Market Report Plastics - June 2010

Information about the market for plastics is being presented by:

bvse - Bundesverband Sekundärrohstoffe und Entsorgung e.V.

1. The market for primary plastics

Plastics processors are suffering from the considerable raw material prices. In addition, the existing supply shortages are still having an impact as they are hardly offset by imports. There is a considerable global demand for plastics. For the time being, a change in the current situation is not in sight. However, the prices are increasing at a lower speed than before.The great demand for standard plastics has continued in June. According to EUWID the May Price Watch showed a further price increase, namely by 20 /t on average for all standard plastics. Thus the average price for May 2010 for the ten types of plastics listed below was at 1278 /t; thus it exceeded the previous month's quote by 20 /t. The following prices were then quoted for the ten types of standard plastics in the Price Watch: LDPE film grade 1300 - 1350 /t, LLDPE film grade 1280 - 1340 /t, HDPE injection moulding 1190 - 1230 /t, HDPE blow moulding 1190 - 1210 /t, PS general purpose 1370-1390 /t, PS high impact 1450 - 1470 /t, PP homopolymer 1310 - 1350 /t, PP copolymer 1360 - 1400 /t, PVC tube grade 1050 - 1090 /t and PVC film/cables 1100 - 1140 /t. In week 24 the PP and LLDPE prices for Europe on the London Metal Exchange (LME) were quoted as follows: the purchase prices of PP for July, August and September were at USD 1315 respectively, whereas those of LDPE were at USD 1350 respectively. Thus the July quotes for PP were reduced by 20 USD/t, whereas the LLDPE quotes held their own. The price of PET for packaging quoted in May exceeded the previous month's quote by 40 /t, i.e. it was at 1300 - 1400 /t.

The price rises are fluctuating within a narrower margin than in the previous months; they range from 10 /t to 40 /t. Supply shortages, which have even increased, are driving the prices up. LDPE and PVC are relatively stable, with price rises of 10 /t. There have been no plastics imports to offset the excess demand. The LME quotes also show price stabilisation for the next few months. Experts say the demand continues to be high. Additional, albeit slighter, price increases have been predicted for the June Price Watch. However, the LME quotes show clearly that market saturation and thus price stabilisation are to be expected for the next few months.

2. The market for secondary plastics

The situation of plastics recycling has improved considerably over the first two quarters in 2010. The secondary markets continue to be driven by the boosts in demand from the primary markets. Since January, there has been an increased demand for bale goods. The recyclates, above all regrind and regranulates, are selling well. Even though there have been reports on slumps in the demand for exports from the Far East (see below), our own observations show a great interest in purchasing in Germany.

2.1 EUWID Price Watch

The phase of price consolidation continues. According to the EUWID Price Watch, there are reports on price increases, price continuity and price decreases. Nevertheless, on the whole, the market is characterised by a considerable domestic demand. A decline in orders from the business with the Far East has been reported for the first time since November 2009.

PE: On the whole, PE shows both price rises and price decreases. The quotes for regrind tend to increase by 10 - 30 /t, whereas the price of film grade has decreased by 10 - 20 /t. The demand for film from the Far East is reported to have declined. This has led to immediate price reductions. The price of PE post industrial has further decreased, whereas the quote for HDPE hollow bodies has risen considerably, namely by 40 /t. Colour-separated regrind from crates is in great demand. Hence, the quotes for May have changed as follows: HDPE mixed colours 370 - 500 /t, LDPE mixed colours 360 - 470 /t, LDPE natural 450 - 600 /t and LDPE film grade natural (K40) 380 - 500 /t. The following prices are quoted for post-user PE: LDPE shrink film mixed colours (E49) 220 - 280 /t, film transparent natural < 70 ΅m 320 - 360 /t, film transparent natural < 70 ΅m 30 - 80 /t, LDPE-farm film black/white > 70 ΅m 20 - 65 /t, PE mixed film (98/2) 340 - 370 /t, PE mixed film (90/10) 200 - 230 /t, PE mixed film (80/20) 180 - 200 /t, HDPE hollow bodies mixed colours (C29) 90 - 250 /t, HDPE regrind from crates colour-separated 470 - 550 /t and HDPE regrind from crates mixed colours 360 - 460 /t.

