Market Report Plastics - May 2010

Information about the market for plastics is being presented by:

bvse - Bundesverband Sekundärrohstoffe und Entsorgung e.V.

1. The market for primary plastics

The global economic crisis, which is nearly over, is now being followed by a financial crisis in Europe. The drastic surge in crude oil prices has been stopped even though large amounts of unused crude oil have been leaking into the Gulf of Mexico for five weeks. What impact does this have on the plastics markets? The plastics markets are booming. There is a considerable global demand for standard plastics. However, plastics and economy experts are trying to predict whether this boom is likely to continue, whether it is nothing but an interim high or whether we are threatened by a collapse.The EUWID Price Watch only shows price increases for the first four months in 2010, viz. for all standard plastics quoted. The prices listed in the EUWID Price Watch now approximately equal the June 2008 quotes. In April 2010 the average price of the ten types of plastics listed below was at 1258 /t, whereas it was quoted at 1202 /t in March; in February the quote was at 1161 /t and in January it was at 1094 /t. The following prices are now quoted for the ten types of standard plastics: LDPE film grade 1270 - 1330 /t, LLDPE film grade 1260 - 1320 /t, HDPE injection moulding 1180 - 1220 /t, HDPE blow moulding 1180 - 1200 /t, PS general purpose 1340 - 1380 /t, PS high impact 1410 - 1460 /t, PP homopolymer 1280 -1320 /t, PP copolymer 1330 - 1370 /t, PVC tube grade 1020-1070 /t and PVC film cables 1080 - 1140 /t. In week 20 the two PP and LLDPE prices for Europe on the London Metal Exchange (LME) were quoted as follows: the purchase prices of PP for June, July and August were at USD 1335 respectively, whereas those of LLDPE attained USD 1350 respectively. The price of PET for packaging exceeded the previous month's quote by 45 /t, i.e. it was at 1270 - 1350 /t. The price rises, which vary considerably according to the type of plastics, range from 20 /t to 120 /t. The following prices increased in particular: PE by 20 - 60 /t, PS by 100 - 120 /t, PP by 90 - 100 /t and PVC by 20 /t. In the case of HDPE, only injection moulding attained an increase of 20/t in the upper price range, otherwise the prices of HDPE held their own. The markets for HDPE and PVC are largely balanced with respect to supply and demand. The continuing supply shortages are driving the prices further up.

The upward trend of technical plastics continues, too. In the EUWID Price Watch for April the quotes for all technical plastics exceeded the prices listed in February - except for the PMMA quote. The price rises ranged from 5 /t to 30 /t in this case. The following prices were quoted: PMMA crystal clear 2200 - 2350 /t, ABS natural 1600 - 1700, ABS black or white 1680 - 1800, ABS mixed colours 2300 - 2550, PC crystal clear 2550 - 2700 /t, PC GF 2750 - 2900 /t, POM natural 1900 - 2000 /t, PA 6 natural 1950 -2150 /t, PA 6 black 1950 - 2150 /t, PA 6 GF reinforced 2200 - 2350 /t, PA 66 natural 2600 - 2800 /t and PA 66 GF 2850 - 3050 /t. The prices of technical plastics are driven up by a great demand, which is in part accompanied by a shortage of supply. Experts expect the resurgence of technical plastics to continue, meaning that the prices attained will stabilise.

The global reductions in supply have led to market and price stabilisation throughout Europe. There have been no plastics imports to offset the excess demand. The LME data also shows price stabilisation for the next few months. Experts still assess the demand as being high. Further, albeit slighter, price increases have been predicted for May.

2. The market for secondary plastics

The outcome of the first 2010 quarter was highly satisfactory for plastics recycling. The boosts in demand from the primary plastics market consistently furthered the development of the secondary plastics market. Ever since January, there has been an increased demand for bale goods and regrind. Recyclates have also been selling more easily and at higher prices in this market. The price rises, which have been steadily high since January, are in part rather specific and occur in small steps. On the whole, however, this has led to a steady price rise in all secondary plastics. The Chinese markets are booming. As a consequence, plastics are in great demand in the Far East. Thus a great demand for exports can also be discerned again. Germany appears to have become the focus of demand from the Far East. The falling dollar exchange rate has also contributed to reviving the demand for exports.

2.1 EUWID Price Watch

The EUWID Price Watch shows price consolidation rather than a consistent price increase. All types of plastics quoted have been affected by price increases of 10/t to 30/t. Only the prices of PET have risen more considerably.

