Market Report Plastics - July 2012

Information about the market for plastics is being presented by:

bvse - Bundesverband Sekundärrohstoffe und Entsorgung e.V.

1. The market for primary plastics

The IK-Industrial Association for Plastics Packaging (IK-Industrievereinigung Kunststoffverpackungen) has published its latest trend report at www.kunststoffverpackungen.de. The German plastics packaging industry continues to assess the current economic situation as being favourable. 43 per cent of IK members interviewed have rated the present situation as being good and 52 per cent consider it to be satisfactory. The companies themselves expect a slight decline in turnover for the third quarter of 2012, the account balance is expected to fall to 1.1 points compared to + 7.2 for the preceding quarter. Hence the preview presented in IK Economic Trend for the third quarter of 2012 is much more favourable than the rating given by the ifo Business Climate Index. Companies take a more critical attitude towards the developments in exports expected to occur in the next quarter. In this area, the account balance is likely to rise by approximately 30 points, which confirms that the economic situation continues to deteriorate in a considerable number of EU member states. The euro crisis is now having an increasingly negative impact on German small and medium-sized enterprises (SMEs).

According to the report for last year, submitted by the IK Industrial Association for Plastics Packaging at www.kunststoffverpackungen.de, the volume of plastics packaging amounted to 4.31 million tons worth of 13.22 billion and thus rose by 5.2 per cent, which equals a 9.4 per cent increase in turnover compared to the preceding year. Plastics represented approximately 41 per cent of the German packaging market, thus accounting for the highest proportion of overall packaging. Plastics film, for its part, accounted for the highest proportion of plastics packaging materials - with 1.73 million tons.

The price decreases in standard plastics predicted in May with a view to the summer months are now becoming a reality for the second time. The price declines are caused by the fall in mineral oil and precursor prices; the quote for ethylene has decreased by 263 /t and that for propylene by 201 /t compared to the previous month. Experts expect a further decline in mineral oil and precursor prices. Furthermore, a strong purchasing restraint is discernible. Plastics processors expect plastics prices to decline further in August too, which is why they are postponing their purchase order placements. Over and above that, the processors demand for plastics is relatively low during the summer months.

The prices of standard plastics decreased by 60 /t to 190 /t in June. Only PS held its own. Hence, the average price of the ten types of plastics listed by EUWID as shown below is 1,344 /t. Thus, the plastics price decreased by 126 /t compared to the previous month. The following prices were listed in the EUWID Price Watch in June 2012: LDPE film grade 1270 - 1350 /t, LLDPE film grade 1220 - 1300 /t, HDPE injection moulding 1290 - 1350 /t, HDPE blow moulding 1290 - 1350 /t, PS crystal clear 1460 - 1490 /t, PS high impact 1590 - 1630 /t, PP homopolymer 1290 - 1340 /t, PP copolymer 1340 - 1390 /t, PVC tube grade 1160 - 1200 /t and PVC film/cables 1260 - 1300 /t. The price slump in PET is explained by the surplus supply in production, by the purchasing restraint on the part of the processors, by the demand for beverages, which has been restrained until now, and by the decline in precursor prices. According to experts, PET prices are likely to bottom out in August.

The situation on the technical plastics markets has eased. The global supply of technical plastics is now sufficient, and there are very few reports on shortages. Hence, even though the high demand for technical plastics has decreased, it has levelled out at an acceptable volume. The major reasons for the price decrease include, above all, declining precursor prices and a certain purchasing restraint, caused by hopes for a further fall in prices.

The price decreases expected to occur in May and June have become a reality. As far as technical plastics are concerned, the quotes for PMMA, POM and PA decreased by 100 /t or 200 /t, whereas PMMA and PC have held their own. The following prices were listed for technical plastics in the EUWID Price Watch for June: PMMA crystal clear 2460-2600 /t, ABS natural 1900 -2050 /t, ABS white/black 2000 2150 /t, ABS mixed colours 2600 2900 /t, PC crystal clear 2750 - 3000 /t, PC GF 3050 - 3300 /t, POM natural 2050 - 2250 /t, PA 6 natural 2450 - 2650 /t, PA 6 black 2450 - 2650 /t, PA 6 GF reinforced 2800 - 2900 /t, PA 66 natural 3100 - 3200 /t and PA 66 GF 3200 - 3300 /t.

