Market Report Plastics - January 2011

Information about the market for plastics is being presented by:

bvse - Bundesverband Sekundärrohstoffe und Entsorgung e.V.

1. The market for primary plastics

The favourable economic predictions for Germany are coming thick and fast. For the fourth time in a row, the ifo institute has raised its business climate index - to the highest value since German reunification. This news also directly concerns plastics processing - and technical plastics in particular, which leads to a further increase in the high demand for plastics. The chemical industry is again making considerable investments to expand the plastics business.In December, the EUWID Price Watch for standard plastics showed price rises again. In December 2010, the average price of the ten types of plastics listed below was 1308 /t and thus exceeded the previous month's quote by 21 /t. The price increases ranged between 10 /t and 40 /t; only PVC held its own. The following prices were quoted for the ten types of standard plastics: LDPE film grade 1340 - 1390 /t, LLDPE film grade 1300 - 1330 /t, HDPE injection moulding 1170 - 1230 /t, HDPE blow moulding 1170 - 1230 /t, PS crystal clear 1370-1420 /t, PS high impact 1420 - 1520 /t, PP homopolymer 1320 - 1380 /t, PP copolymer 1370-1430 /t, PVC tube grade 1120 - 1180 /t and PVC film/cables 1190 - 1250 /t. The price of PET continues to increase: In December, the price quoted for PET for packaging was 1420 - 1530 /t, thus it exceeded the previous month's quote by 75 /t. No end is currently in sight to the upward PET price spiral.

In December, the EUWID Price Watch for technical plastics indicated price increases again. Since December 2009, the prices of technical plastics have risen continually, albeit to various degrees. In December 2010, the price rises ranged between 50/t and 100/t. The demand for technical plastics will continue to be high. Further orders are expected to be placed after the winter break. In the EUWID Price Watch for December, technical plastics were quoted at: PMMA crystal clear 2450 - 2650 /t, ABS natural 1750 - 1950, ABS white/black 1850 - 2050, ABS mixed colours 2450 - 2800, PC crystal clear 2800 - 3000 /t, PC GF 3100 - 3200 /t, POM natural 2200 - 2250 /t, PA 6 natural 2200 - 2400 /t, PA 6 black 2200 - 2400 /t, PA 6 GF reinforced 2550 - 2650 /t, PA 66 natural 3000 - 3200 /t and PA 66 GF 3100 - 3300 /t. From December 2009 to December 2010, the prices thus rose by 13% for PMMA, by 37% for ABS, by 29% for PC, by 17% for POM, by 20% for PA6 and by 24% for PA66.

While the DAX rose by 16%, the average price increases ranged from 17% to 39% for standard plastics and from 13% to 37% for technical plastics. Standard plastics have nearly reached the record highs they attained in the third quarter of 2008; technical plastics surpassed this threshold as early as in May 2010.

The demand for plastics exceeded the supply in December, too. Furthermore, plastics processors attempted to replenish their stocks if they could receive enough material. The prices of plastics precursors increased markedly again in December. It is still winter in Europe and North America, which is why the demand for mineral oil products continues to be high. In December 2010, mineral oil was quoted at USD 88 per barrel. The prices of numerous standard plastics and technical plastics have been predicted to rise in February 2011.

The economic and financial crisis has been overcome with respect to secondary plastics. The 2010 price increase is likely to continue in 2011, too - albeit to a lesser extent. True, the secondary plastics business has declined during the 2010/2011 winter break; however, this decline is not as strong as it was during the 2008/2009 Christmas period. Even in 2009/2010, the decline in business during the Christmas period and the Chinese New Year's celebrations was markedly lower than in the previous years. This favourable trend, which started in 2009/2010, seems to be continuing in 2010/2011, too.

2. The market for secondary plastics

In December 2010 and January 2011, it has become obvious that this positive trend in the primary markets is directly supporting the secondary markets. Recyclates are gaining in value as a result of the price rises in the primary markets and the lack of primary material supply. The winter break is also being used to build up stocks of plastics. As a result of the decline in the euro and the strength of the dollar, the export trade with the Far East is gaining in importance on the European markets. There are several indications that the Chinese New Year will be celebrated extensively in February 2011.

