Market Report Plastics - June 2012

Information about the market for plastics is being presented by:

bvse - Bundesverband Sekundärrohstoffe und Entsorgung e.V.

1. The market for primary plastics

With 2011 having been a good year for plastics, plastics producers in Germany are now looking ahead “with an optimistic and realistic outlook”. This is what Dr. Wolfgang Hapke, the President of Plastics Europe Deutschland e.V., explained to the press, cf. www.plasticseurope.de. According to Hapke, pre-crisis levels have, on the whole, been attained again or even been slightly exceeded. However, he added that it looked as though the successful race to catch up was being followed by a growth pause. Hapke said that the growth rate for the current year 2012 was expected to be roughly equal to the increase in the Gross Domestic Product (GDP).

In 2011 plastics production in Germany rose by 1.4 per cent to reach 20.7 million tons; within the same period, the plastics producers’ turnover increased to € 25.3 billion, i.e. by 7.5 per cent. The growth in turnover on the domestic market, which equalled 9.8 per cent, was considerably higher than that on the foreign markets (5.8 per cent). In 2011 exports declined by 2.5 per cent in volume compared to the previous year, to reach 11.9 million tons, while they increased by 8.3 per cent in value. The 2011 import quantities held their own at the previous year’s level of 8.4 million tons, while import values increased by 13.3 per cent to reach € 14.5 billion.

The price declines in standard plastics announced in May will become a reality in June. These price declines are caused by the decreasing mineral oil and precursor prices; the quote for ethylene has decreased by 120 €/t and that for propylene by 125 €/t compared to the previous month. Experts expect the prices of mineral oil and precursors to decline further during the summer months. Furthermore, a strong purchasing restraint is noticeable. Plastics processors expect plastics prices to decline further in the next few months too, which is why they are postponing their purchase order placements as long as possible. In addition, the forthcoming summer break is likely to cause a decline in the processors’ demand for plastics. In view of the relatively low stock levels, it is good to see that a continuous minimum number of purchase orders is required to enable ongoing production.

The prices of standard plastics are likely to decline by 20 €/t to 80 €/t in June. Only the prices of PS, for their part, have increased at the lower end of the price range, namely by 20 €/t. Thus, the average price of the 10 types of plastics listed by EUWID in June is 1,470 €/t, i.e. the plastics price has decreased by 24 €/t compared to the previous month. The following prices were listed in the EUWID Price Watch in May 2012: LDPE film grade 1460 - 1540 €/t, LLDPE film grade 1410 -1490 €/t, HDPE injection moulding 1480 - 1540 €/t, HDPE blow moulding 1480 - 1540 €/t, PS crystal clear 1460 - 1490 €/t, PS high impact 1600 - 1630 €/t, PP homopolymer 1480 - 1530 €/t, PP copolymer 1530 - 1580 €/t, PVC tube grade 1220 - 1260 €/t and PVC film/cables 1320 - 1360 €/t. PET for packaging has decreased again in the May Price Watch. The slump in PET prices is explained both by the excess supply and by the decline in precursor prices. PET prices are likely to decline further.

2. The market for secondary plastics

The price slump currently taking place in post-consumer paper and scrap metals is likely to affect post-consumer plastics in June, too. While the May price indeces still indicated stable prices on the secondary plastics markets, considerable market changes have been announced for June and July, leading to falling prices for bale goods. Recyclates, i.e. regrind, regranulates, regenerates/compounds and agglomerates, have held their own. Despite the large supply, considerable purchasing restraint is also noticeable in June and July – the demand is faltering. However, the plastics processors’ stock levels are relatively low, which leads to continuous order placements. Processors are speculating that prices will decline further. However, there are hopes that the markets will stabilise at a higher level after the summer break. Plastics processors have already been working to full capacity since autumn 2010 without having had any opportunity to carry out thorough production plant checks during that period.

On the one hand, there are still reports on restrained export trade with the Far East; on the other hand, the export demand for certain grades has increased considerably again. The relative weakness of the euro or/and the strength of the dollar are decreasing the prices of exports to the Far East; and yet, there are still reports on considerable freight charges and a shortage of sea containers. The People’s Republic of China has come to carry out very effective border controls for imports, while checking and increasingly restricting imports via Hong Kong. According to the Chinese Association of Plastics Recycling, PRC-CPPIA, approximately 9.02 million tons of post-consumer plastics were imported to China in 2011. In the first quarter the German Federal Statistical Office (destatis) reported that direct imports to the People’s Republic of China had increased by 35 %, i.e. by 150,500 tons, in the first quarter of 2011 to 203,300 tons in the first quarter of 2012. Exports to Hong Kong decreased from 70,100 tons to 49,500 tons within the same period!

2.1 EUWID Price Watch

The Price Watch for post-consumer plastics showed only a few changes in May. The plastics markets are stagnating. However, post-consumer plastics are coming under pressure because of the falling virgin material prices. Only post-user PE is reported to have undergone slight price changes, all other plastics prices have held their own.

