Market Report Plastics - May 2012

Information about the market for plastics is being presented by:

bvse - Bundesverband Sekundärrohstoffe und Entsorgung e.V.

1. The market for primary plastics

The Government of the Federal Republic of Germany expects a slight economic growth again for this year. The Government is said to expect a 0.7% increase in growth for the current year and a 1.6% increase for the next. According to Federal Minister of Economics and Technology Dr. Philipp Rφsler Germany will remain Europes growth engine. With reference to the plastics industry, this still means that the demand for plastics from all sectors of the economy is slightly more restrained, but none the less satisfactory.

The PlastixxST Index published by ki - Kunststoff Information continuously rose from the low it had reached in December 2011 (with 2,000 points) until April 2012, when it attained 2,400 points. The Plastixx ST Index in April 2012 was identical to that in April 2011. According to expert reports, the demand for plastics stagnated in April and May as a result of the public holidays. In addition, there are reports on excess supplies of standard plastics in Europe. Plastics processors are thus hoping for prices to fall in May and June, explaining this by the drop in mineral oil prices, which has also entailed a decline in the listings for precursor prices. Hence, plastics processors are currently showing restraint with respect to purchases so as to ensure that they can benefit from the price drops expected to occur in May and June. The future price decline in plastics is heralded by the 50 /t decrease in PS prices.

However, according to EUWID the April quotes for standard plastics still showed rising prices - and that despite the rather restrained demand during the Easter break. These price increases - by 20 /t to 60 /t - can be explained by the price changes in precursors. Hence, the average price of the ten plastics listed in EUWID is 1494 /t. Thus, the plastics price exceeds the listing for the previous month by 23 /t. The following quotes were listed in the EUWID Price Watch for April 2012: LDPE film grade 1540 - 1590 /t, LLDPE film grade 1470-1530 /t, HDPE injection moulding 1500 - 1570 /t, HDPE blow moulding 1520 - 1570 /t, PS crystal clear 1440 - 1490 /t, PS high impact 1580 - 1630 /t, PP homopolymer 1510 - 1580 /t, PP copolymer 1560 - 1630 /t, PVC tube grade 1220 -1260 /t and PVC film/cables 1320 - 1360 /t. PET for packaging decreased according to the April Price Watch. Hence, PET is now quoted at 1480 - 1600 /t, i.e. its price has fallen short of the previous months quote by 60 /t. The collapse in PET prices can be explained both by the excess supply and by the declining precursor prices.

The trends in the markets for technical plastics are proving to be inconsistent. On the one hand, the demand is reported to be on the decline compared to the previous months; on the other hand, it is said to be sufficient or even favourable. Furthermore, there are reports that the plastics processors stocks are abundant. Precursor prices are declining. There is a sufficient supply of technical plastics, yet without there being any excess capacity. Processors are ultimately speculating that a price drop will occur in May and June, which is why they are showing restraint in respect to purchase order placements. As far as technical plastics are concerned, the April 2012 quotes for ABS exceeded those listed in the previous month by 100 /t for ABS, by 225 /t for PC and by 25 /t for POM, whereas PMMA and PA held their own. The EUWID Price Watch showed the following prices of technical plastics in April: PMMA crystal clear 2460 - 2600 /t, ABS natural 2100 - 2250, ABS white/black 2200 - 2350, ABS mixed colours 2800 - 3100, PC crystal clear 2750 - 3000 /t, PC GF 3050 - 3300 /t, POM natural 2150 - 2350 /t, PA 6 natural 2550 - 2750 /t, PA 6 black 2550 - 2750 /t, PA 6 GF reinforced 2900 - 3000 /t, PA 66 natural 3200 - 3300 /t and PA 66 GF 3300 - 3400 /t.

2. The market for secondary plastics

The secondary plastics market responds cautiously to the changes regarding primary materials; in some sectors, it has become independent of the shorter-term trends followed by the primary materials. Despite the public holidays, the demand for recyclates has been favourable in April and May. Certain secondary plastics were quoted at slightly higher prices in April. On the whole, it can be said that: the prices of bale goods and post-industrial materials have risen slightly, the quotes for regranulates have also picked up. The recyclers order books are full until the end of the second quarter. There are already indications that the third quarter will be satisfactory, too. The export trade with the Far East is stagnating; there are reports on increases in freight charges and a shortage of sea containers.

2.1 EUWID Price Watch

EUWID reveals a small-step price policy. The prices of some selected grades have been raised slightly. The EUWID Price Watch for April relating to post-consumer plastics showed slight price rises in PE-P and PVC, namely by 5 /t to 35 /t on average. The price increases often occur only at one end, i.e. either in the lower or in the upper range of the listings.

As a result of the favourable demand for PE, the prices of certain grades could be raised by 5 /t to 35 /t. The prices of PE post industrial have changed as follows: HDPE mixed colours 500 - 700 /t and HDPE natural 650 - 750 /t. The quotes for post-user PE have changed as follows: film transparent natural < 70 ΅m 340 - 380 /t, LDPE farm film b/w > 70 ΅m (B41) 40 - 60 /t, HDPE hollow bodies mixed colours (C29) 240 - 330 /t, HDPE regrind from crates, colour-separated 640 790 /t as well as HDPE regrind from crates, mixed colours 570 700 /t. Hence, the prices of film transparent natural < 70 ΅m and LDPE farm film have slightly decreased by 5 /t or 10 /t on average.

