Market Report Plastics - October 2009

Information about the market for plastics is being presented by:

bvse - Bundesverband Sekundärrohstoffe und Entsorgung e.V.

1. The market for primary plastics

All in all, the situation of standard plastics is inconsistent, despite clear price trends. It would be possible to derive a clear trend from the price increases if the demand were not assessed as being relatively low. The prices of precursors are inconsistent, too. To date, the economic boost, which is likely to have a positive impact on plastics sales, has been developing relatively slowly. There are a number of indications that the predicted shifts and increases in the capacities and quantities of production have had an impact, which is changing global markets.The quotes for standard plastics are reported to have risen again in September - with the exception of the prices quoted for PS. The prices of PS were slightly reduced, namely by 20 /to. The price increases for standard plastics ranged from 60 to 110 /to. In the EUWID Price Watch the average price of the ten types of plastics listed below is meanwhile at 1097 /to; thus it exceeds last month's price by 61 /to. It is amazing to see that the quotes for all types of standard plastics have changed only slightly, namely by +/- 38 /to. In other words, all the ten types of plastics listed have the same price within the above-mentioned standard range. The following prices are quoted for the ten types of standard plastics: LDPE film grade 1070-1140 /to, LLDPE film grade 1070-1140 /to, HDPE injection moulding 1050-1100 /to, HDPE blow moulding 1070-1120 /to, PS general purpose 1050-1100 /to, PS high impact 1100-1160 /to, PP homopolymer 1040-1100 /to, PP copolymer 1090-1150 /to, PVC tube grade 1050-1110 /to und PVC film/cables 1090-1150 /to.

The price structure of PET is inconsistent, too: in September, PET for packaging was quoted at 1100 - 1200 /to; thus its price had increased by 25 /to compared to the previous month. The demand for PET was considered to be relatively low in September and October. Spot prices are already on the decline. The seasonal autumn and winter doldrums in the demand for PET have had a negative impact on its prices.

The quotes on the London Metal Exchange, which apply throughout Europe, have declined, too. In week 43 the purchase prices of PP quoted for November, December and January were at 1045 US-$ respectively. The purchase prices of PP for November, December and January attained 1150 US-$ respectively. Thus the November quotes for PP decreased by 80 US-$, whereas those for LLDPE decreased by 70 US-$. The LME quotes indicate a slight decrease in prices.

2. The market for secondary plastics

There have been warnings that the decline in prices that occurred in autumn 2008 might repeat itself. While prices and sales still showed positive trends at the beginning of September, sales slumped markedly at the end of September and at the beginning of October, both in domestic and foreign trade. Exports to the People's Republic of China suffered from a number of factors; however, these are mainly due to the continuing economic crisis, which has led to a decrease in product sales. At least, market prices are now set on the basis of market fluctuations, rather than orienting themselves towards primary product prices. Since mid-October the plastics markets have been stabilizing. However, it is not possible to infer clear trends from this development. The secondary plastics market has hardly ever differed more from the markets for other types of plastics.

2.1 EUWID Price Watch

PE: The quotes for PE post-industrial waste remained unchanged in September, too. Regrind sold well, with prices remaining stable. The price index for post-user PE shows significant changes. The prices of mixed tissue decreased for all grades quoted here. Colour-separated regrind from crates even increased by up to 55 /to on average. Thus the prices of the following types of plastics changed: LDPE shrink film natural (E 40) 280 - 350 /to, mixed tissue (98/2) 270 - 300 /to, mixed tissue (90/10) 160 - 210 /to and mixed film (80/20) 150 - 180 /to as well as HDPE regrind from crates, colour-separated 440 - 520 /to.

PP: The PP markets showed more fluctuation again. The sales of PP post-industrial wastes slightly increased. The quote for PP film slightly increased, viz. by 10 - 20 /to: film mixed colours (K59) 0 - 100 /to, film natural (K50) 150 - 220 /to.

PS: The prices remained unchanged compared to the previous month. The situation of PS and EPS was assessed as being relatively difficult.

The change in PVC quotes cannot be regarded as a significant market resurgence yet. Nevertheless, the demand for PVC products from the private building and construction sector should not be underestimated. For instance, the prices of high-grade post-industrial wastes increased by 20 /to, viz. for PVC-U mixed colours, which was quoted at 200 - 370 /to, and for tube grade mixed colours, which was also quoted at 200 - 370 /to. The price of windowframe regrind mixed colours was at 320 - 420 /to and thus rose by 20 /to.

PET post user: Again, there is fierce competition in the PET market. The export trade with the Far East is stagnating. Favourable virgin material prices have reduced the quotes for PET considerably. High-quality PET bale goods are selling well. There has been a low demand for PET mixed colours - both in domestic and in foreign trade. Due to their increased production capacities, the goods dealers involved in waste collection are speculating on the demand for PET, which is likely to be steadily high throughout Europe. However, PET processors seem to have an amazingly flexible way of adapting themselves to the respective market situation. Since July EUWID has resumed price quotation in its own index. In the restructured price index published in September, the reuse system bottle grade PET transparent was quoted at 190 - 230 /to, whereas PET mixed colours was quoted at 90 - 120 /to. EUWID expressly points out that the new quotes are not in line with the prices quoted before the index was restructured.

2.2 plasticker price index

The price index showed sufficient supply and demand in September. Most prices remained unchanged; i.e. price increases were more or less balanced out by price reductions. Fluctuations ranged from - 80 /to to + 100 /to. PET bale goods, PET regrind and PET regranulates decreased by 10 /to, 40 /to and 80 /to. The two PVC grades decreased by 40 /to. The quotes for polyolefins, however, slightly increased. The first forecast of the October quotes shows that the prices quoted are likely to stabilize.

The following price changes greater than/less than 40 /to can be reported for September compared to August: HDPE regranulates + 100 /to, LDPE regranulates + 100 /to, PS regranulates + 70 /to as well as PET regranulates - 80 /to.

Standard plastics

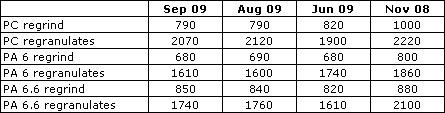

The September quotes for technical plastics hardly changed compared to the previous month. The quotes fluctuated only slightly, namely from - 50 /to to + 20 /to. The forecast of the October quotes shows that the markets are likely to stabilise and that the prices of regranulates might decrease, namely by 100 /to to 300 /to.

Technical plastics

*Supply figures too low to attain statistical significance

The quotes for secondary plastics, which are updated on an hourly basis, can be calculated using the price lists that are derived from the quotations published in the raw material exchange plasticker. The prices listed in this index are quoted with reservation - as the majority of the quotes submitted are not necessarily equivalent to the sales prices.Therefore, the information provided by plasticker indicates distinctly different market behaviour than the prices quoted by EUWID.

The EUWID price quotes refer to bale goods or regrind. The given prices were quoted for business transactions between sorting plants and sales agents or the processing industry, as the case may be. As a rule, prices refer to quantities in excess of 20 to ex works. The prices attainable in trade can differ considerably from the indicated price range in both directions, depending on the grade of the type of plastic material quoted. The abbreviations used for some grades refer to the list of waste plastics published by the German Federal Association for Secondary Raw Materials and Waste Disposal (bvse)/Bureau of International Recycling (BIR).