2. The market for secondary plastics

In June and July there have been reports on market shifts from a variety of sources, according to which the above virgin material prices are influencing the prices of recyclates (regrind and regranulates). However, the quotes for the processing and recycling input, i.e. for bale goods, have now finally decreased, too. According to the EUWID Price Watch for June, there have been price reductions in the majority of the quality grades listed. The plastics prices published in the Plasticker Price Index for June (bale goods, regrind, regranulates) nearly held their own. There are hopes that input prices will be offset by output prices and/or that the prices of plastics wastes separated into fractions will be offset by the stock listings for recyclates and final products during the summer break. During that time the markets are likely to calm down and find their balance.

At present the summer break is having an impact, i.e. the demand for plastics has fallen markedly. True, the preliminary price indeces for standard plastics and also for technical plastics show that prices have fallen considerably; and yet, the impact of these price decreases is likely to be limited because the turnover in July and August is expected to be low. Plastics processors have been showing restraint with respect to purchases in July; expecting prices to decline further, they have only bought the most essential input. Purchases are currently being made just in time (JIT) the processors warehouses are empty. It is now possible to benefit from the summer break to bring production to a halt in the manufacturing plants and to carry out thorough overhauls without losing market share.

The export trade with the Far East is proceeding relatively smoothly, too. Traders can select the quality grades required without being under pressure. There has been a slight rise in demand lately. The export demand derives impulses from the decrease in the euro exchange rate.

2.1 EUWID Price Watch

The plastics markets have been stagnating in July. According to the EUWID Price Watch for post-consumer plastics, the prices of many quality grades have been reduced. The price decreases have mostly peaked at 35 /t to 50 /t. The majority of these reductions amount to 10/t to 20 /t. Experts expect the Price Watch to indicate a further decline in prices in July.

The prices of many types of PE have fallen. As far as PE post-industrial is concerned, the listings for bale goods and regrind have decreased by 5 /t to 20 /t: HDPE mixed colours 490 - 670 /t, HDPE natural 650 - 750 /t, LDPE mixed colours 490 - 620 /t, LDPE natural 650 - 700 /t, LDPE film mixed colours (K49) 230 - 310 /t and LDPE natural (K40) 440 - 550 /t. The listings for post-user PE have changed more markedly, with price decreases ranging from 10 /t to 50 /t: LDPE shrink film natural (E40) 420-500 /t, LDPE shrink film mixed colours (E49) 220 - 280 /t, film transparent natural < 70 ΅m 320 - 350 /t, Folie transparent mixed colours < 70 ΅m 70 - 120 /t, LDPE farm film black/white > 70 ΅m 40 - 60 /t, mixed film 98/2 330 - 350 /t, mixed film 90/10 210 - 250 /t, mixed film 80/20 200 - 220 /t, HDPE-hollow bodies mixed colours (C29) 160 - 300 /t, HDPE regrind from crates colour-separated 640 - 750 /t and HDPE regrind from crates, mixed colours 550 - 650 /t.

The prices of PP have changed by 15 /t to 25 /t on average: film mixed colours (K59); film mixed colours (K59) 140 - 300 /t, film natural (K50) 350 - 450 /t, homopolymer mixed colours 450 - 680 /t, homopolymer natural 650 - 800 /t, copolymer mixed colours 470 - 680 /t and copolymer natural 650 - 800 /t. The quality grades of regrind and regranulates offered in the PP markets vary tremendously, with poor grades pulling the prices of high-quality recyclates down.

The boom in the building industry still has a stabilising effect on PS prices. The pressure exerted by the virgin material markets is also lower than that for other plastics. This is why the PS markets have proved to be relatively stable. The average price decreases range from 10 /t to 20 /t: standard mixed colours 500 - 670 /t, standard crystal clear 600 - 800 /t, standard white 600 - 800 /t, high impact mixed colours 600 - 680 /t, high impact black 630 - 700 /t and high impact white 700 - 850 /t.

PVC prices have decreased relatively slightly. The quotes for PVC have been stabilised by the favourable developments in the building industry. PVC recyclates are currently in great demand. The quotes for PVC post-industrial have decreased by 20 /t to 35 /t on average. The following prices were quoted for PVC post-industrial in June: PVC_P transparent 420 - 550 /t, PVC_P mixed colours 330 - 450 /t, PVC_U transparent 500 - 600 /t, PVC_U mixed colours 430 - 570 /t and tube grade mixed colours 520 - 580 /t. The quotes for PVC windowframe regrind are lower by 5 /t to 10 /t on average: windowframe regrind white 630 - 740 /t, windowframe regrind mixed colours 500 - 590 /t and windowframe regrind single-shade white 720 - 840 /t.

