plasticker-News

| 2009-11-26 |

|

MBS: Polyolefins congress highlights key industry issues

|

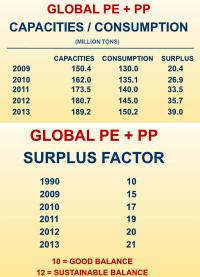

Key business and technology issues facing the polyethylene and polypropylene supply chains got a good airing at the PEPP 2009 global congress on polyolefins organized by Maack Business Services in Zurich in October. This annual meeting regularly attracts representatives from virtually all the world’s top polyolefin suppliers, and many of their customers.Subjects coming under the spotlight this year included: In his scene-setting presentation, Konrad Scheidl, Executive V.P. and Partner at MBS, emphasized the global shift in PO production capacity. While 20 years ago, close to two-thirds of all global polyethylene capacity was in Western Europe and North America, by 2015 it will be just one-third, and the regions will be major net importers. The Middle East, China and Asia Pacific will have tripled their share to almost half, although China will still be a net importer. And all the while, total capacity will have almost quadrupled. Data for polypropylene are quite similar. “Surplus factor” is much too high Scheidl demonstrated the dangers for producers through the use of the ‘surplus factor’ – nameplate capacity minus offtake, divided by nameplate capacity. A good surplus factor is 10, while 12 is sustainable, he said. And yet, overall, across PE and PP, it is almost 20 years since a 10 has achieved. The figure is already over 15, and could almost hit 20 by 2013. Capacities totalling almost 50 million tpa are now at least 15 years old, and in some cases three times that, Scheidl noted. Their costs have been written off, and they could, theoretically, be shut down. “But sites die very slowly, if at all.”. More Information: www.mbspolymer.com |

Maack Business Services, Colazza, Italien

back to news list back to news list |  back to top back to top |