Market Report Plastics - August 2013

Information about the market for plastics is being presented by:

bvse - Bundesverband Sekundärrohstoffe und Entsorgung e.V.

1. The market for primary plastics

In August the ifo Institut reported on a new rise in the Business Climate Index for Germany’s trade and industry. The Index has now reached 107.5 points, whereas last month’s value amounted to 106.2 points. Entrepreneurs are satisfied with their current business situation. Even the optimistic attitude towards future business developments has improved. The German economy is moving up a gear. Companies are expecting to receive significant impulses from the export trade, which will lead to further boosts in the demand for plastics. This is likely to partially offset the low demand for plastics attained in the first half-year.

Standard plastics: Even though the summer break has started, standard plastics sales were satisfactory in July. To date, it is noticeable that the resurgences observed in the plastics markets can unfortunately no longer completely offset the lack of orders that prevailed during the first half-year. The price rises in primary goods can be explained by both the increase in demand and the rise in precursor prices.

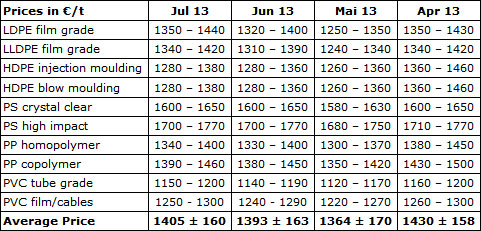

In July the average price of standard plastics increased by 12 €/t. This is the second increase in a row. The average July prices thus held their own compared to those attained in the previous month, cf. Table 1.The price rises amounted to 10 €/t to 35 €/t on average. The July prices 2013 considerably exceeded those attained in July 2012. PET bottles were quoted at 1220 - 1290 €/t by EUWID; this price fell short of the previous month’s by 35 €/t. The considerable supply of PET is held responsible for the fact that PET prices decreased again in July. The increased demand for PET expected for the summer months is likely to lead to stable or higher PET prices in the subsequent months.

Table 1: EUWID quotes for standard plastics attained over the past four months; prices in €/t.

2. The market for secondary plastics

There was little fluctuation in the secondary markets in July; the plastics markets proved to be calm. The information provided by plastics recyclers on the summer break vary considerably; nevertheless, there are reports on positive market impulses for August. According to the EUWID magazine, standard plastics prices for July 2013 remained nearly unchanged relative to the previous month, whereas plasticker reports on slight price falls. EUWID and plasticker each report on restrained demand for plastics. Hence, the trends described by the two price indeces are in line with each other.

The Chinese “Green Fence Action“ continues to be effective: according to the Chinese customs authorities, the decreases in waste plastic imports were 31 per cent in July. Chinese plastics recyclers are complaining about a lack of processing goods. Only the very best plastics quality grades can still be shipped to China. There is now more processing material with very varied quality grades in the markets. The prices of non-processed and used plastics will slump further if “Green Fence” is continued.

2.1 EUWID Price Watch

According to the EUWID Price Watch, waste plastics prices have nearly held their own: export goods continue to be stable. Only the prices of post-user film are reported to have changed in two cases: the price of film transparent mixed colours <70 m has fallen by 5 €/t on average, which means it is now quoted at 40 – 160 €/t; the price of LDPE farm film b/w > 70 m has fallen by 10 €/t, i.e. it is now quoted at 30 – 60 €/t. EUWID does not report on any price reductions in mixed tissue. The quality grades of mixed film traded now adapt to the market fluctuations, i.e. only high-quality materials are sold at more favourable prices.

The PE markets proved to be stable in July. The supply of HDPE hollow bodies and PP increased. The supply of PP processing materials also rose. PS and PVC held their own – in July there was only a slight resurgence in PS and PVC. The PS and PVC markets are expected to change favourably in August and in the next few months.

The situation in the PET market remained difficult in July, too. As a result of the increased beverage consumption during the summer months, the number of bottles released on the market is rising. The supply of PET bottles has considerably increased during the summer months. Despite the falling purchase prices, recyclers continue to fight for profitable margins because virgin material prices are still declining. According to EUWID, the quotes for PET transparent and PET coloured have each fallen by 35 €/t. The new quotes are as follows: PET transparent 350 – 380 €/t and PET coloured 160 – 190 €/t.

2.2 plasticker price index

The plasticker internet platform publishes quotes on an hourly basis. However, the present market report shows the final monthly prices. The preliminary quotes previously accumulated are only represented during the reporting month in question, in this case for August 2013 – these quotes merely reflect an interim situation that does not become definitive until the following month.