According to the June Price Watch, the prices of used and returnable PET bottles have been reduced, namely by 58 /t for PET transparent and by 45 /t for PET coloured. The following prices are quoted by EUWID for used and returnable PET bottles: PET transparent 400 - 470 /t and PET coloured 200 - 260 /t. PET processors continue to take a critical view of the currently precarious situation concerning the markets and listings. The prices of bale goods have been gradually reduced within the framework of continued and slow-moving negotiations, whereas there is a high price pressure on the recyclates produced. The purchase prices of bale goods are still too high. Bottle quantities are expected to rise during the summer months, which is likely to cause a further decline in input prices.

2.2 plasticker price index

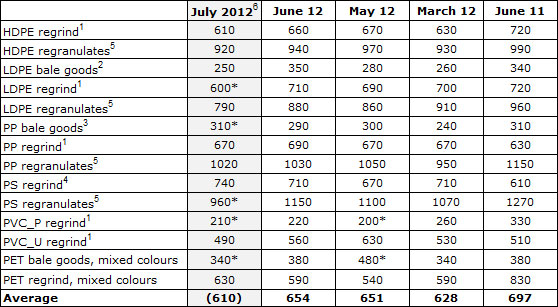

Due to the market changes predicted, the current listings presented by plasticker, i.e. the July quotes of 10 July 2012, will be published again on this page both for standard plastics (cf. Table 1) and for technical plastics (cf. Table 2). However, these tables reflect an interim situation rather than the final July listings. According to plasticker, the prices of standard plastics have fallen markedly in July. There have been further price declines in technical plastics, too.

The plasticker price index for June shows that the average value for standard plastics quotes has nearly held its own compared to the previous month. The price rises range between 10 /t and 70 /t and the price decreases between 10 /t and 100 /t. PVC prices have been stabilising. The longer-term trend of PVC_P towards declining prices ground to a halt in June, whereas the longer-term tendency of PVC_U towards attaining higher prices stopped in May. June was characterised by a very large supply. According to plasticker, the following prices changed by more than +/- 40 /t compared to the previous month: LDPE bale goods +70 /t, PVC_U -70 /t, PET bale goods -100 /t and PET regrind +50 /t.

The summer break is having an impact! The first forecast of the current July prices, whose final listings will not be published until August, shows that supply has decreased markedly compared to the previous month. The demand for standard plastics has decreased compared to the first five months. Considerable price declines are discernible.

Table 1: Prices of standard plastics in plasticker, quoted in /t

*: Supply figures too low to attain statistical significance; 1: equivalent to the grade post-industrial, mixed colours; 2: equivalent to K49; 3: equivalent to K59; 4: equivalent to standard, mixed colours; 5: equivalent to the grade regranulates, black, 6: forecast (likely to be amended by additional quotes)

According to the plasticker price index for June, technical plastics have fallen by 74 /t on average compared to the previous month. The price rises, ranging from 10 /t to 70 /t, have been significantly outstripped by the price decreases, which range from 20 /t to 260 /t. The average price difference between June 2012 and June 2011 is 175 /t. The production shortages in the virgin materials are now balanced out. Hence, the demand for recyclates has now decreased too, causing the considerable decline in prices. The number of bids and quotes published by plasticker in June has risen markedly. The prices of PA 6.6. regranulates have been steadily falling since August 2011 and those of ABS regranulates since February 2012. According to plasticker, the following quotes changed by more than +/- 70 /t in June: PC regranulates -200 /t, PBT-regrind +80/t, PBT regrind -110 /t, PBT regranulates -260 /t and PA 6.6 regrind -90 /t.

The first forecast of the current July prices, whose final listings cannot be published until August, indicates a potential for price decreases again, namely by 45 /t on average. The number of quotes submitted in June decreased markedly compared to the previous month. In July the demand for standard plastics indicated has fallen short of the volume attained during the first five months.

Table 2: Prices of technical plastics in plasticker, quoted in /t

5: equivalent to the grade regranulates, black. 6 forecast (likely to be amended by additional quotes)

No guarantee for any of the prices. All EUWID prices are quoted ex works. As a rule, the prices quoted refer to quantities in excess of 20 tons. The monthly quotes for secondary plastics, which are updated on an hourly basis, can be calculated using the price lists that are derived from the quotations published in the raw material exchange plasticker. The prices listed in this index are quoted with reservation - as the majority of the quotes submitted are not necessarily equivalent to the sales prices. Furthermore, plasticker does not distinguish between the following grades: transparent, mixed colours or colour-separated. Therefore, the information provided by plasticker may indicate different market behaviour than the prices quoted by EUWID.