Market Report Plastics - September 2011

Information about the market for plastics is being presented by:

bvse - Bundesverband Sekundärrohstoffe und Entsorgung e.V.

1. The market for primary plastics

The financial markets are upsetting the real economy. The oil price - which is also an important economic parameter - is showing a downward trend: at the end of week 38, the world market price of mineral oil was USD 99/barrel. In August, the prices of the majority of plastics precursors decreased. Furthermore, there still is a considerable demand for plastics products - despite all of the financial turbulence. The current economic prospects would normally lead to restraint in purchasing plastics - if it were not for the demand for plastics, which is again considerable after the summer break. Furthermore, production surpluses were largely reduced as early as during the summer months, which has caused the demand for plastics to increase further.

In August and September, supply and demand have been largely balanced with respect to standard plastics. As a result of the holidays, plastics production and processing have in part been reduced. The prices quoted in the EUWID Price Watch have held their own compared to the previous month: PS has increased by 50 /t, whereas PP has decreased by 10 /t, which has stopped prices from collapsing further. The average price of the ten types of plastics listed below is 1363 /t. Thus, the plastics price exceeds the previous month's quote by 9 /t. Hence, the following prices were quoted in July: LDPE film grade 1380 - 1420 /t, LLDPE film grade 1270 -1 340 /t, HDPE injection moulding 1280 - 1330 /t, HDPE blow moulding 1270 - 1320 /t, PS crystal clear 1400 - 1440 /t, PS high impact 1530 - 1590 /t, PP homopolymer 1350 - 1440 /t, PP copolymer 1400 - 1490 /t, PVC tube grade 1180 - 1220 /t and PVC film/cables 1280 - 1320 /t. The PET price consolidated in August. PET for packaging was quoted at 1530 - 1620 /t, thus exceeding the previous month's quote by 25 /t on average. Increased precursor prices and rising PET quotes in Asia are having an impact on the European Market. PET prices are expected to rise further in September, too. Pointing to the insecure economic situation, experts do not make any predictions on the further price developments of standard plastics in October.

As far as technical plastics are concerned, the prices of ABS and PC fell by 50 /t and by 200 /t according to the EUWID Price Watch for August, whereas PMMA, POM and PA held their own. In the EUWID Price Watch, technical plastics are quoted as follows: PMMA crystal clear 2560 - 2700 /t, ABS natural 1900 - 2100, ABS white/black 2000 - 2200, ABS mixed colours 2600 - 2950, PC crystal clear 2950 - 3150 /t, PC GF 3250 - 3450 /t, POM natural 2500 - 2550 /t, PA 6 natural 2650 - 2850 /t, PA 6 black 2650 - 2800 /t, PA 6 GF reinforced 3000 - 3100 /t, PA 66 natural 3400 - 3500 /t and PA 66 GF 3500 - 3600 /t. On the one hand, the decline in technical plastics prices is explained by the end of the holidays; on the other hand, it is attributed to the end of the boom in demand. According to the Internet journal "ki-Kunststoffinformation", however, the price of ABS increased by 40 /t to 50 /t in August, whereas PC, PA, PBT, POM and PMMA held their own. In general, technical plastics are in great demand.

2. The market for secondary plastics

The secondary plastics markets continue to gain in independence. There is still a considerable demand for secondary plastics in all areas of the plastics chain, where the demand for recycling and processing products far exceeds the supply. High-quality recyclates in particular are selling well. The trend towards well-defined grades and recyclates continues.

Many plastics recyclers and plastics processors continued to produce at an unreduced pace during the summer break. The demand for plastics in September and October is high. In addition, the purchasing restraints that occurred during the summer months have to be balanced out. Even though the demand from China increased again during the first half-year of 2011, the markets in the Far East do not dominate the markets or determine the prices. Exports to Hong Kong are on the decline because it is difficult to forward the goods to the People's Republic of China.

Furthermore, both plastics recycling and plastics processing companies are said to be undergoing change: on the one hand, certain business areas are being successfully expanded; on the other hand, the number of sales or insolvencies of companies is rising.

