Market Report Plastics - July 2013

Information about the market for plastics is being presented by:

bvse - Bundesverband Sekundärrohstoffe und Entsorgung e.V.

1. The market for primary plastics

According to a report published in the KI Dialog section of the KI-Kunststoff Information online portal the plastics industry in German-speaking countries was faced with a discernible economic low in the first six months of 2013. True, the expectations for improved business that 27 per cent of the industry’s enterprises had at the beginning of this year were met. Nevertheless, the rate of companies faced with a deterioration in business activities, which is now 38%, nearly doubled compared to January’s expectations. The KI Development Index (KI Entwicklungsindex), which was only 83.5 points in January 2013 – the lowest level since the 2009 crisis year -, has now risen to 89.2 points. The advantage is: things are likely to improve in the second half of 2013. The KI Expectation Index (KI Erwartungsindex) has risen by a good three points to 94.7 relative to January.

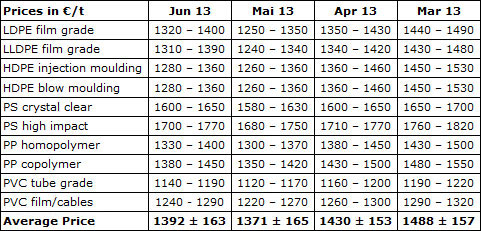

Standard plastics: The price decline in standard plastics observable since March 2013 came to a halt in June. In June the average price increased by 21 €/t compared to the previous month, cf. Table 1. It is doubtful whether the price rises will be maintained during the summer break. According to reports by KI and EUWID the demand is still restrained. There is excess capacity in the PET markets. In the case of PET, the demand for beverage bottles is likely to rise as the weather conditions improve.

Table 1: EUWID quotes for standard plastics over the past four months; prices quoted in €/t.

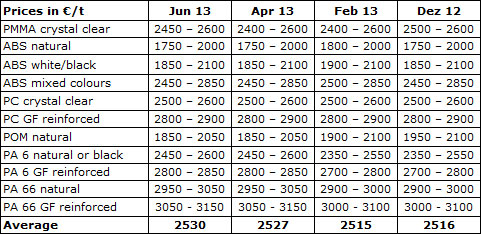

Technical plastics: The technical plastics markets have proved to be very stable according to the bimonthly EUWID listings for 2013. The average price of technical plastics has risen slightly and in small gradations since December 2012. Despite the restrained demand there is still a large supply of technical plastics. Only the price of PMMA rose slightly in June. Hence, the Price Watch indicates price stability. Germany’s demand for automobiles is increasing, which means that the existing price level can be maintained in the next few months, too.

Table 2: EUWID quotes for technical plastics over the past four months; prices quoted in €/t

2. The market for secondary plastics

The secondary plastics markets are plodding along; there have been no decisive market impulses in June and July, either. In addition, the summer break is imminent. Despite some favourable indications the plastics markets prove to be calm and stable. As a consequence, both used plastics and plastics recyclates can be purchased at comparatively favourable prices. Plastics recyclers expect the existing trend to continue in July and August.

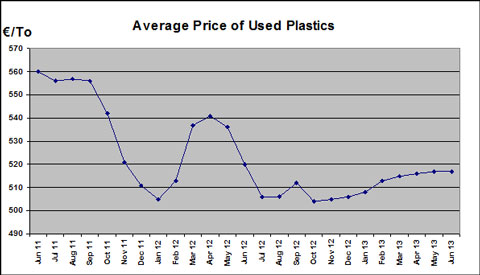

According to the EUWID magazine, the prices of standard plastics for June 2013 did not change compared to May, whereas plasticker indicates a slight price fall. Hence, the trends described by the two price indices are roughly in line with each other. Both EUWID and plasticker report on restrained demand for plastics. The Plasticker Price Index shows an average price fall of 19 €/t for July. Figure 1 shows the developments in the average EUWID listings for standard plastics over the past 24 months. Since October 2012, the average quotes for standard plastics have been steadily rising.

The Chinese “Green Fence Campaign” is still ongoing. Only the very best quality grades are finding their way to China. The predictions concerning the continuation of this policy are subject to frequent change. At present there are even speculations that “Green Fence” will last right into the Chinese New Year’s celebrations. If “Green Fence” is continued, then the prices of post-user materials are expected to slump markedly.

The impact of the Green Fence policy is increasingly perceivable. The quantities of bale goods available in the markets have now risen considerably. At times it is appalling to see the quality of the grades offered for sale. Since the quality grades often do not meet the processors’ expectations, it is necessary to either sort the materials again or to sell them at considerably reduced prices or for an additional payment. To date, waste collection and waste management companies have hardly come to terms with the situation. In the case of plastics recycling in particular, waste collection and waste management companies still have considerable scope for improving the quality grades based on waste separation. Numerous waste collection and waste management companies have hardly deployed the opportunities provided by plastics recycling in Europe.

It is interesting to observe the developments in the secondary markets for technical plastics. On the one hand, there is a lot of fluctuation in price setting; on the other hand, orders are placed very carefully or just in time – even in this area. Regrind and regranulates can be purchased at very favourable prices. The plasticker preview indicates a marked decline in prices for July.

Figure 1: Representation of a selection of average prices from the monthly EUWID Price Watch for used plastics. The quality grades natural, white and transparent have been included in this chart.