Standard plastics

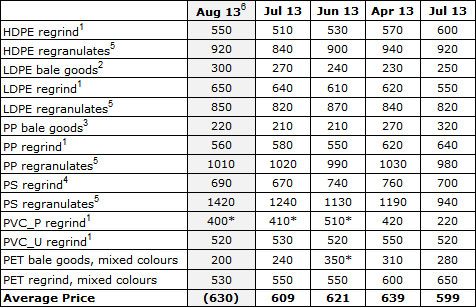

The July quotes fell short of those for June by 12 €/t, with price rises ranging from 10 €/t to 110 €/t and price reductions ranging from 20 €/t to 90 €/t. The price of PS regranulates surged by 110 €/t! There was sufficient demand in July; PP regrind was in great demand. According to plasticker, the price quotes changed by more than +/- 40 €/t compared to the previous month for: HDPE regranulates -60 €/t, LDPE regranulates – 50 €/t, PS regrind – 70 €/t and PS regranulates + 110 €/t. The information on the changes in PVC_U regrind, whose price fell by 100 €/t, and PET coloured, which decreased by 90 €/t, is given with reservation as supply and sales figures fell short of those for the previous month. The medium-term trend shows that the prices of LDPE bale goods have been increasing since May 2013, whereas the quotes for PET regrind have been falling since October 2012.

According to the first forecast of the August quotes, whose final listings cannot be published until the end of September, the prospective average price is 630 €/t. Thus, the prices indicated by the plasticker internet platform on 26th August 2013 fell short of the previous month’s by 21 €/t. The demand shown in the fourth week of August was satisfactory – and that despite the summer holidays.

Table 2: Prices of standard plastics according to plasticker, quoted in €/t

*: Supply figures too low to attain statistical significance; 1: equivalent to the grade “post-industrial, mixed colours”; 2: equivalent to K49; 3: equivalent to K59; 4: equivalent to “standard, mixed colours”; 5: equivalent to the grade “regranulates, black”, 6: forecast (likely to be amended by additional quotes)

Technical plastics

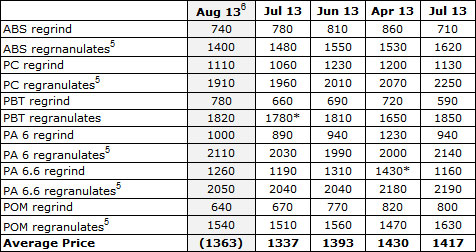

Technical plastics can still be purchased at favourable prices. However, the prices might have bottomed out already. The July prices fell for the third time in a row. The price decrease was 56 €/t relative to the previous month. In the course of July, there was restrained demand for technical plastics, with price reductions ranging from 30 €/t to 170 €/t. Only the price of PA 6 regranulates rose, namely by 40 €/t. According to plasticker the following quotes changed by more than +/- 70 €/t: PC regrind - 170 €/t, PA 6.6-regrind - 120 €/t and POM regrind -100 €/t. As regards the medium-term trend, ABS regrind has been falling since November 2012, while the prices of PC regranulates and POM regrind have been decreasing since July 2012 and May 2013 respectively.

The first forecast of the August quotes, whose final listings cannot be published until the beginning of September, indicates a prospective average price of 1,363 €/t. Hence, the technical plastics price indicated by the plasticker internet platform on 26th August 2013 slightly exceeded the previous month’s by 26 €/t. The demand for technical plastics shown in the fourth week of August was satisfactory.

Table 3: Prices of technical plastics according to plasticker, quoted in €/t

5: equivalent to the grade "regranulates, black". 6 forecast (may be amended by additional quotes)

No guarantee for any of the prices. All EUWID prices are quoted ex works. As a rule, the prices quoted refer to quantities in excess of 20 tons. The monthly quotes for secondary plastics, which are updated on an hourly basis, can be calculated using the price lists that are derived from the quotations published in the raw material exchange plasticker. The prices listed in this index are quoted with reservation - as the majority of the quotes submitted are not necessarily equivalent to the sales prices. Furthermore, plasticker does not distinguish between the following grades: transparent, mixed colours or colour-separated. Therefore, the information provided by plasticker may indicate different market behaviour than the prices quoted by EUWID. Plasticker offers the quality grades regrind and regranulates in the form of both virgin materials and secondary materials.