohstoffe und Entsorgung e.V.

1. The market for primary plastics

The economic situation in Germany can still be described by procrastination and hesitancy, yet production activity is also discernible. All signals indicate that there is enough reason for careful optimism despite a continuing downswing in the economy, which poses considerable problems to the companies’ short and medium-term planning. It looks as though the sustainability of Germany’s consumption could be maintained, which involves short-term consumer goods, medium-term convenience goods and long-term real estate alike. Additionally, the considerable number of niches and speciality items that are utilised, for the most part, by small and medium-sized enterprises (SMEs) are having a stabilising effect on the economic situation. The goods produced by SMEs are selling sufficiently well at home and abroad.

In October the upward price trend that had occurred in September came to an end. The low demand for standard plastics and the decline in precursor prices led to a slight decrease in the plastics prices listed by EUWID. Plastics processors still expect the prices to fall further, which is why they are showing some hesitancy in making purchases. There is a considerable supply of standard plastics. The plastics price quotes for the past two months are expected to hold their own or to slightly decline.

With the exception of PS, standard plastics prices have dropped by 20 €/t to 30 €/t. The prices attained by PS have risen by 25 €/t on average. According to EUWID, the average price of the ten types of plastics listed below is 1484 €/t. Thus, the plastics price has fallen short of the quote for the previous month by 19 €/t. The following standard plastics prices were quoted by EUWID in October: LDPE film grade 1450 - 1500 €/t, LLDPE film grade 1410 - 1470 €/t, HDPE injection moulding 1500 - 1570 €/t, HDPE blow moulding 1480 - 1550 €/t, PS crystal clear 1590 - 1650 €/t, PS high impact 1720 - 1780 €/t, PP homopolymer 1420 - 1510 €/t, PP copolymer 1470 - 1560 €/t, PVC tube grade 1190 - 1230 €/t and PVC film/cables 1290 - 1330 €/t. The PET markets stabilised in October; there is sufficient supply, and the demand is still on the decline. However, the demand for PET is likely to resurge again as a result of the Christmas business.

According to the bimonthly EUWID Price Watch for August technical plastics held their own compared to September. The demand cannot be assessed as being sufficient because current production is based on economic goods and consumer goods; nevertheless, the markets are only subject to small fluctuation because there is a lack of impulse for growth. By year-end this situation is unlikely to change significantly with respect to technical plastics.

2. The market for secondary plastics

In October the developments in the secondary markets once again followed the trends in the primary markets. With the exception of PS, the prices listed by EUWID in the October Price Watch decreased by 14 €/t for standard plastics. PS held its own, as was the case in the primary market. Bale goods can be purchased at a more favourable price. However, recyclate prices are also on the decline. As opposed to this, the price decreases in all the standard plastics listed by plasticker were considerably lower: on average, they attained 7 €/t. The demand for plastics has been on the decline in October and November. Primary plastics processors have reduced their dependence on the volatility of primary plastics markets by building up storage capacity in a well-targeted fashion. This is equally true of plastics recyclers, who are storing a larger quantity of recyclates than previously. The demand for plastics is likely to go down in the next two months.

There are reports that border controls on Far East exports to the People’s Republic of China continue to be tightened. This seems true of both the European export harbours and the Chinese import harbours. Even the AQSIQ system has been tightened. If possible, exports to China are to be effected on the direct route, and only to the recycling centres set up for this purpose. The People’s Republic of China continues to attach great importance to quality grades. Exports to Hong Kong are being made increasingly difficult. The environmental regulations are also having a more considerable impact. As a result of the increasingly tight regulations, a large number of plastics recyclers in the People’s Republic of China are competing to obtain sufficient quantities for processing. The increasing demands on the quality of the materials exported to China have led to a drop in import quantities. According to the report published in Recycling International the decline equals 50 per cent in some harbours,. Additionally, the export costs have risen because customs clearance is currently taking up much more time. However, this will ultimately lead to a considerable change in the way plastics recycling is carried out in China.

2.1 EUWID Price Watch

In October the EUWID Price Watch indicated moderate price decreases of 5 €/t to 50 €/t for numerous used plastics. The price rises that had occurred in the previous month are thus obsolete.

PE: PE was subject to the highest number of price changes . The price decreases in post-industrial PE equalled 15 €/t on average. Only the quote for mixed-coloured LDPE film increased by 20 €/t in the higher price range. The quotes changed as follows: HDPE mixed colours 470 – 640 €/t, HDPE natural 630 - 750 €/t, LDPE mixed colours 480 - 600 €/t, LDPE natural 630 - 700 €/t, LDPE film mixed colours (K 49) 240-320 €/t and LDPE film natural (K 40) 440 - 500 €/t. The prices of post-user PE fell by 12 €/t on average; they changed as follows: film transparent natural < 70 µm 370-420 €/t, LDPE farm film b/w 30 - 65 €/t. Mixed film 90/10 240 - 280 €/t, mixed film 80/20 230 - 260 €/t, HDPE regrind from crates, colour-separated 620 - 720 €/t and HDPE regrind from crates, mixed colours 510 - 620 €/t.