2.1 EUWID Price Watch

To assess the development during the year 2010, it is of particular interest to compare December 2010 to September 2008, when the plastics quotes reached an all-time high before the crisis. This comparison shows that the 2010 December quotes decreased by 75 /t for PE post-industrial, by 48 /t for post-user PE, by 66 /t for PP post-industrial, by 33 /t for PCV and by 63 /t for PS. The situation is only different for PET, whose 2010 December prices far exceeded the quotes for September 2008. It is surprising that this comparison reveals marked differences between the individual types of plastics. In December 2010, the EUWID Price Watch showed a relatively consolidated market for secondary plastics. The standard plastics quotes have nearly held their own compared to the previous month. The prices of PE, PP and PS regrind are likely to rise in January or February 2011.

According to the December Price Watch, PE post-industrial has held its own. In January and February, the prices of PE regranulates are expected to rise by 20 /t to 40 /t. Three marginal price reductions, namely of 5 /t to 15 /t, can be reported for post-user PE: Film transparent natural < 70 ΅m 380 - 405 /t, mixed film (90/10) 230 - 270 /t and mixed film (80/20) 180 - 225 /t. All other quotes held their own compared to the previous month.

PP: On the whole, the PP markets are being changed through the intervention of DSD GmbH. In the post-user area, the interventions of DSD GmbH/DKR in market developments have led to soaring prices. As a result of this intervention, hardly any post-user PP grades are currently being launched on the free markets. There is still a high demand for PP post- industrial. Regrind is selling well, but its prices remained stable in December.

PS: During the winter break, the demand for EPS traditionally sinks due to the decline in the building trade. Since the demand for PS from the packaging sector is stable, the quotes for regrind have held their own.

PVC: And PVC also held its own in December 2010. As a result of the winter break in the building trade, the PVC quotes are expected to remain unchanged right into February.

PET post user: The winter break is not having an impact on the PET market. There is still a high demand for PET among processors. In addition, the considerable primary prices are pushing up the PET bottle quotes. In December, the prices of transparent PET increased by 28 /t on average, whereas those of mixed-coloured PET rose by an average 23 /t. The EUWID quotes for used and disposable PET bottles are still at record high levels; they are quoted as follows: PET transparent 440 - 485 /t and PET coloured 250 - 305 /t. A trend reversal for PET is not in sight in the next few months.

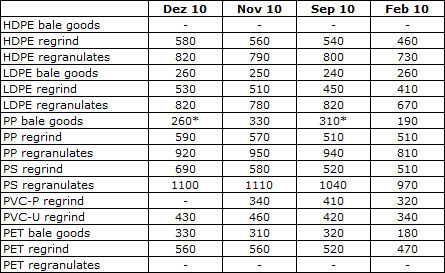

2.2 plasticker price index

The plasticker price index for December reveals a trend towards stable or, at best, slightly rising prices for all standard plastics quoted. While some prices have decreased, namely by 10 /t to 30 /t, the majority of prices have risen by 10 /t to 110 /t. Bale goods and regrind are quoted at higher prices, whereas the quotes for regranulates are inconsistent. As far as standard plastics are concerned, the price of PS regrind rose by 110 /t in December 2010 compared to the previous month. The forecast of the January quotes shows that the trend described above is likely to continue.

Secondary standard plastics

In the plasticker price index for November, the quotes for technical plastics were inconsistent, but they ultimately indicated price stabilisation. The following price changes of greater than/less than 70 /t can be reported for December 2010 compared to the previous month: PC regrind - 110 /t, PC regranulates +90 /t, PA 6 regrind + 60/t, PA 6 regranulates - 120 /t, PA 6.6 regrind +10 and PA 6.6 regranulates - 140 /t. The forecast of the January quotes shows slightly declining or, at best, stable prices.

Secondary technical plastics

*Supply figures too low to attain statistical significance

The quotes for secondary plastics, which are updated on an hourly basis, can be calculated using the price lists that are derived from the quotations published in the raw material exchange plasticker. The prices listed in this index are quoted with reservation - as the majority of the quotes submitted are not necessarily equivalent to the sales prices.Therefore, the information provided by plasticker indicates distinctly different market behaviour than the prices quoted by EUWID.

The EUWID price quotes refer to bale goods or regrind. The given prices were quoted for business transactions between sorting plants and sales agents or the processing industry, as the case may be. As a rule, prices refer to quantities in excess of 20 to ex works. The prices attainable in trade can differ considerably from the indicated price range in both directions, depending on the grade of the type of plastic material quoted. The abbreviations used for some grades refer to the list of waste plastics published by the German Federal Association for Secondary Raw Materials and Waste Disposal (bvse)/Bureau of International Recycling (BIR).