Market Report Plastics - May 2011

Information about the market for plastics is being presented by:

bvse - Bundesverband Sekundärrohstoffe und Entsorgung e.V.

1. The market for primary plastics

There is extremely good economic news: in May German foreign trade has reached a new record high. The EU countries are Germany's most important business partners. This news suggests that there is a continually high demand for plastics from the processing industry. However, the favourable predictions for the plastics industry are being overclouded by the high raw material prices.

The latest economic trends, as provided by the German Association for Plastics Packaging and Film (IK Industrievereinigung Kunststoffverpackungen e.V.) for the second quarter of 2011, have shown that more than 80 per cent of the companies surveyed expect the prices of plastics packaging to rise, cf. www.kunststoffverpackungen.de. The IK members expect the raw material prices to further increase in the second quarter of 2011, even though these prices have been at record levels for quite a while. According to IK estimates, the cost burden for companies will rise further. This not only applies to human resources and transport costs, but also to energy costs. Apart from that, the companies assess the further economic development as being favourable.

Time and again, it is impressive to see how speculators change the raw material prices according their current interests and according to how they assess the situation, see also the German daily newspaper Süddeutsche Zeitung of 7th/8th May 2011, p. 25. There is a continuous or even increasing trend towards speculating on raw material prices. Market mechanisms that are closer to reality are, in part, completely superseded by these speculations. The volatility of raw material prices is increased by these battles for records - often for the disadvantage of the processing industry -, which renders long-term agreements obsolete.

The 2011 mineral oil quotes are still running parallel to the curve for 2008; this also applies to the marked price decline to USD 108/barrel, which took place in week 18. These slightly more reasonable mineral oil prices would be welcome if they did not confirm the similarity in development to the 2008 price curve - n. b.: in July 2008 the mineral oil prices peaked at USD 145/barrel! Even though the increasing processing depth is stabilising the respective markets, the impact of these price leaps on precursors and plastics can often only be balanced out insufficiently.

The EUWID Price Watch for April shows price consolidation for standard plastics. For instance, the prices of standard plastics, with the exception of PS, have slightly increased, namely by 20 â¬/t to 50 â¬/t. PS has decreased by 78 â¬/t on average. Thus the average price quoted in May for the ten types of plastics listed below was 1501 â¬/t. This quote has, above all, been lowered by the price reduction in PS. Hence, the average price thus determined only exceeds the previous month's quote by 5 â¬/t. The following prices are listed in the EUWID Price Watch for the ten types of standard plastics: LDPE film grade 1570 - 1630 â¬/t, LLDPE film grade 1490 - 1550 â¬/t, HDPE injection moulding 1420 - 1470 â¬/t, HDPE blow moulding 1420 - 1470 â¬/t, PS crystal clear 1530 - 1560 â¬/t, PS high impact 1620 - 1660 â¬/t, PP homopolymer 1530 - 1630 â¬/t, PP copolymer 1600-1700 â¬/t, PVC tube grade 1220 - 1220 â¬/t and PVC film/cables 1310 - 1360 â¬/t. PET shows consolidation, too: in March the price of PET for packaging was quoted at 1700 - 1780 â¬/t, thus falling short of the previous month's quote by 10 â¬/t on average. The price of PET is expected to further decline.

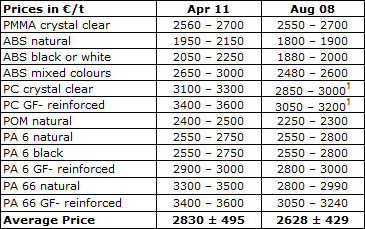

According to the EUWID Price Watch, there have been continuous price rises in technical plastics since December 2009. With the exception of ABS , the prices of technical plastics rose again in April 2011, namely by 103 â¬/t on average. In April technical plastics reached record highs, see Table 1. The demand for technical plastics, which is only partially met by a sufficient supply, is likely to remain high until autumn 2011.

Table 1: Comparison between the EUWID quotes for technical plastics; prices quoted in â¬/t

1 Record high in February 2008

In April and May the increased precursor prices have again pushed the plastics prices up. However, the European plastics markets have been much more balanced with respect to supply and demand than in the previous months. According to some experts, the price stabilisation that has occurred in May can be explained by the extensive Easter holidays, which caused a decline in production. Experts even expect the prices of some standard plastics to go down in May and June. Only a few types of standard plastics are in short supply. On the whole, only part of the prices are thus expected to remain stable in May. According to the experience gained in the previous years, the global plastics markets might show a tendency towards decline in view of the forthcoming summer break.