PP: The PP secondary markets are now well balanced with respect to their quality grades. However, the volume outflow of PP recyclates into the higher-quality grades of automobiles as well as electrical and electronic equipment (WEEE) has stalled as a result of the demand, which is in decline in this area. The PP prices have decreased by 20 €/t on average: film mixed colours (K 59) 120 - 280 €/t, film natural (K 50) 300 - 400 €/t, homopolymer mixed colours 430-630 €/t, homopolymer natural 600 - 750 €/t, copolymer mixed colours 440 - 630 €/t and copolymer natural 620-750 €/t.

PS shows very few price changes. Only the quote for high impact mixed colours, which attains 600-700 €/t, has increased by 20 €/t in the higher price segment. As a result of the favourable weather conditions, the building activity has not yet slumped, which is stabilising the demand for PS.

As far as post-industrial PVC is concerned, the price increases that had occurred in the previous month were reversed: PVC_P transparent 410 - 490 €/t, PVC_U transparent 480 -600 €/t, PVC_U mixed colours 420 - 580 €/t and tube grade mixed colours 500 - 560 €/t. The average price decrease equals 11 €/t. PVC window frame regrind: the quality grade single-shade white is now quoted at 620 – 740 €/t.

Stagnation in PET prices: October proved to be a stable month. The increase in beverage consumption is expected to lead to further market impulses during the Christmas business period. Increasing quantities of biological PET are making inroads into the market. The EUWID quotes for used and disposable PET bottles held their own in October: PET transparent 340 - 400 €/t and PET coloured 160 - 210 €/t.

2.2 plasticker price index

Due to the market changes predicted, the current listings derived from plasticker will be presented below for the sixth time in a row – both those for standard plastics, cf. Table 1, and those for technical plastics, cf. Table 2. However, the prices quoted merely reflect an interim situation rather than the final November listings. They show that standard plastics prices, as published by the internet platform plasticker on 13 November 2012, have risen by 32 €/t on average. According to the plasticker listings published on 19 November 2012, technical plastics prices have increased by 44 €/t.

Standard plastics: The October quotes, which attained 646 €/t on average, are equal to those listed in September - with 651 €/t on average. However, the listings for each type of plastic have changed significantly, which involves a re-assessment of the existing prices. In October the demand for standard plastics was lower than in the previous month. The Price Index shows both price reductions of 10 €/t to 160 €/t and price rises of 10 €/t to 200 €/t. PE is quoted at a lower price, whereas the listings for PP, PS, PVC and PET have attained a stable level. The price of LDPE bale goods has fallen by 50 per cent. The number of quotes for PVC_P is too low to substantiate the price rise of 200 €/t. According to plasticker, the following prices changed by more than +/- 40 €/t compared to the previous month: HDPE regrind - 50 €/t, HDPE regranulates - 70 €/t, LDPE bale goods - 160 €/t, PP bale goods - 80 €/t, PS regranulates - 60 €/t, PVC_U regrind + 60 €/t and PET regrind mixed colours +70 €/t.

According to the first forecast of the current November quotes, whose final listings cannot be published until December, the average price is likely to attain 678 €/t. The demand for standard plastics has once again decreased in November.

Table 1: Prices of standard plastics in plasticker, quoted in €/t

*: Supply figures too low to attain statistical significance; 1: equivalent to the grade “post-industrial, mixed colours”; 2: equivalent to K49; 3: equivalent to K59; 4: equivalent to “standard, mixed colours”; 5: equivalent to the grade “regranulates, black”, 6: forecast (likely to be amended by additional quotes)

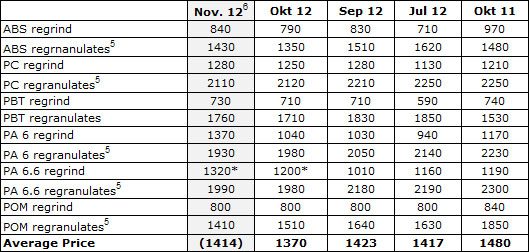

Technical plastics: In October technical plastics prices decreased once again. The quote for technical plastics has fallen by 53 €/t compared to the previous month. The October Price Index shows two price rises, namely of 10 €/t and 60 €/t; apart from that, it indicates price declines of 20 €/t to 150 €/t. There was still a considerable purchasing demand in October; it even exceeded that for September. The prices of regranulates from PC, PA and POM are reported to have bottomed out over the past 18 months. According to plasticker, the following quotes changed by more than +/- 70 €/t in October: ABS regranulates -150 €/t, PA 6.6 regranulates -90 €/t and POM regranulates -150 €/t.

According to the first forecast of the current November quotes, whose final listings cannot be published until the beginning of December, prices are likely to rise by 44 €/t on average. The supply figure for November has slightly fallen compared to October. However, in total, technical plastics show a long-term trend towards a gradual decline in prices.

Table 2: Prices of technical plastics in plasticker, quoted in €/t

5: equivalent to the grade „regranulates, black“. 6 forecast (likely to be amended by additional quotes)

No guarantee for any of the prices. All EUWID prices are quoted ex works. As a rule, the prices quoted refer to quantities in excess of 20 tons. The monthly quotes for secondary plastics, which are updated on an hourly basis, can be calculated using the price lists that are derived from the quotations published in the raw material exchange plasticker. The prices listed in this index are quoted with reservation - as the majority of the quotes submitted are not necessarily equivalent to the sales prices. Furthermore, plasticker does not distinguish between the following grades: transparent, mixed colours or colour-separated. Therefore, the information provided by plasticker may indicate different market behaviour than the prices quoted by EUWID.