PP: PP post industrial largely follows the corresponding PE trend. High-quality grades have increased by 10 - 20 /t in the upper price range. The May quotes have changed as follows: film mixed colours 50 - 130 /t, film natural 270 - 350 /t, homopolymer mixed colours 320 -450 /t and copolymer mixed colours 320 - 450 /t.

PS: PS shows considerable price increases for many grades. The price rises have been very diverse. They range from 10 - 80 /t. Above all, the quote for the grade "high impact" has increased by 80 /t. Thus the following prices are quoted for May: standard mixed colours 390 - 490 /t, standard crystal clear 470 - 560 /t, standard white 420 - 550 /t, high impact mixed colours 430 - 600 /t, high impact black 430 - 650 /t and high impact white 500 - 700 /t.

PVC: The prices of certain types of PVC grades have risen again, namely by 20 - 50 /t. The May quotes for PVC post industrial have changed as follows: PVC-U mixed colours 300-400 /t and tube grade mixed colours 250 - 400 /t. As far as PVC windowframe regrind is concerned, the quote for the mixed-coloured grade has increased by 25 /t; thus it is now at 350 - 450 /t.

PET post user: The PET market has been and still is overheated; it is characterised by a great demand: a low supply of used bottles is accompanied by a high domestic demand. The considerable virgin material prices are driving the prices of R-PET up, too. The prices set by trade have been steadily increasing. Traders and agents are focussing, above all, on spot prices, which are driving up the forward prices. The processors do not have any means of avoiding the high purchase prices. As the considerable input prices can hardly be passed on to the products, there is now even the danger of production cutbacks. Experts report on a decline in exports, which is due to the continuously high prices.

Since August 2009, the PET prices have been steadily rising. The PET market in June is characterised by a further price increase. In May the following prices were quoted for used and disposable PET bottles: PET transparent 390 - 435 /t and PET coloured 210 - 250 /t. As a consequence, the price of PET transparent has risen by 40 /t on average and that of PET coloured by 25 /t on average. The prices of coloured PET bottles have also reached record levels.

2.2 plasticker price index

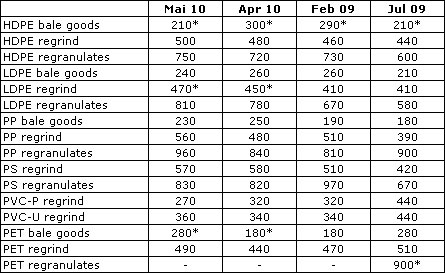

The plasticker price index for May shows a price increase for standard plastics. The price increases ranging between 10 /t and 120 /t prevail; nevertheless, three prices have decreased by - 20 /t to - 50 /t. The quotes for bale goods tend to decrease, whereas those for regrind and regranulates have increased. There is a clear trend towards price increases for all PET grades. The following price changes of greater than/less than 40 /t can be reported for May compared to April: PP regrind + 80 /t, PP regranulates + 120 /t, PET regrind + 50 /t and PVC_P regrind - 50 /t. The first forecast of the June quotes shows that the prices continue to rise, namely by 10 /t to 130 /t.

Secondary standard plastics

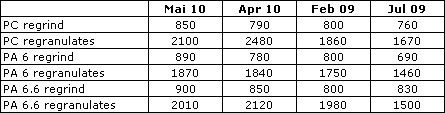

The prices of technical plastics decreased in May, namely by 50 /t to 110 /t. The quotes for regranulates decreased by 120 /t to 380 /t. The first forecast of the June quotes shows rising prices.

Secondary technical plastics

*Supply figures too low to attain statistical significance

The quotes for secondary plastics, which are updated on an hourly basis, can be calculated using the price lists that are derived from the quotations published in the raw material exchange plasticker. The prices listed in this index are quoted with reservation - as the majority of the quotes submitted are not necessarily equivalent to the sales prices.Therefore, the information provided by plasticker indicates distinctly different market behaviour than the prices quoted by EUWID.

The EUWID price quotes refer to bale goods or regrind. The given prices were quoted for business transactions between sorting plants and sales agents or the processing industry, as the case may be. As a rule, prices refer to quantities in excess of 20 to ex works. The prices attainable in trade can differ considerably from the indicated price range in both directions, depending on the grade of the type of plastic material quoted. The abbreviations used for some grades refer to the list of waste plastics published by the German Federal Association for Secondary Raw Materials and Waste Disposal (bvse)/Bureau of International Recycling (BIR).