2.1 EUWID Price Watch

With the exception of PET, the August quotes for standard plastics as shown in the EUWID Price Watch have held their own compared to the previous month. There is a considerable demand for PET post industrial. Both regrind and bale goods are in great demand, too. There is also a considerable demand for post-user PE film in the Far East. The recycling of PE regrind from crates is gaining in importance. While PE continued to sell well during the summer break, the PP markets proved to be more consolidated during that period. Even though there is a sufficient supply of PP and a stable demand for PS in the markets, EPS is shifting towards EPP. PS and PVC are still benefitting from the boom in the construction industry.

PET post user: The PET markets are consolidating. The price decline in PET bottles has nearly been stopped. Furthermore, primary prices are stabilising the quotes for used bottles. There is a considerable demand for PET recyclates, which hold a firm position in the European processing markets. In August, the EUWID quotes decreased again, albeit only slightly, namely by 10 /t. In August, the following prices were quoted for used and disposable PET bottles: PET transparent 460 - 520 /t and PET coloured 330 - 400 /t.

2.2 plasticker price index

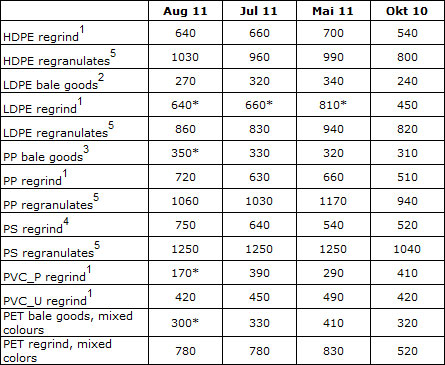

In August the prices of standard plastics quoted in plasticker were inconsistent. The price reductions ranged between 20 /t and 50 /t, whereas the price rises were between 20 /t and 90 /t, which shows that the price level attained has quite obviously consolidated. As a result of the holidays, the July and August sales were lower than in the previous months. According to plasticker, the following price quotes changed by more than 40 /t in August: HDPE regranulates +70 /t, LDPE bale goods -50 /t, PP regrind +90 /t and PS regrind +90 /t. The forecast of the September price index shows that the prices equal those quoted in August.

Table 1: Prices of standard plastics in plasticker, quoted in /t

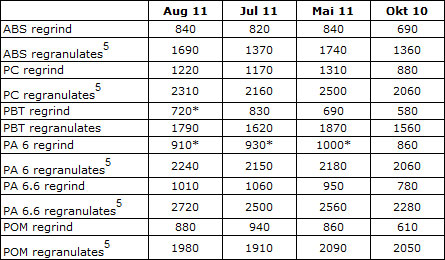

*: Supply figures too low to attain statistical significance1: equivalent to the grade "post-industrial, mixed colours"; 2: equivalent to K49; 3: equivalent to K59; 4: equivalent to "standard, mixed colours"; 5: equivalent to "regranulates, black"

The July and August forecasts for further price decreases in technical plastics have not continued in September. The plasticker quotes for technical plastics went up considerably again in August. However, the August price rises did not fully offset the July price cuts. In plasticker regrind remained stable, whereas regranulates were quoted at higher prices throughout. The price rises in regranulates ranged between 70 /t and 320 /t. The August sales figures exceeded those of July. The first forecast of the September quotes shows prices which approximately equal those quoted in August. The following price quotes changed by more than 70 /t in August: ABS regranulates + 320 /t, PC regranulates + 150 /t, PBT regranulates + 170 /t, PA 6 regranulates + 90 /t as well as PA 6.6 regranulates + 220 /t.

Table 2: Prices of technical plastics in plasticker, quoted in /t

All EUWID prices are quoted ex works. As a rule, the prices quoted refer to quantities in excess of 20 tons. The monthly quotes for secondary plastics, which are updated on an hourly basis, can be calculated using the price lists that are derived from the quotations published in the raw material exchange plasticker. The prices listed in this index are quoted with reservation - as the majority of the quotes submitted are not necessarily equivalent to the sales prices. Furthermore, plasticker does not distinguish between the following grades: transparent, mixed colours or colour-separated. Therefore, the information provided by plasticker may indicate different market behaviour than the prices quoted by EUWID.