Market Report Plastics - July 2009

Information about the market for plastics is being presented by:

bvse - Bundesverband Sekundärrohstoffe und Entsorgung e.V.

1. The market for primary plastics

Standard plastics prices in the primary market are reported to have increased throughout! The price rises range between 10 and 70 /to. Standard plastics prices have been continuously and gradually increased since February; this trend still continued in June. According to the EUWID Price Watch the average price quoted for the ten types of plastics listed below is meanwhile at 899 /to; thus it has increased by 32 /to compared to the previous month. The price index for the ten types of standard plastics listed below shows the following price quotes: LDPE film grade 880-920 /to, LLDPE film grade 880-950 /to, HDPE injection moulding 840-910 /to, HDPE blow moulding 860-900 /o, PS general purpose 920 - 950 /to, PS high impact 970-1000 /to, PP homopolymer 800-870 /to, PP copolymer 850-920 /to, PVC tube grade 850-890 /to, PVC film/cables 890-930 /to. PVC prices have thus risen distinctly, namely by 70 /to, whereas the prices quoted for other types of plastics have increased by 20 /to on average. Experts mention a number of reasons for this economic resurgence, yet they do not regard it as a sign of long-term market recovery. The economic resurgence is explained by the following factors: the increase in raw material prices, the reductions in supply, the rise in export demand and stock replenishment.PET: The June quote for PET packaging from Western Europe is 1100 - 1150 /to, thus falling short of the previous month by 50 /to. Hopes for an increase in the demand for PET continue to be based on the rise in bottle consumption during the summer months. However, the global capacities in the spot market still rapidly offset the regional increase in demand.

Again, the EUWID Price Watch for June shows distinct price increases in technical plastics. Only the price of PPA has remained unchanged. Price decreases range between 50 and 200 /to for all types of technical plastics. This trend is not expected to be reversed in the next few months. Experts fear the summer doldrums and hope for an increase in demand in the automobile industry. The quotes for two months are: PMMA crystal clear 2200-2400 /to, ABS natural 1150-1250 /to, ABS white or black 1230-1350 /to, ABS mixed colours 1850-2000 /to, PC crystal clear 2150-2350 /to, PC GF 2350-2550 /to, POM natural 1900-2050 /to, PA 6 natural 1700-2100 /to, PA 6 black 1700-2100 /to, PA 6 GF reinforced 1950-2300 /to, PA 66 natural 2100-2400 /to und PA 66 GF 2350-2400 /to.

On the London Metal Exchange (LME) price quotes have remained firm! The quotes submitted here are average values based on LME purchase and sales prices. In week 29 the purchase prices of PP for August, September and October were at 1010 US-$, 1015 US-$ and 1020 US-$ respectively. The purchase prices of LLDPE quoted for August and September peaked at 1190 US-$ and 1195 US-$ respectively. Hence, the August quotes for PP have increased by 25 US-$/to compared the previous month, whereas those for LLDPE have risen by 30 US-$/to. The LME quotes and the price rises mentioned above suggest that prices are likely to further stabilize. However, the increase in raw material prices is also due to crude oil speculation and is thus not expected to continue in the long term. Therefore, one may well ask whether the prices quoted for standard plastics and technical plastics can be maintained throughout the summer months.

2. The market for secondary plastics

In June secondary plastics prices still remained relatively stable compared to the previous month. The plastics market is inconsistent; the overall situation continues to be difficult. The summer doldrums are putting additional brakes on the economy. Recyclers are reducing their stocks and are not producing at full capacity any more. In certain areas, demand is reported to have decreased tremendously. High-quality recyclates are quoted at comparatively favourable prices. The export trade with the Far East has also declined since the previous month; nevertheless, goods from Europe, PE and PET in particular, are still in great demand there. Some export enquiries from the Far East are assessed as being merely speculative with regard to a potential surge in demand and raw material prices. However, it should also be pointed out that the Far East has by all means made large-scale purchases of other types of goods, namely certain metal grades, for strategic reasons. Furthermore, some economic data indicate that the economic situation has been improving since May; for instance, the demand for automobiles has been rising. Moreover, there is a steadily growing demand for various types of export goods, such as machinery and equipment.

2.1 EUWID Price Watch

Again, the market for post-industrial PE remained stable in June. The price quoted for regrind remained unchanged. Hence, the June quotes are as follows: HDPE mixed colours 300 - 450 /to, HDPE natural 400 - 530 /to, LDPE mixed colours 250 - 400 /to, LDPE natural 350 - 450 /to, LDPE film mixed colours (K49) 160 - 240 /to and LDPE film natural (K40) 300 - 450 /to.