2. The market for secondary plastics

The secondary plastics market has lost its previous buffer effect: price changes in the primary market are having an immediate and even largely unchanged impact on the secondary markets. The demand from the primary markets is also boosting the secondary markets. However, as a result of the still increasing input prices and the increased processing costs, the cost situation for plastics processors and plastics recyclers is still tense; while turnover is increasing, the proceeds are going down. There is a continually high demand for recyclates, i.e. high-quality regrind, regranulates and regenerates/compounds, in Europe. High-grade recyclates favourably supplement virgin materials. The prices of recyclates are increasing; the increased manufacturing costs could in part be passed on. Even in April and May there is a restrained demand from the Far East for plastics grades from Europe. The export trade with the Far East is characterised by price reductions and declining quantities. Even though the export trade with the Far East is still an important pillar of the plastics chain, it no longer dominates the European plastics markets. On the whole, the prices are expected to stabilise or slightly decline in May. During the summer break the prices are likely to further decrease. This situation could then be utilised to build up warehouse capacity.

2.1 EUWID Price Watch

As far as secondary plastics are concerned, the EUWID Price Watch for April nearly exactly follows the price trends from the primary market. The prices quoted now indicate price consolidation. The price increases in all standard plastics range from 5 â¬/t to 30 â¬/t. There are price reductions in post-user PE and PS post-industrial.

The April Price Watch shows slight price increases in PE post-industrial for LDPE film grade by 16 â¬/t on average, all other quotes have held their own. The two quotes have changed as follows: LDPE film grade mixed colours (K49) 235 - 330 â¬/t and LDPE - film grade natural (K40) 450 - 580 â¬/t.

The post-user PE grades show consolidated prices: the prices of some grades have slightly risen here (by 20 â¬/t to 30 â¬/t), whereas the quotes for other grades have slightly decreased (by 10 â¬/t to 40 â¬/t). In the Price Watch, post-user PE shows further price differentiations, i.e. the upper and lower price caps have been expanded in various ways. Export film is quoted at a lower price. The following quotes were given in April: LDPE shrink film natural (E40) 470 - 530 â¬/t, LDPE shrink film mixed colours (E49) 250 - 300 â¬/t, film transparent natural < 70 µm 300 - 340 â¬/t, film transparent mixed colours < 70 µm 60 - 110 â¬/t, LDPE farm film black/white (B41) 20 - 60 â¬/t, mixed film (80/20) 150 - 190 â¬/t, mixed film (90/10) 200 - 240 â¬/t, HDPE hollow bodies mixed colours (C29) 200 - 350 â¬/t, HDPE regrind from crates colour-separated 650 - 800 â¬/t and HDPE regrind from crates mixed colours 600 -700 â¬/t.

PP: PP is in short supply both with respect to post-industrial and post-consumer goods. The price increases in PP from the primary markets can also be observed in the secondary markets. The prices of post-industrial have risen by 23 â¬/t on average: film grade mixed colours (K59) 180 - 350 â¬/t, film grade natural (K50) 380 - 530 â¬/t, homopolymer mixed colours 480 -700 â¬/t, homopolymer natural 630 - 820 â¬/t, copolymer mixed colours 480 - 700 â¬/t and copolymer natural 630 - 830 â¬/t.

PS: Following the record highs in March, PS decreased by 24 â¬/t on average in April. Above all, the upper price limit of PS was lowered. In April the following quotes were given for PS post-industrial in April: standard mixed colours 500 - 700 â¬/t, standard crystal clear 600 -820 â¬/t, standard white 600 - 820 â¬/t, high impact mixed colours 600 - 720 â¬/t, high impact black 600 -7 30 â¬/t and high impact white 700 - 980 â¬/t. High impact mixed colours and high impact black show the largest price reductions.

PVC: Both the prices of PVC post-industrial and those of PVC windowframe regrind have been increased by 30 â¬/t throughout, which exceeded the increase in the prices of primary goods by 10 â¬/t. In April the following prices were quoted for post-industrial: PVC_P transparent 480 - 580 â¬/t, PVC_P mixed colours 430 - 530 â¬/t, PVC_U 480 - 580 â¬/t and tube grade mixed colours 430 - 580 â¬/t. Windowframe regrind was quoted at: white 630 - 750 â¬/t, mixed colours 480 - 580 â¬/t and single-shade white 730 - 870 â¬/t. The price rises are explained by the increased primary prices, the boom in the building industry as well as the great demand for PVCF goods on a broad scale, i.e. for windows, tubes, cables, pipes and film.

