Market Report Plastics - August 2011

Information about the market for plastics is being presented by:

bvse - Bundesverband Sekundärrohstoffe und Entsorgung e.V.

1. The market for primary plastics

Despite all financial turbulences plastics products are still in great demand. However, the supply situation has been continuously improving, which caused the prices to decline in June and July. At the beginning of July there were still speculations on a further decline in prices, which, in part, led to purchasing restraint, whereas warehouses were filled at the more favourable prices from the middle to the end of July. From the end of July to the beginning of August the plastics prices stabilised. From the middle to the end of August the current financial turbulences are likely to have a destabilising effect on the plastics markets. The mineral oil prices, which are falling as a result of the crisis, are likely to decrease precursor prices with a certain time lag.

It is finally absolutely clear: the slump in the mineral oil prices is matched by the quotes on the stock exchanges. Parallel to the quotes on the stock exchanges, the raw material prices are also falling; above all, this applies to the futures contracts for mineral oil, see the information on the mineral oil market provided by Tecson-Digital, www.tecson.de/oelweltmarkt.html. The mineral oil quotes have kept their high levels of USD 100 - 124/barrel since mid-February 2011. In July the OPEC oil production was at the highest level in three years. This shows clearly that the current mineral oil prices are more or less free from any natural price setting: instead of being determined by such factors as oil production and transport costs or supply and demand, they are based on nothing but speculation!

The EUWID Price Watch for July shows marked price decreases in standard plastics. The PVC price fell by 45 /t on average, whereas the other prices dropped by 80 /t to 130 /t; hence the average quote for the ten types of plastics listed below was 1354 /t. Thus the plastics price fell short of the previous month's quote by 91 /t. Hence, the following prices were quoted in July: LDPE film grade 1380 - 1420 /t, LLDPE film grade 1270 - 1340 /t, HDPE injection moulding 1280 - 1330 /t, HDPE blow moulding 1270 - 1320 /t, PS crystal clear 1350 - 1390 /t, PS high impact 1480 - 1540 /t, PP homopolymer 1360 - 1450 /t, PP copolymer 1410 - 1490 /t, PVC tube grade 1180 -1220 /t and PVC film/cables 1280 - 1320 /t. The boom in the construction industry is keeping the prices of PVC and PS at high levels. The price slump in PET slowed down in July. The decline in the precursor prices makes it possible to produce at more favourable prices. Production surpluses from Asia are making inroads into the European market. PET for packaging is quoted at 1500 - 1600 /t and has thus fallen short of the previous month's quote by 40 /t on average.

2. The market for secondary plastics

The secondary plastics markets are proving to be much more stable than the primary markets. For instance, the pressure seems to have been taken off the secondary markets in July - a pressure that had been caused both by the high primary prices and by the considerable demand. The markets have now achieved a balance. In addition, the summer break is having a moderating effect - albeit in a very restrained way. Industry experts expect the prices to remain stable throughout the summer break. A lot of processors continue to produce unabatedly despite the summer break. There is a very high demand for secondary plastics. Recyclates are still in great demand all across Europe. The demand for secondary plastics from the Far East has proved to be stable at a lower level than in the previous years and thus, however, no longer determines the markets.

In July the market changes from the primary markets were only in part reflected by the EUWID Price Watch for secondary plastics, whereas plasticker showed them more clearly. The plastics processers tried to postpone their purchases in July, too, so as to be able to benefit from the price reductions. However, in July and August the prices, which have in part been more favourable, have been used to negotiate longer-term sales conditions or to fill warehouses.

2.1 EUWID Price Watch

In July standard plastics were quoted at stable prices in the EUWID Price Watch. The price index showed only very few price changes in July. For instance, all quotes for production waste held their own. Only post-user PET showed slight price changes, namely by +/- 10 /t to +/- 20 /t on average. Industry experts expect price stability or slightly rising prices for August. PE market behaviour has hardly changed compared to the previous month. PVC and PS continue to benefit from the boom in the construction industry. The PP markets are still consolidating. There is sufficient supply, which is selling well in the markets. The plastics trend towards PP continues. There is again a considerable demand for PP recyclates as well as sufficient competition in the PP market, which is now demonstrated by the high grades of recylates again.