PE: PE shows moderate price increases, namely of 10 /t to 30 /t. There is an increased demand for film in the export trade. Regrind shows price rises of 10 - 20 /t. Further price increases have been predicted for the May Price Watch. As far as PE post-industrial is concerned, HDPE has held its own. The quote for LDPE has increased by 10 /t to 20 /t - both for regrind and for film. Thus the April quotes are as follows: HDPE mixed colours 350 -470 /t, HDPE natural 470 - 600 /t, LDPE mixed colours 330-450 /t, LDPE natural 450 -570 /t, LDPE film natural (K49) 200 - 270 /t und LDPE film natural (K40) 360 - 500 /t. The following prices are quoted for post-user PE: LDPE shrink film natural (E40) 420 - 460 /t, LDPE shrink film mixed colours (E49) 230 - 290 /t, film transparent natural < 70 ΅m 340 -370 /t, film transparent natural < 70 ΅m 40 - 100 /t, LDPE farm film black/white > 70 ΅m 30 - 70 /t, PE mixed film (90/10) 200 - 240 /t, PE mixed film (80/20) 180 - 210 /t, HDPE hollow bodies mixed colours (C29) 90 - 210 /t, HDPE regrind from crates colour-separated 470 - 5 40 /t and HDPE regrind from crates mixed colours 350 - 460 /t.

PP: PP follows the trend on the PE markets. Even PP shows moderate price rises, namely of 10 /t to 30 /t. The following prices were quoted in April: film mixed colours 50 - 110 /t, film natural 260 - 350 /t, homopolymer mixed colours 320 - 430 /t, homopolymer natural 400 -600 /t, copolymer mixed colours 320 - 430 /t and copolymer natural 400 - 600 /t.

PS: PS also shows price rises of 20 - 30 /t for certain grades. PS is in great demand. The primary markets are driving the secondary markets in this case, too. The following prices were quoted in April: standard mixed colours 390 - 490 /t, standard crystal clear 470 - 550 /t, standard white 400 - 540 /t, high impact mixed colours 380 - 520 /t, high impact black 430 - 580 /t and high impact white 450 - 620 /t.

PVC: The resurgence of the building sector has finally led to increased PVC quotes. The increased demand for regrind continues. In April the following prices were quoted for PVC post industrial: PVC-P transparent 350 - 440 /t, PVC-P mixed colours 310 - 370 /t, PVC-U mixed colours 250 - 380 /t and trube grade mixed colours 220 - 370 /t. PVC windowframe regrind was quoted as follows: windowframe regrind white 500 - 600 /t, windowframe regrind mixed colours 330 - 420 /t and windowframe regrind single-shade white 600 - 740 /t.

PET post user: Experts describe the PET market as overheated. The situation is very tense, above all for recyclers. The demands from discounters are considered as exaggerated by the processors because the current prices of transparent and disposable PET bottles now exceed those that were paid before the crisis, i.e. in September 2008 ( 310 - 340/t). In April the following prices were quoted in the EUWID Price Watch for used and disposable PET bottles: PET transparent 350 - 395 /t and PET coloured 190 - 230 /t. This means that the quote for PET transparent has increased by 60 - 70 /t, whereas the price of PET coloured has risen by 30 - 40 /t. The PET market is driven by the price increases in primary materials, by a shortage of supply in used bottles as well as a high demand from the domestic and foreign market. The quantity of beverage bottles is accompanied by large processing capacities in Germany and Europe. Even mixed PET that has not been derived from beverage bottles is selling well. The demand from the Far East for German PET continues to rise.

2.2 plasticker price index

The plasticker price index for April shows that the prices of standard plastics have stabilised. Even though the price increases that range from 10 /t to 40 /t prevail, five quotes have been reduced by 10 /t to 80 /t. The quotes for bale goods tend to be slightly higher, whereas those for regrind are inconsistent and the prices of regranulates are stable. The following price changes of greater than/less than 40 /t can be reported for April 2010 compared to March 2010: PVC-P regrind - 80 /t and PET regrind - 80/t. The first forecast of the May quotes shows show that the prices LDPE regranulates, PP regrind and PET bale goods are likely to rise.

Secondary standard plastics

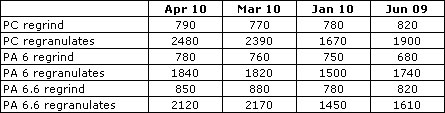

The prices of technical plastics were also slightly higher in April, namely by 20 /t to 90 /t; only the quote for PA 6.6. regranulates was reduced by 50 /t. The first forecast of the May quotes reveals price stabilisation.

Secondary technical plastics

*Supply figures too low to attain statistical significance

The quotes for secondary plastics, which are updated on an hourly basis, can be calculated using the price lists that are derived from the quotations published in the raw material exchange plasticker. The prices listed in this index are quoted with reservation - as the majority of the quotes submitted are not necessarily equivalent to the sales prices.Therefore, the information provided by plasticker indicates distinctly different market behaviour than the prices quoted by EUWID.

The EUWID price quotes refer to bale goods or regrind. The given prices were quoted for business transactions between sorting plants and sales agents or the processing industry, as the case may be. As a rule, prices refer to quantities in excess of 20 to ex works. The prices attainable in trade can differ considerably from the indicated price range in both directions, depending on the grade of the type of plastic material quoted. The abbreviations used for some grades refer to the list of waste plastics published by the German Federal Association for Secondary Raw Materials and Waste Disposal (bvse)/Bureau of International Recycling (BIR).