Market Report Plastics - February 2010

Information about the market for plastics is being presented by:

bvse - Bundesverband Sekundärrohstoffe und Entsorgung e.V.

1. The market for primary plastics

According to the EUWID Price Watch, the prices of all standard plastics increased considerably in January, namely by 74 /t on average. The average price of the ten types of standard plastics listed below was at 1094 /t in January, compared to 1019 /t in December. The price rises, which varied considerably depending on the type of plastics, ranged from 10 /t to 170 /t. The following prices increased in particular: PE by 50 - 80 /t, PS by 150 -180 /t, PP by 40 - 60 /t and PVC by 5 /t. According to the Price Watch, the following prices were quoted for the ten types of standard plastics: LDPE film grade 1070 - 1120 /t, LLDPE film grade 1070 - 1120 /t, HDPE injection moulding 1040 - 1100 /t, HDPE blow moulding 1060 - 1100 /t, PS general purpose 1180 - 1200 /t, PS high impact 1240 - 1270 /t, PP homopolymer 1030 - 1100 /t, PP copolymer 1080 -1150 /t, PVC tube grade 940 - 980 /t und PVC film/cables 990 - 1040 /t. The price of PET for packaging exceeded the previous month's quote by 25 /t on average; it was at 1170-1220 /t.Empty stocks have been replenished in January and February. The drastic reductions in the supply of plastics have led to prices rising as a result of the current demand for production. At the same time the market prices attained for the different types of plastics have exceeded the price rises from precursors.

The quotes for Europe on the London Metal Exchange (LME) also show that prices are rising. In week 7 the purchase prices of PP for March, April and May were at USD 1165 respectively. The purchase prices of LLDPE quoted for March, April and May attained USD 1220 respectively. Hence, the January quotes for PP increased by 80 USD/t and those for LLDPE by 75 USD/t. The March quotes for PP across Europe fall short of those for Asia by 45 USD/t and by 385 USD/t compared to those for North America. The March quotes for LLDPE across Europe are 120 USD/t lower than those for Asia and 200 USD/t lower than those for North America.

The continuing winter cold is stabilising crude oil prices. This is likely to lead to another, albeit slighter, increase in the cost of precursors, which might then have a price-boosting effect on plastics. In March and April, prices are predicted to slightly increase or stabilise at the level attained. The demand for plastics from industry, trade and private consumption is expected to rise in the next few months. However, experts warn that primary materials are overvalued.

2. The market for secondary plastics

This time the boost in demand from the primary markets has had an immediate impact on the secondary plastics markets. Low supply quantities of primary and secondary materials, a stronger dollar and the increased export demand are driving the prices of secondary plastics up almost everywhere. There is still a lack of sufficient and high-quality input among plastics processors and recyclers. Above all, there has been a demand for good film from the Far East in January and February. Despite the holidays in the Far East, export demand was high in January and February.

However, the secondary plastics markets are also assessed as being inconsistent. On the one hand, the prices are expected to increase again in the next two months; on the other hand, there are warnings that the markets may be overheating. Experts think that the current boom is not due to real demand. Furthermore, they presume that decreasing virgin material prices will have a negative impact on the secondary market. Plastics processors and plastics recyclers are coming under pressure as input prices are increasing; however, these price rises can only be passed on to regranulates to a limited extent.

2.1 EUWID Price Watch

PE: Above all, natural film is in great demand in the export trade with the Far East. The prices attained in foreign trade are distinctly higher than those achieved on the domestic market. Experts consider the export demand for film to be exaggerated in some cases. The Price Watch for PE post-industrial shows price increases of 20 /t on average, namely for: HDPE mixed colours 330 - 450 /t, HDPE natural 420 - 530 /t, LDPE mixed colours 280 -420 /t, LDPE natural 350 - 450 /t, LDPE film mixed colours (K49) 150 - 230 /t and LDPE film natural (K40) 300 - 440 /t. The prices of post-user PE have also increased throughout, namely by 10 - 40 /t: LDPE shrink film natural (E40) 330 - 370 /t, LDPE shrink film mixed colours (E49) 160 - 220 /t, film transparent natural < 70 ΅m 290 - 350 /t, film transparent natural < 70 ΅m 20 - 80 /t, LDPE farm film black or white > 70 ΅m 20 - 50 /t, PE mixed film (90/10) 190 - 230 /t, PE mixed film (80/20) 160 - 200 /t and HDPE hollow bodies mixed colours (C29) 90 - 210 /t. Mixed-coloured bale goods from HDPE bottles attained price increases of 70 -110 /t!