PE prices have proved to be largely stable. As far as PE post industrial is concerned, the listings for bale goods and regrind have held their own. The prices of post-user PE have also changed slightly. The price increases are reported to have occurred either at the upper or the lower end of the listings, with prices rising by 5 €/t to 15 €/t and decreasing by 10 €/t to 20 €/t. The following changes have occurred in post-user PE: film transparent natural < 70 µm 330 - 360 €/t, film transparent mixed colours < 70 µm 80 - 130 €/t, mixed film 98/2 330 - 360 €/t, mixed film 90/10 210 - 250 €/t and mixed film 80/20 200 - 220 €/t.

Even though the prices of PP have not changed, experts point out that the PP markets have come under pressure because of the developments in PE. Even the price of PS has held its own compared to the previous month. The boom in the building industry is stabilising PS prices. Even PVC prices have so far been stabilised by the building boom. Nevertheless, experts do not necessarily assess the prices of PS and PVC as being stable. PVC_P mixed colours has decreased by 30 €/t at the lower end of the price range, to reach 350 – 470 €/t.

According to the May Price Watch, the prices for used and returnable PET bottles have decreased, namely by 43 €/t on average for PET and by 45 €/t for PET mixed colours. The following prices are now listed for used and returnable PET bottles: PET transparent 455 -530 €/t and PET mixed colours 250 - 300 €/t. The PET processors are complaining about the crisis of the markets and listings. As pressure on regrind and regranulates is increasing, the excessive purchasing prices can only be balanced out with difficulty.

2.2 plasticker price index

Owing to the current market changes the current quotes indicated by plasticker, i.e. the June quotes of 17th June 2012, will, for the first time, be listed both for standard plastics (cf. Table 1) and for technical plastics (cf. Table 2) below. These quotes are not the final June listings; instead, they are merely preliminary values. Plasticker does not indicate any market distortions for standard plastics in June. However, marked price decreases are discernible for technical plastics!

The plasticker price index for May shows that the average value for standard plastics quotes has held its own compared to the previous month, with prices rising by 10 €/t to 70 €/t and decreasing by 10 €/t to 60 €/t. PVC_P shows a longer-term trend towards declining prices and PVC-U towards higher prices. The bids and quotes listed in plasticker were at a good level in May, too. According to plasticker the following price quotes changed by more than +/- 40 €/t compared to the previous month: LDPE regranulates – 60 €/t and PVC_U + 70 €/t.

The first forecast of the current June quotes, whose final listings will not be published until July, shows further price stabilisation at the previous month’s level. The number of quotes will increase considerably; it will even double for some types of plastics.

Table 1: Prices of standard plastics in plasticker, quoted in €/t

*: Supply figures too low to attain statistical significance; 1: equivalent to the grade “post-industrial, mixed colours”; 2: equivalent to K49; 3: equivalent to K59; 4: equivalent to “standard, mixed colours”; 5: equivalent to the grade “regranulates, black”, 6: forecast that may be amended by additional quotes.

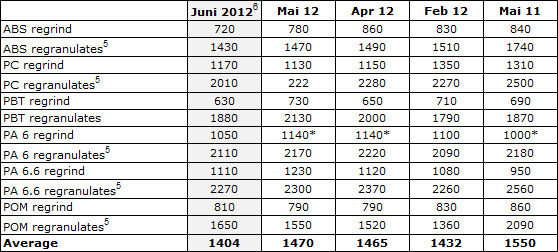

The average value for the technical plastics quotes has nearly held its own compared to the previous month according to the plasticker price index for May, too. Compared to the previous year, the average price difference between May 2012 and May 2011 was 80 €/t all the same. The price rises in May 2012 were roughly offset by the price decreases. The prices quoted for technical plastics were inconsistent: there were price rises of 30 €/t to 130 €/t and price decreases of 20 €/t to 80 €/t. In May the bids and quotes listed by plasticker were at a good level. According to plasticker the following price quotes changed by more than +/- 70 €/t in May 2012: PBT regrind +80 €/t, PBT regranulates + 130 €/t and PA 6.6 regrind + 110 €/t.

The first forecast of the current June quotes, whose final listings will not be published until July, shows marked price decreases, namely by 66 €/t on average. The supply figure will increase considerably. Only POM will probably be quoted at a higher price in June, too.

Table 2: Prices of technical plastics in plasticker, quoted in €/t

*: Supply figures too low to attain statistical significance; 5: equivalent to the grade „regranulates, black“. 6 forecast that may be amended by additional quotes.

No guarantee for any of the prices. All EUWID prices are quoted ex works. As a rule, the prices quoted refer to quantities in excess of 20 tons. The monthly quotes for secondary plastics, which are updated on an hourly basis, can be calculated using the price lists that are derived from the quotations published in the raw material exchange plasticker. The prices listed in this index are quoted with reservation - as the majority of the quotes submitted are not necessarily equivalent to the sales prices. Furthermore, plasticker does not distinguish between the following grades: transparent, mixed colours or colour-separated. Therefore, the information provided by plasticker may indicate different market behaviour than the prices quoted by EUWID.