Market Report Plastics - June 2009

Information about the market for plastics is being presented by:

bvse - Bundesverband Sekundärrohstoffe und Entsorgung e.V.

1. The market for primary plastics

The price level of standard plastics in the primary market has stabilized, albeit at a low level. The reduction in supply, which was caused by production plant closures, has had a stabilizing effect on prices. Since February the prices of standard plastics have been continuously and gradually increased. Nevertheless, there is still a tremendous difference of 230 - 250 /to in all quotes compared to the prices paid in October 2008. In May 2009 the prices quoted for PS and PVC rose by 20 - 30 /to. According to the EUWID Price Watch the average price for the ten types of plastics listed below is meanwhile at 868 /to; thus it has increased by 10 /to compared to the previous month. The price index for standard plastics shows the following price quotes: LDPE film grade 860-910 /to, LLDPE film grade 860-930 /to, HDPE injection moulding 820-910 /to, HDPE blow moulding 840-880 /o, PS general purpose 880 - 930 /to, PS high impact 930-980 /to, PP homopolymer 770-850 /to, PP copolymer 820-900 /to, PVC tube grade 780-820 /to, PVC film/cables 820-860 /to.PET: In May PET for packaging from Western Europe was quoted at 1100 - 1150 /to, thus exceeding the previous month by 30 /to on average. Hopes for an increase in the demand for PET are based on the rise in bottle consumption during the summer months. However, the global capacities in the spot market rapidly offset the regional increase in demand.

On the London Metal Exchange (LME) price quotes reveal an upward trend! The quotes submitted here are average values based on LME purchase and sales prices. In week 26 the purchase prices of PP for July, August and September were at 985 US-$, 995 US-$ and 1000 US-$ respectively, whereas those of LLDPE were at 1160 US-$, 1165 US-$ and 1170 US-$ respectively. Hence, the July quotes for PP have increased by 145 US-$/to compared to the prices quoted in the previous month, whereas those for LLDPE have risen by 180 US-$/to. Further distinct increases in standard plastics prices can be predicted for the next few months on the basis of the LME quotes and the price rises mentioned above.

2. The market for secondary plastics

The prices of secondary plastics have not undergone any major changes compared to the previous month. The overall situation continues to be difficult; however, it has stabilized at a low level. Production plant capacities are still temporarily reduced by closures, maintenance breaks, or extended vacations. The collectors', sorters', reprocessors', processors' and traders' stocks are abundant. Meanwhile high-quality recyclates are again moving along the sales channels, albeit at a lower price level. The export trade with the Far East is stabilizing European markets. The demand for European goods is on the increase in the export trade with the Far East. The current export situation is assessed as being relatively unstable by traders and merchants alike.

2.1 EUWID Price Watch

The market for post-industrial PE remained stable in May, too. In particular the price quotes for regrind remained unchanged. In May prices were quoted as follows: HDPE mixed colours 300 - 450 /to, HDPE natural 400 - 530 /to, LDPE mixed colours 250 - 400 /to, LDPE natural 350 - 450 /to, LDPE film mixed colours (K49) 160 - 240 /to and LDPE film natural (K40) 300 - 450 /to.

Only the quotes for PE post-user plastics have changed again in the EUWID Price Watch for May. There is a shortage of film from packaging, as consumption is on the decline due to the economic crisis. The export demand for film from packaging has also boosted the corresponding price quotes. Price increases range between 10 and 50 /to. Hence, PE post-user is quoted as follows: LDPE shrink film natural (E40) 270-360 /to, LDPE shrink film mixed colours (E49) 170-220 /to, LDPE stretch film natural (E70) --- /to, film transparent natural <70 mm 290-350 /to, film transparent coloured <70 mm 20-100 /to, LDPE farm film natural <70 mm (B40) --- /to. LDPE farm film black or white >70 mm (B41) 0-30 /to, mixed film (98/2) 300 - 350 /to, mixed film (90/10) 150-230 /to, mixed film (80/20) 140 - 200 /to, HDPE hollow bodies mixed colours (C29) 20-100 /to, HDPE regrind from crates colour-separated 400-450 /t and HDPE regrind from crates mixed colours 300-440 /to.

PP: PP markets are stagnating; they are still characterized by a low demand and by low sales. Price quotes have remained unchanged compared to the previous month.

PS: There are no changes compared to the previous month, either. PS stocks are still abundant. There is, at least, a higher demand for this material than for PP.

PVC quotes have also remained unchanged compared to the previous month. However, the number of purchases and sales has increased.

Post-user PET: The EUWID quotes for PET continue to be suspended. As a result of the increase in the export demand for PET prices have risen by 20 /to. Export prices exceed domestic market prices by 30 /to. Price increases by 160 - 220 /to for natural bottles and 60 - 100 /to for mixed-coloured goods are considered as indicative of current PET quotes. Mixed-coloured goods are selling very slowly. Hopes for the PET market are based, on the one hand, on the continuous increase in primary goods prices and, on the other hand, on the increasing demand for beverage bottles during the summer.

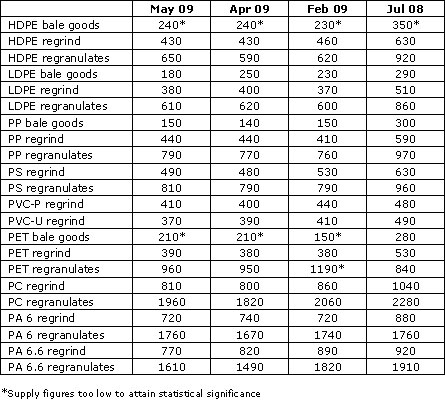

2.2 plasticker price index

The price quotes for secondary plastics can be calculated on the basis of plasticker (cf. www. plasticker.de). The prices listed in this index are quoted with reservation - as the majority of the quotes submitted are not necessarily equivalent to the sales prices.Therefore, the information provided by plasticker indicates distinctly different market behaviour than the prices quoted by EUWID.

Standard plastics prices for May remained firm compared to April 2009. Most of the price changes range between +/- 10 and 20 /to. The first forecast of the June quotes also shows consolidated prices or slight price increases by 10 - 40 /to. The following changes greater than/less than 40/to can be reported for May compared to April: HDPE regranulates + 60 /to and LDPE bale goods - 70 /to. The following changes greater than/less than 70 /to can be reported for technical plastics compared to April: PC regranulates + 140 /to, PA 6-regranulates + 90 /to as well as PA 6.6 regranulates - 120 /to.

The given prices are, above all, based on the monthly published EUWID Price Watch for primary plastics and waste plastics. The price quotes for waste plastics refer to bale goods or regrind in this case. The given prices were quoted for business transactions between sorting plants and sales agents or the processing industry, as the case may be. As a rule, prices refer to quantities in excess of 20 to. The prices achievable in trade can differ considerably from the indicated price range in both directions, depending on the sort of plastic material offered. The abbreviations used for some grades refer to the list of waste plastics published by the German Federal Association for Secondary Raw Materials and Waste Disposal (bvse)/Bureau of International Recycling (BIR). This market report is based on various sources which have been correspondingly edited by journalists. Finally, our own sources of information and enquiries have been used in this market report.