Market Report Plastics - June 2013

Information about the market for plastics is being presented by:

bvse - Bundesverband Sekundärrohstoffe und Entsorgung e.V.

1. The market for primary plastics

The ifo Business Climate Index for Germany’s trade and industry rose slightly from May to June, namely from 105.7 index values to 105.9 index values. Thus the Business Climate Index has held its own in difficult surroundings. Even though the current economic situation is assessed as being slightly less favourable, optimism in regards to future business developments continues to increase. Germany’s economy is holding ground. These economic developments should have a positive impact on the demand for plastics. However, despite the decline in plastics prices, boosts in demand are not yet clearly discernible.

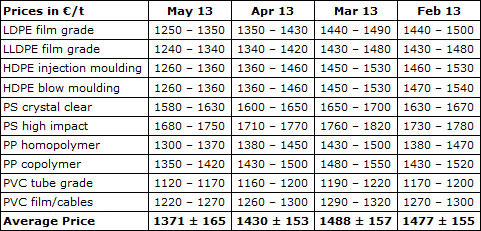

Standard plastics: This month the standard plastics prices attained over the past four months have been listed again, cf. Table 1. Since March the prices have declined by 117 €/t on average. The price decreases should actually trigger a boost in demand. According to EUWID and ki-Kunststoff Information there has only been a rather low demand despite the price decreases. Experts hope that prices have reached their lowest level in the May quotes. Plastics prices are expected to rise in June and July. An improvement in the weather conditions should lead to a rise in the demand for beverage bottles. The proportion of PET in non-beverage packaging continues to rise.

Tablel 1: Developments in the EUWID quotes for standard plastics over the past four months; prices quoted in €/t.

2. The market for secondary plastics

Despite some positive indications, the developments in April and May did not meet the favourable expectations of some experts. In May and June, there have been no positive signals, either. This has led to both used plastics and plastics recyclates being purchased at comparatively favourable prices. There have been some indications that the 2013 summer break is likely to be very short. Plastics recyclers expect the current trend to continue in July and August.

The Chinese “Green Fence Action“ is still ongoing. The goods are already subjected to tight border checks while being loaded for shipping in Germany, then in the European export harbours and then, once again, when they are being imported to Hong Kong or the People’s Republic of China. If the plastics inside the containers are contaminated or mixed with other materials, this will be detected during these border checks. Only the very best quality grades are still finding their way to the People’s Republic of China.

The EUWID magazine shows that the prices for May remained unchanged compared to the previous month, whereas they fell slightly according to plasticker. Hence, the price indices show similar trends. The demand for plastics is reported to be restrained by both EUIWD and plasticker.

2.1 EUWID Price Watch

The EUWID magazine showed three marginal price increases in May. The price rises apply to mass-produced goods, i.e. post-user PE, the price of which attains 5 €/t to 10 €/t on average. The quotes for all other standard plastics have held their own.

The prices of post-user PE have remained unchanged: LDPE shrink film natural (E 49) 440 – 540 €/t, film transparent natural < 70 m 400 – 435 €/t and LDPE farm film black/which > 70 m 40 – 70 €/t. There is a considerable demand for mixed film 98/2 in the export trade with the Far East, which is quoted at 400 – 435 €/t.

The demand for post-industrial PP is slightly higher than in the PE markets. However, the summer demand is very restrained. The quotes for PS and PVC have remained unchanged, too – to date, the economic resurgence has not been noticeable in the EUWID Price Watch.

PET: The situation in the PET market is still difficult. As a result of the faltering outflow of goods to China, PET bottle sellers can no longer force through every price they want to charge. The supply of used PET beverage bottles evened out much better in May than in the previous months: even though beverage sales continue to stagnate, the PET processing capacity is consolidated. EUWID has started to make a slight change to PET purchase prices. The quotes for transparent PET and coloured PET have now fallen by 5 €/t on average. The following new prices are quoted: PET transparent 400 – 430 €/t and PET coloured 220 – 235 €/t.

2.2 plasticker price index

The plasticker internet platform publishes quotes on an hourly basis. However, the present market report shows the final monthly prices. The preliminary quotes previously accumulated are only represented during the reporting month in question, in this case for June 2013 – these quotes merely reflect an interim situation that does not become definitive until the following month. According to the data published by plasticker on 14 June 2013, the quotes for standard plastics more or less held their own, while those for technical plastics decreased by 30 €/t on average compared to the previous month.

Standard plastics

The May quotes fell by 13 €/t on average relative to April, with price decreases ranging from 10 €/t to 150 €/t. The demand for standard plastics, which was considerable at the beginning, deteriorated in the further course of the month. According to plasticker the following prices changed by more than +/- 40 €/t in May compared to April: PS regranulates – 150 €/t and PVC_P regrind + 150 €/t.

The first forecast of the June quotes, whose final listings cannot be published until July, indicates an average price of 623 €/t, which means that plastics prices will remain unchanged compared to May. The developments in the first two weeks of June show that standard plastics are in great demand.

Table 2: Prices of standard plastics in plasticker, quoted in €/t

*: Supply figures too low to attain statistical significance; 1: equivalent to the grade "post-industrial, mixed colours"; 2: equivalent to K49; 3: equivalent to K59; 4: equivalent to "standard, mixed colours"; 5: equivalent to the grade "regranulates, black", 6: forecast (likely to be amended by additional quotes)

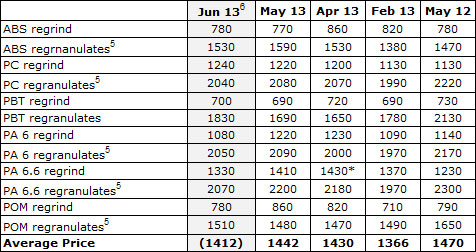

Technical plastics

Die May quotes slightly increased, namely by 12 €/t compared to April. However, this price increase is still within the fluctuation margin of +/- 70 €/t defined further below, which ultimately indicates price stability. In May the demand for technical plastics remained stable, with price rises and price decreases ranging from 10 €/t to 90 €/t, respectively. According to plasticker the following price quotes changed by more than +/- 70 €/t in May: ABS regrind - 90 €/t and PA6 regranulates + 90 €/t.

The first forecast of the June quotes, whose final listings cannot be published until the beginning of July, indicates a slight decline in prices. The June prices have shown a steady demand for recyclates from technical plastics compared to the previous month.

Table 3: Prices of technical plastics in plasticker, quoted in €/t

5: equivalent to the grade "regranulates, black". 6 forecast (likely to be amended by additional quotes)

No guarantee for any of the prices. All EUWID prices are quoted ex works. As a rule, the prices quoted refer to quantities in excess of 20 tons. The monthly quotes for secondary plastics, which are updated on an hourly basis, can be calculated using the price lists that are derived from the quotations published in the raw material exchange plasticker. The prices listed in this index are quoted with reservation - as the majority of the quotes submitted are not necessarily equivalent to the sales prices. Furthermore, plasticker does not distinguish between the following grades: transparent, mixed colours or colour-separated. Therefore, the information provided by plasticker may indicate different market behaviour than the prices quoted by EUWID.