The demand for PP is assessed as being considerable. The price rises in certain PP grades range between 10 /t and 20 /t. The following prices are quoted in the April Price Watch: homopolymer mixed colours 470 - 700 /t, homopolymer natural 650 - 800 /t, copolymer mixed colours 500 - 700 /t as well as copolymer natural 650 - 800 /t.

PS has held its own compared to the previous month. The price level attained in April 2012 was roughly equivalent to that of April 2011. The demand for PVC was assessed as being good to very good. PVC was able to attain slight price rises between 5 /t and 10 /t. PVC post industrial: PVC_P mixed colours 380 - 470 /t, PVC_U mixed colours 460 - 610 /t and tube grade mixed colours 420 - 580 /t. Windowframe regrind: windowframe regrind white 630 -750 /t, windowframe regrind mixed colours 500 - 600 /t and windowframe regrind single-shade white 730 - 850 /t.

The quotes for used and disposable PET bottles have increased again slightly according to the April Price Watch, namely by 35 /t on average for PET transparent and by 25 /t for PET coloured. The following prices are now quoted for used and disposable PET bottles according to EUWID: PET transparent 500 570 /t and PET coloured 295 345 /t. The increased PET prices quoted for used and returnable bottles are not in line with the marked price decline in primary plastics, which is why PET processors are hoping for the prices of bottle materials to fall. The export trade with the Far East is stagnating, which is further increasing pressure on the sale of bale goods. The prices of imported bottles have already decreased by 30 /t to 50 /t. However, current PET prices are considerably lower than the record prices attained in 2011.

2.2 plasticker price index

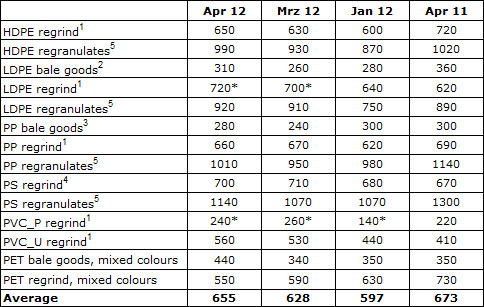

According to the plasticker price index for April, the quotes for standard plastics increased by 27 /t on average compared to the previous month. The price rises ranged between 10 /t and 100 /t and the price decreases between 10 /t and 40 /t. The price of regrind hardly increased. The quotes for regranulates and bale goods were slightly higher than in the previous month. The bids and quotes listed in plasticker attained high levels in April, too. According to plasticker the following listings changed by more than +- 40 /t for: HDPE regranulates +60 /t, LDPE bale goods +50 /t, PP regranulates +60 /t, PS regranulates +70 /t and PET bale goods mixed colours +100 /t. The price of PET bale goods mixed colours rose markedly by 100 /t in April. In May this price has held its own, too. However, PET regrind mixed colours shows a longer-term trend towards declining prices. The first forecast of the May listings, which will be published in June, indicates price stabilisation.

Table 1: Prices of standard plastics in plasticker, quoted in /t

*: Supply figures too low to attain statistical significance1: equivalent to the grade "post-industrial, mixed colours"; 2: equivalent to K49; 3: equivalent to K59; 4: equivalent to "standard, mixed colours"; 5: equivalent to "regranulates, black"

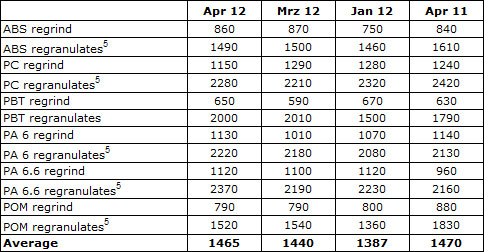

According to the plasticker price index for April, the listings for technical plastics increased by 25 /t on average compared to the previous month; there are reports on both rising and falling prices. The quotes for technical plastics increased step by step, attaining approximately the same level as last year. Technical plastics prices were inconsistent: the price rises ranged between 20 /t and 180 /t, and there were price decreases of 10 /t to 140 /t. POM has recovered from the low it had reached in January and February 2012. The estimates for PBT regranulates are likely to attain new record levels in June, with 2,160 /t. The first forecast of the May listings, which will be published in June, reveals a trend towards further price increases. A good demand for technical plastics can be discerned for May and June. According to plasticker the following price quotes changed by more than +/- 70/t in April: PC regrind -140 /t, PA 6 regrind 120 /t and PA 6.6 regranulates +180 /t.

Table 2: Prices of technical plastics in plasticker, quoted in /t

5: equivalent to the grade regranulates, black

No guarantee for any of the prices. All EUWID prices are quoted ex works. As a rule, the prices quoted refer to quantities in excess of 20 tons. The monthly quotes for secondary plastics, which are updated on an hourly basis, can be calculated using the price lists that are derived from the quotations published in the raw material exchange plasticker. The prices listed in this index are quoted with reservation - as the majority of the quotes submitted are not necessarily equivalent to the sales prices. Furthermore, plasticker does not distinguish between the following grades: transparent, mixed colours or colour-separated. Therefore, the information provided by plasticker may indicate different market behaviour than the prices quoted by EUWID.