Post-user PET: The PET markets are consolidating, too. The price slump in PET is slowing down. The amount of PET offered in Germany is increasing. Furthermore, the decline in primary prices is lowering the prices of used bottles. In July, the EUWID quotes were on the decline again, albeit to a lesser extent than in the previous months. For instance, the price of PET transparent decreased by 10 /t in the lower range and by 50 /t in the top range. In the case of PET mixed colours, this equals 10 /t in the lower range and up to 30 /t in the top range. The following prices were quoted for used and disposable PET bottles in July: PET transparent 470 - 540 /t and PET mixed colours 340 - 410 /t.

2.2 plasticker price index

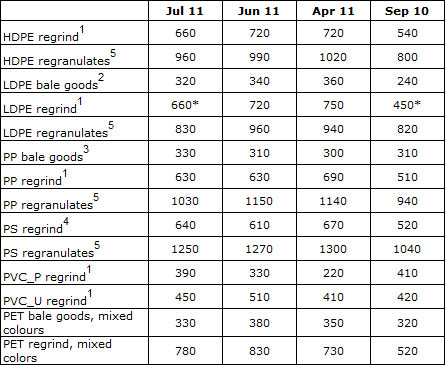

In July the prices of standard plastics quoted in plasticker decreased considerably. These price reductions ranged between 20 /t and 130 /t. Nevertheless, there were three price rises, namely of 20 /t for PP bale goods, of 30 /t for PS regrind and of 60 /t for PVC_P regrind. The July turnover was lower than that of the previous month. This can probably be explained by two reasons: on the one hand, the summer break; on the other hand, the purchasing restraint, which enables buyers to benefit from further price decreases. According to plasticker, the following price quotes changed by more than +/- 40 /t in July: HDPE regrind - 60 /t, LDPE regrind -60 /t, LDPE regranulates -130 /t, PVC_U regrind -60 /t, PET bale goods -50 /t and PET regrind -50 /t. The forecast of the August price index shows stable prices.

Table 1: Prices of standard plastics in plasticker, quoted in /t

*: Supply figures too low to attain statistical significance1: equivalent to the grade "post-industrial, mixed colours"; 2: equivalent to K49; 3: equivalent to K59; 4: equivalent to "standard, mixed colours"; 5: equivalent to "regranulates, black"

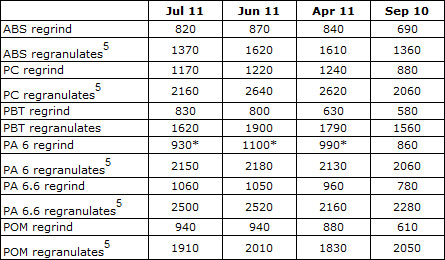

The July prices in plasticker were determined by marked price decreases in technical plastics. In July the price decreases in regrind equalled 50 /t to 170 /t. The quotes for regrind were still more stable than those for regranulates, whose prices fell by 20 /t to 480 /t throughout! Sales were on the decline in July. The price reductions in July can be explained by the fact that purchasers continued to speculate on a further fall in prices. The first forecast of the August quotes, however, shows price consolidation. The following price quotes changed by more than 70 /t in July: ABS regranulates - 250 /t, PC regranulates - 480 /t, PBT regranulates - 280 /t, PA 6 regrind - 170 /t and POM regranulates - 100 /t.

Table 2: Prices of technical plastics in plasticker, quoted in /t

The monthly quotes for secondary plastics, which are updated on an hourly basis, can be calculated using the price lists that are derived from the quotations published in the raw material exchange plasticker (cf. www.plasticker.de). The prices listed in this index are quoted with reservation - as the majority of the quotes submitted are not necessarily equivalent to the sales prices. Furthermore, plasticker does not distinguish between the following grades: transparent, mixed colours or colour-separated. Therefore, the information provided by plasticker may indicate different market behaviour than the prices quoted by EUWID.

All EUWID prices are quoted ex works. As a rule, the prices quoted refer to quantities in excess of 20 tons. The monthly quotes for secondary plastics, which are updated on an hourly basis, can be calculated using the price lists that are derived from the quotations published in the raw material exchange plasticker (cf. www.plasticker.de). The prices listed in this index are quoted with reservation - as the majority of the quotes submitted are not necessarily equivalent to the sales prices. Furthermore, plasticker does not distinguish between the following grades: transparent, mixed colours or colour-separated. Therefore, the information provided by plasticker may indicate different market behaviour than the prices quoted by EUWID.