Market Report Plastics - September 2010

Information about the market for plastics is being presented by:

bvse - Bundesverband Sekundärrohstoffe und Entsorgung e.V.

1. The market for primary plastics

The boom on the German, European and international markets continues. Even during the summer break there was a considerable demand for plastics. However, the capacities withdrawn from the plastics chain are gradually being expanded again, which is boosting the supply of plastics; in this way, the prices of standard plastics are going to decrease in the medium or long term.According to the EUWID Price Watch for August, the majority of the standard plastics prices have fallen, namely by 10 /t on average. The price decreases range from 20 /t to 30 /t. PVC shows slight price rises, namely by 10 /t to 20 /t. PS has held ist own. In August 2010 the average price of the ten types of standard plastics listed below was quoted at 1266 /t. The following prices were quoted for the ten types of standard plastics: LDPE film grade 1310 - 1350 /t, LLDPE film grade 1280 - 1340 /t, HDPE injection moulding 1160 - 1200 /t, HDPE blow moulding 1160 - 1200 /t, PS general purpose 1250 - 1300 /t, PS high impact 1320 - 1380 /t, PP homopolymer 1310 - 1360 /t, PP copolymer 1360 - 1410 /t, PVC tube grade 1110 - 1160 /t and PVC film/cables 1160 - 1210 /t. In July, the price of PET for packaging fell short of the previous month's quote by 40 /t, i.e. it was quoted at 1220 - 1270 /t. Thus, the PET prices decreased for the third time in a row.

In week 38, the PP and LLDPE prices for Europe on the London Metal Exchange (LME) were quoted as follows: The PP purchase prices for October, November and December held their own at 1290 USD/t, whereas those of LDPE were 1400 USD/t. Compared to the previous month, the prices quoted in October thus changed neither for PP nor for LLDPE. Hence, the LME shows stable markets, which are hardly going to change in the next few months. According to experts, there is still a considerable demand as well as a small surplus of plastics.

2. The market for secondary plastics

There was a relatively high demand for secondary plastics during the summer break. In the summer months, some processors and recyclers were faced with standstills in production, whereas others effected warehouse sales; however, in part the production quantities also held their own. The warehouse supplies in the plastics chain, i.e. on the sorters', processors' and recyclers' part, are relatively low. As a result of the increase in demand, recyclates are being quoted at a markedly higher price than last month. High-grade recyclates can still be purchased at relatively favourable prices compared to virgin materials.

The domestic market has been intensifying competition for secondary plastics with the Far East again. The demand from China for German bale goods continues. China is effecting well-targeted purchases of specific plastics grades through various channels. The import strategy of the People's Republic of China is changing, which leads to input of better grades being introduced to recycling centres in a controlled fashion.

The plastics recyclers still have capacities available and might be able to process and recycle additional input. The considerable demand for secondary plastics expected for the third and fourth quarters is likely to stabilise the price level attained.

2.1 EUWID Price Watch

With the exception of PET, the EUWID quotes for August 2010 have not yet attained the same level as in August 2008. It is striking that the price ranges in the 2008 August quotes were markedly wider than those in August 2010; among other things, this shows that the materials will also be better quality after the crisis. The EUWID Price Watch shows price increases in August, even though PE and PP are quoted at lower prices on the primary markets

The price increases range between 10 /t and 50/t. PS has held ist own, as on the primary market.

PE: In part, the market shows marked price rises, namely for nearly all PE quotes. High-grade film is selling better again in the Far East. As far as PE post industrial is concerned, the increases range from 10 /t to 20 /t. The following prices were quoted for PE post industrial in August: HDPE mixed colours 400 - 540 /t, HDPE natural 500 - 650 /t, LDPE mixed colours 370 - 480 /t, LDPE natural 500 - 650 /t, LDPE film mixed colours (K49) 200-270 /t as well as LDPE natural (K40) 400 - 530 /t. In August 2010, the prices of post-industrial waste fell short of those quoted in August 2008 by 70 /t on average. The post-user PE area shows price increases of 10 /t to 50 /t. The following prices were quoted for post-user PE in August: LDPE shrink film natural (E40) 430 - 480 /t, LDPE shrink film mixed colours (E49) 220 - 290 /t, film transparent < 70 ΅m 330 - 370 /t, film transparent mixed colours < 70 ΅m 40-95 /t, LDPE farm film black/white > 70 ΅m (B41) 30 - 70 /t, mixed film (98/2) 330 - 375 /t, mixed film (90/10) 220 - 260 /t, mixed film (80/20) 190 - 225 /t, HDPE hollow bodies mixed colours 100 - 270 /t, HDPE regrind from crates colour-separated 500-600 /t and HDPE regrind from crates mixed colours 400 - 480 /t. Im August 2010, the prices of post-user PE, which fluctuated wildly, fell short of those quoted in August 2008 by 60 /t on average.