PP: The demand for PP reflects the development on the virgin material markets. There are warnings that the markets may be overreacting here, too. The price of PP post-industrial has increased by 10 - 50 /t. The following prices are quoted: film mixed colours (K59) 30-100 /t, film natural (K50) 170-270 /t, homopolymer mixed colours 250-420 /t, homopolymer natural 330 - 520 /t, copolymer mixed colours 250 - 420 /t and copolymer natural 350-520 /t.

PS: The quotes for some post-industrial grades are 20 - 40 /t higher, namely: standard mixed colours 300 - 400 /t, standard crystal clear 400 - 500 /t, high impact black 350 - 500 /t and high impact white 400 - 560 /t. The secondary markets for PS follow the marked price increases on the PS primary markets to a lesser extent.

PVC: Largely moderate price rises of 10 - 20 /t can be reported for some types of PVC post-industrial. However, the quote for the grade "PVC-U transparent" has risen by 50 /t in the lower price range. Hence, the following amended prices are quoted for PVC post-industrial: PVC-P transparent 340 - 410 /t, PVC - P mixed colours 310-370 /t, PVC-U mixed colours 250-380 /t. The quote for PVC windowframe regrind has remained unchanged. The demand from the building and construction sector was disrupted in the winter months.

PET post user: There is fierce competition in the PET market. Domestic demand is accompanied by a great demand from the Far East, whereas the quantities of beverage bottles are accompanied by considerable processing capacities in Germany and Europe. Beverage consumption is seasonally low. Therefore, the trade has been able to implement price rises. Further price increases have been announced. EUWID quoted the following prices for used and disposable PET bottles in January: PET natural 220 - 255 /t and PET mixed colours 100 - 140 /t. Consequently, the prices of PET transparent rose by 10 - 15 /t, whereas those of PET mixed colours increased by 10 - 20 /t.

2.2 plasticker price index

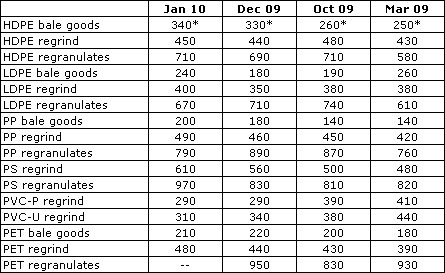

The Plasticker Price Index shows varied trends for standard plastics in December. Even though the price rises ranging between 10 and 140 /t distinctly prevailed, four prices were reduced by 10 /t to 100 /t. The first forecast of the February quotes shows price stabilisation at the level attained. The following price changes in standard plastics of greater/less than 40 /t can be reported for January 2010 compared to December 2009: LDPE bale goods + 60 /t, LDPE regrind + 50 /t, PP regranulates - 100 /t, PS regrind + 50 /t, PS and PS regranulates + 140 /t.

Secondary standard plastics

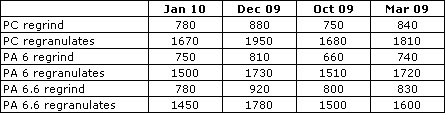

The prices of technical plastics decreased drastically in January. The deviations ranged from - 60 to - 330 /t. The forecast of the February quotes reveals price stabilisation.

Secondary technical plastics

*Supply figures too low to attain statistical significance

The quotes for secondary plastics, which are updated on an hourly basis, can be calculated using the price lists that are derived from the quotations published in the raw material exchange plasticker. The prices listed in this index are quoted with reservation - as the majority of the quotes submitted are not necessarily equivalent to the sales prices.Therefore, the information provided by plasticker indicates distinctly different market behaviour than the prices quoted by EUWID.

The EUWID price quotes refer to bale goods or regrind. The given prices were quoted for business transactions between sorting plants and sales agents or the processing industry, as the case may be. As a rule, prices refer to quantities in excess of 20 to ex works. The prices attainable in trade can differ considerably from the indicated price range in both directions, depending on the grade of the type of plastic material quoted. The abbreviations used for some grades refer to the list of waste plastics published by the German Federal Association for Secondary Raw Materials and Waste Disposal (bvse)/Bureau of International Recycling (BIR).