The quotes for PE post-user plastics have changed in the EUWID Price Watch for June; the price quoted for film has decreased by 10 - 30 /to.Thus the price increase of the previous month has been reversed. Hence, PE post-user is quoted as follows: LDPE shrink film natural (E40) 270-360 /to, LDPE shrink film mixed colours (E49) 170-220 /to, LDPE stretch film natural (E70) --- /to, film transparent natural <70 mm 270-320 /to, film transparent coloured <70 mm 20-80 /to, LDPE farm film natural <70 mm (B40) --- /to. LDPE farm film black or white >70 mm (B41) 0-50 /to, mixed film (98/2) 270 - 320 /to, mixed film (90/10) 150-200 /to, mixed film (80/20) 130 - 180 /to, HDPE hollow bodies mixed colours (C29) 20-100 /to, HDPE regrind from crates colour-separated 400-450 /t and HDPE regrind from crates mixed colours 300-430 /to.

PP: The PP markets are stagnating; they are still characterized by a low demand and by low sales. The quotes for mixed-coloured film (K59) and mixed-coloured homopolymer have decreased by 10 /to to reach 0 - 90 /to and 230 - 400 /to respectively.

PS: The price quotes have remained unchanged compared to the previous month. Excess production capacities for primary PS have been reduced. The prices of secondary PS tend to decrease by 10 - 20 /to.

PVC quotes have also remained unchanged compared to the previous month. The situation of PVC-U has slightly improved. The following prices are quoted for windowframe regrind: Windowframe regrind white 490 - 600 /to, windowframe regrind mixed colours 300 - 400 /to and windowframe regrind single-shade white 600 - 740 /to. Meanwhile the PVC industry has introduced short-time working as well. The economic decline in private and public housing cannot be offset by private renovations. Housing market slumps range between 10 and 20 %.

Post-user PET: The EUWID quotes for PET continue to be suspended in June. The methods of price quotation are reported to have been amended in July. The export demand for reuse system PET bottles continues to increase. Export prices exceed domestic market prices by 40 on average. As a consequence, domestic market prices are also on the increase, namely by 10 - 20 /to. Price rises of 170 - 230 /to for transparent bottles and 70 - 120 /to for mixed-coloured goods are considered as indicative of current PET quotes. The majority of mixed-coloured goods are exported. Hopes for the PET market are based on the increasing demand for beverage bottles during the summer months.

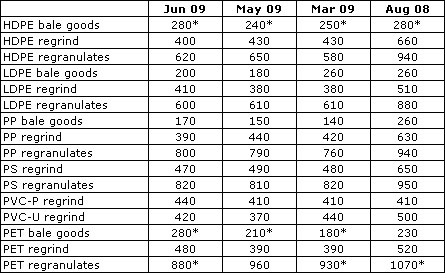

2.2 plasticker price index

Standard plastics prices have remained unchanged compared to May 2009. A clear trend is not discernible: price changes range between - 80 and + 90 /to. The prices of PET bale goods and PET regrind have increased by 70 /to and 90 /to respectively, whereas the quotes for PET regranulates have decreased by 80 /to. The prices of regranulates tend to decrease. The first forecast for July suggests that the June trend is likely to continue. The following price changes greater than/less than 40 /to can be reported for June compared to May: PP regrind - 50/to, PVC_U regrind +50 /to, PET bale goods + 70 7to, PET regrind + 90 /to and PET regranulates - 80 /to.

Standard plastics

The prices of technical plastics still remained stable in June. In June changes ranged between - 60 /to and + 50 /to. However, the forecast for July reveals distinct decreases of 160 - 190 in the quotes for regranulates.

Technical plastics

*Supply figures too low to attain statistical significance

The price quotes for secondary plastics can be calculated on the basis of plasticker (cf. www. plasticker.de). The prices listed in this index are quoted with reservation - as the majority of the quotes submitted are not necessarily equivalent to the sales prices.Therefore, the information provided by plasticker indicates distinctly different market behaviour than the prices quoted by EUWID.

The EUWID price quotes refer to bale goods or regrind. The given prices were quoted for business transactions between sorting plants and sales agents or the processing industry, as the case may be. As a rule, prices refer to quantities in excess of 20 to ex works. The prices attainable in trade can differ considerably from the indicated price range in both directions, depending on the grade of the type of plastic material quoted. The abbreviations used for some grades refer to the list of waste plastics published by the German Federal Association for Secondary Raw Materials and Waste Disposal (bvse)/Bureau of International Recycling (BIR).