2.1 EUWID Price Watch

As a result of the existing excess supply of bale goods, the EUWID Price Watch should actually indicate considerable price decreases in post-user goods. However, the price indices, showing the quality grades quoted, react very conservatively. The excess supply of poor quality grades only has a limited impact on the supply of quality grades quoted by EUWID. Hence, the standard plastics prices published by EUWID have held their own until now.

PE: The PE markets prove to be stable. A solid basic turnover can be made by processing bale goods. As far as post-user PE is concerned, only LDPE shrink film natural (E 49) has held its own: its price has risen by 20 €/t compared to the previous month, which means it is now quoted at 440 – 540 €/t. There are diverse quality grades of regrind and recyclates in the PP market. Unfortunately, poorer quality grades of PP recyclates offered in the market are dragging the prices of higher-quality grades down, too. The PP markets are fluctuating slightly more than those of PE. PP processing is still subject to change: at times the markets are influenced by an excess supply of post-user PP, and at times it is difficult to obtain suitable processing input. The quotes for PS and PVC have remained unchanged, too – to date, the prices of PP have not really recovered, and PVC has risen only slightly.

PET: The situation in the PET market continues to be difficult. As a result of the rise in beverage consumption during the summer months, an increasing quantity of beverage bottles is being launched on the market. In addition, recyclers can import beverage bottles at favourable prices. Even the outflow to the Far East is faltering. Virgin material prices have been steadily decreasing since February 2013: in February they were quoted at 1450 – 1600 €/t – as opposed to 1340 – 1490 €/t in June. According to EUWID the price of PET transparent fell by 15 €/t, while the price quoted for PET coloured was lower by 18 €/t. The following prices are listed: PET transparent 390 – 410 €/t and PET coloured 200 – 220 €/t.

2.2 plasticker price index

The plasticker internet platform publishes quotes on an hourly basis. However, the present market report shows the final monthly prices. The preliminary quotes previously accumulated are only represented during the reporting month in question, in this case for July 2013 – these quotes merely reflect an interim situation that does not become definitive until the following month. According to the data published by plasticker on 19 July 2013, the quotes for standard plastics more or less held their own, while those for technical plastics decreased by 70 €/t on average compared to the previous month.

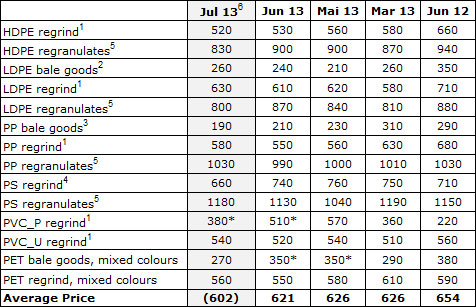

Standard plastics

The June quotes have remained nearly unchanged compared to May. The two price rises are 30 €/t, while the price decreases range from 10 €/t to 60 €/t. The price of PP bale goods has been steadily falling since December 2012. There was sufficient demand in June. On the whole, a trend towards lower prices is discernible. According to plasticker, the June quotes for PVC_P regrind changed by 60 €/t compared to the previous month. However, these PVC quotes are submitted with reservation, as the supply and sales figures are likely to rise.

The first forecast of the July quotes, whose final listings cannot be published until August, shows an average price of 602 €/t. The July demand has slightly improved over the first three weeks compared to the previous month.

Table 3: Prices of standard plastics in plasticker, quoted in €/t

*: Supply figures too low to attain statistical significance; 1: equivalent to the grade "post-industrial, mixed colours"; 2: equivalent to K49; 3: equivalent to K59; 4: equivalent to "standard, mixed colours"; 5: equivalent to the grade "regranulates, black", 6: forecast (likely to be amended by additional quotes)

Technical plastics

There is a lot of fluctuation in technical plastics developments. The June quotes sank by 30 €/t compared to May. Thus, technical plastics reached the level attained in the summer of 2012. From April to July 2013, the average prices of technical plastics fell gradually from 1430 €/t to 1323 €/t, i.e. by 107 €/t within four months. Technical plastics have not yet bottomed out. In June the demand for technical plastics was relatively low: price rises ranged from 20 €/t to 120 €/t and price decreases from 40 €/t to 240 €/t.

As regards the long-term trend, PC, PA 6 and PA 6.6 regranulates have declined by gradations. According to plasticker, the following price quotes changed by more than +/- 70 €/t in June: PC regranulates – 80 €/t, PBT regranulates + 120 €/t, PA 6 regrind – 240 €/t, PA 6 regranulates – 80 €/t, PA 6.6 regranulates – 120 €/t and POM regrind – 80 €/t.

The first forecast of the July quotes, whose final listings cannot be published until the beginning of August, indicates a further price decline of 70 €/t. The July demand for recyclates from technical plastics has largely held its own compared to the previous month.

Table 4: Prices of technical plastics in plasticker, quoted in €/t

5: equivalent to the grade "regranulates, black". 6 forecast (likely to be amended by additional quotes)

No guarantee for any of the prices. All EUWID prices are quoted ex works. As a rule, the prices quoted refer to quantities in excess of 20 tons. The monthly quotes for secondary plastics, which are updated on an hourly basis, can be calculated using the price lists that are derived from the quotations published in the raw material exchange plasticker. The prices listed in this index are quoted with reservation - as the majority of the quotes submitted are not necessarily equivalent to the sales prices. Furthermore, plasticker does not distinguish between the following grades: transparent, mixed colours or colour-separated. Therefore, the information provided by plasticker may indicate different market behaviour than the prices quoted by EUWID. Plasticker offers the quality grades regrind and regranulates in the form of both virgin materials and secondary materials.