PP: PP largely follows the PE trend. The price of bale goods excess the previous month's quote by 20 /t. PP is popular among plastics processors and plastics recyclers - the PP recycling quantities are increasing. The following prices are quoted for PP: film mixed colours (K59) 70 - 150 /t, film natural (K50) 300 - 370 /t, homopolymer mixed colours 400 - 500 /t, homopolymer natural 450 - 650 /t, copolymer mixed colours 400 - 500 /t and copolymer natural 450 - 650 /t. Im August 2010, the PP prices fell short of those quoted in August 2008 by 77 /t on average.

PS: Im August, the prices held their own. In August 2010, the PS prices fell short of those quoted in August 2008 by 77 /t on average.

PVC: Price increases ranging from 20 /t to 30 /t can be reported for PVC. In August 2010, PVC attained roughly the same price level as in August 2008 - however, with the difference that the price ranges in August 2010 were more narrow. PVC construction and demolition waste is finding its way to recycling, too. The ongoing positive developments in the building and construction industry are stabilising the demand for PVC. The following prices are quoted for PVC post-industrial: PVC-P transparent 400 - 480 /t, PVC-P mixed colours 340 - 420 /t, PVC-U transparent 370 - 450 /t and tube grade mixed colours 350 - 450 /t. The following prices are quoted for PVC windowframe regrind: windowframe regrind white 520 - 640 /t, windowframe regrind white 400 - 480 /t and windowframe regrind single-shade white 640 - 800 /t.

Post-user PET: To date, the price reductions in virgin materials have hardly had any impact on used bottles. On the whole, the quantities of PET beverage packaging are increasing; however, at the same time the processing capacities are being expanded. The PET processors and recyclers are still under enormous pressure because it is practically impossible to compensate for the high input prices. The increase in beverage sales during the summer months has slightly improved the processors' and recyclers' precarious situation. The demand for PET bottles from the Far East has been inconsistent this year; at present, the demand from the Far East is rising again.

The EUWID quotes for used and disposable PET bottles are still at an all-time high. The following prices were quoted in August 2010: PET transparent 390 - 440 /t and PET coloured 220 - 260 /t. Coloured PET bottles continue to attain record prices. The quote for PET transparent has decreased by 10 /t.

2.2 plasticker price index

The evaluation of the data derived from the plasticker price index for August reveals a trend towards stable prices for all standard plastics. Marked price increases ranging from 60 /t to 120 /t can be reported for regranulates. The price of regrind tends to decrease, whereas bale goods have held their own. The following price changes of greater than/less than 40 /t can be reported for August 2010 compared to the previous month: HDPE regranulates + 120 /t, LDPE bale goods + 50 /t, LDPE regrind - 140 /t, LDPE regranulates + 70 /t, PP regranulates + 60 /t, PS regranulates + 70 /t and PET bale goods + 60 /t. The forecast of the September quotes shows that the prices continue to stabilise.

Secondary standard plastics

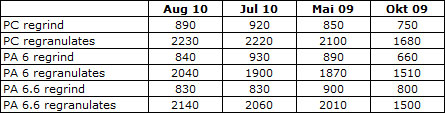

The technical plastics prices stabilised in August. Regranulates showed price increases, whereas regrind showed a trend towards slightly declining prices. The following price changes of greater than/less than 70 /t can be reported for August 2010 compared to the previous month: PA regrind -90 /t, PA 6 regranulates +140 /t, PA 6.6 regranulates +80 /t. The forecast of the September quotes shows that the prices of technical plastics are stabilising at the level attained.

Secondary technical plastics

*Supply figures too low to attain statistical significance

The quotes for secondary plastics, which are updated on an hourly basis, can be calculated using the price lists that are derived from the quotations published in the raw material exchange plasticker. The prices listed in this index are quoted with reservation - as the majority of the quotes submitted are not necessarily equivalent to the sales prices.Therefore, the information provided by plasticker indicates distinctly different market behaviour than the prices quoted by EUWID.

The EUWID price quotes refer to bale goods or regrind. The given prices were quoted for business transactions between sorting plants and sales agents or the processing industry, as the case may be. As a rule, prices refer to quantities in excess of 20 to ex works. The prices attainable in trade can differ considerably from the indicated price range in both directions, depending on the grade of the type of plastic material quoted. The abbreviations used for some grades refer to the list of waste plastics published by the German Federal Association for Secondary Raw Materials and Waste Disposal (bvse)/Bureau of International Recycling (BIR).