PET post user: The falling virgin material prices have not yet had an impact on the secondary markets. The native Rhinelander would describe the PET market as follows: "The PET market is "tilting", i.e. reaching a turning point. On the one hand, this "tilting" refers to the fact that the bottle prices are expected to fall; on the other hand, it refers to shut-downs of processing capacity. The situation described as "worst case" last month, namely declining virgin material prices that are, at the same time, accompanied by higher bottle prices, has become a reality in May. This is causing difficulties for PET recycling and processing. However, the amount of bottles on the market has increased as a result of the warm weather, which is slightly relaxing the existing situation.

The EUWID quotes for transparent and coloured PET increased by 50 â¬/t each on average in April, too. The following prices were quoted for PET: PET transparent 620 - 710 â¬/t and PET coloured 430 - 530 â¬/t. Experts expect the PET prices to stagnate or fall in the EUWID quotes for May.

2.2 plasticker price index

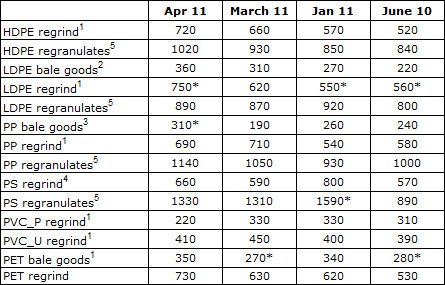

The plasticker price index shows that the prices of standard plastics have risen compared to the previous month in April, too. These price increases range between 20 â¬/t and 120 â¬/t. However, PVU_U regrind decreased by 110 â¬/t. According to plasticker the following price quotes rose by more than 40 â¬/: HDPE regrind +60 â¬/t, HDPE regranulates +90 â¬/t, LDPE bale goods +50 â¬/t, LDPE regrind +130 â¬/t, PP bale goods +120 â¬/t, PP regranulates +90 â¬/t, PS regrind +80 â¬/t, PET bale goods by +80 â¬/t as well as PET regrind by +100 â¬/t. The forecast of the May price index indicates additional price rises.

Table 2: Prices of standard plastics in plasticker, quoted in â¬/t

*: Supply figures too low to attain statistical significance; 1: equivalent to the grade "post-industrial, mixed colours"; 2: equivalent to the grade "K49"; 3: equivalent to K59; 4: equivalent to "standard, mixed colours"; 5: equivalent to the grade "regranulates black".

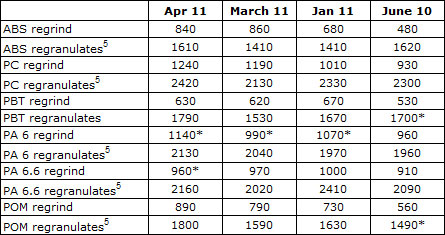

Technical plastics were quoted at markedly higher prices in the plasticker price index for April again. These price rises ranged between 10 â¬/t and 290 â¬/t. Above all, the prices of regranulates went up. Regrind peaked in April, compared to the last 24 months. The following price quotes changed by more than +70 â¬/t: ABS regranulates +200 â¬/t, PC regranulates +290 â¬/t, PBT regranulates +260 â¬/t, PA 6 regrind +150 â¬/t, PA 6 regranulates +90 â¬/t, PA 6.6 regranulates +140 â¬/t, POM regrind +90 â¬/t as well as POM regranulates +240 â¬/t. The first forecast of the May quotes shows an additional price increase.

Table 3: Prices of technical plastics in plasticker, quoted in â¬/t

*Supply figures too low to attain statistical significance

The monthly quotes for secondary plastics, which are updated on an hourly basis, can be calculated using the price lists that are derived from the quotations published in the raw material exchange plasticker (cf. www.plasticker.de). The prices listed in this index are quoted with reservation - as the majority of the quotes submitted are not necessarily equivalent to the sales prices. Furthermore, plasticker does not distinguish between the following grades: transparent, mixed colours or colour-separated. Therefore, the information provided by plasticker may indicate different market behaviour than the prices quoted by EUWID.

The EUWID price quotes refer to bale goods or regrind. The given prices were quoted for business transactions between sorting plants or sales agents or the processing industry, as the case may be. As a rule, the prices refer to quantities in excess of 20 t ex works. The prices attainable in trade can differ considerably from the indicated price range in both directions, depending on the grade of the type of plastic material quoted. The abbreviations used for some grades refer to the list of waste plastics published by the German Federal Association for Secondary Raw Materials and Waste Management (bvse)/Bureau of International Recycling (BIR).