Market Report Plastics - January 2013

Information about the market for plastics is being presented by:

bvse - Bundesverband Sekundärrohstoffe und Entsorgung e.V.

1. The market for primary plastics

According to the first estimates, the 2012 primary plastics markets can only be described by hesitancy and procrastination; however, the second estimates show that they were certainly successful. Just to explain this in more detail: processors placed orders for materials in accordance with the current demand only. Stocks were not replenished according to previously set goals because plastics were traded at relatively expensive prices. There was a considerable lack of new impulses to boost the plastics sales markets; however, established methods were fully deployed. Plastics products were in considerable demand in the domestic markets, while the demand for export materials faltered several times. There was a more sufficient demand for standard plastics; however, the developments in technical plastics were relatively stable. The price indeces of ki Kunststoff Information show that the 2012 plastics prices nearly attained the record highs they had reached in 2011. Price downturns were discernible in the middle of the year. Until September the prices rose again, to fall slightly until the end of the year.

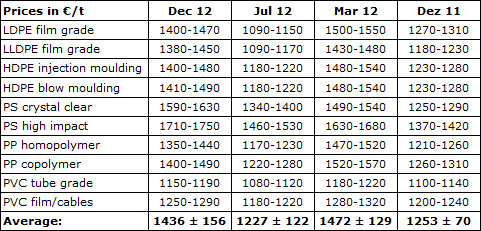

Standard plastics - 2012 end-of-year review: The EUWID quotes attained record levels at 1,472 €/t in March 2012, see Table 1. This market low point, which was at 1,227 €/t in July, did not prevail and was not really relevant, because the plastics quantities delivered at these terms were relatively low as a result of the considerable demand. However, the boost in demand, triggered by the favourable prices in July and the subsequent months, proved that there was a considerable demand for plastics on the processors´part. The increase in the plastics price, however, led to just-in-time order placement only. In addition, the rise in plastics prices substantiates existing concerns about further market developments. At year-end additional increases could be implemented, which means the plastics price, which was at 1,436 €/t in December, nearly attained the record levels reached in March 2012, namely 1,472 €/t. The difference in the average values between the peak values reached in March 2012 and the lowest point attained in July 2012 was, all the same, 219 €/t, which means that plastics prices rose considerably again until December 2012. However, on average the plastics markets were remarkably stable for all months. The difference between the peak prices of standard plastics, quoted at 1,501 €/t on average in April 2011, and the average prices, quoted in March 2012 at 1,472 €/t, was only marginal.

Table 1: Comparison of the prices quoted by EUWID for 2012 (in €/t)

Standard plastics - the December quotes: In the first two weeks of December, there was still a sufficient demand for purchasing goods. Before the Christmas break, some processors replenished their stocks. The average price listed for the ten types of plastics in EUWID was 1,436 €/t. Thus, the plastics price increased by 14 €/t compared to the previous month. In December, the quotes for PE rose by 40 €/t to 60 €/t and those for PS by 10 €/t. PP held its own and the price of PVC decreased by 20 €/t. The PET markets continue to be characterised by a considerable supply and restraint in demand.

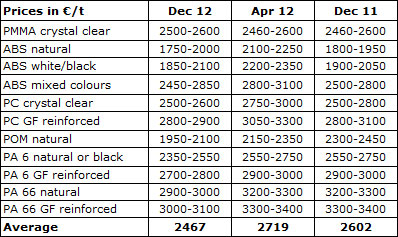

Technical plastics - 2012 end-of-year review: The developments in technical plastics, cf. Table 2, were characterised by a price increase until April 2012 and subsequently, by steadily falling prices. The peak levels of 2,822 €/t, attained in June 2011, could no longer be reached in 2012. The difference between the average values attained in April 2012 (with 2,719 €/t) and the lowest point reached in December 2012 (at 2,476 €/t) was 252 €/t all the same. This means that there has been an overall long-term trend of technical plastics prices towards gradual, yet ultimately continuous decline since June.

Technical plastics - the December quotes: As a result of the winter season, the December demand was lower than the demand in previous months. The prices of technical plastics declined again in December 2012. The prices decreased by 83 €/t on average for ABS and PC. The prices of PMMA, POM and PA held their own. New impulses, which might boost the demand for technical plastics, are expected to occur at the end of February at the latest.

Table 2: Comparison of the prices quoted by EUWID for technical plastics (in €/t)

2. The market for secondary plastics

2012 end-of-year review: 2012 was ultimately a satisfactory year for plastics recyclers. In 2012, recyclates, in addition to primary materials, could more or less hold their own. On the positive side, recyclates still supplement primary goods very advantageously in respect to quality and prices. It is also positive to see that plastics markets continue to gain an independent profile. However, 2012 was a difficult year to the extent that cost increases in recycling and processing could not be passed on to recyclate prices to a sufficient extent. Another reason why 2012 was difficult is that dual systems and industry solutions increasingly interfered with plastics recycling because they used their own processing plants. As far as plastics recycling is concerned, quality plays an increasingly important part in positioning the recyclates in the markets appropriately. Plastics recyclers are now able to prove that complaints about a lack of quality in bale goods are justified. On the whole, the quality of bale goods and the purchase price are often not in line with each other.

Standard plastics markets were quoted at relatively stable prices in 2012. For the most part, only the prices of some select quality grades changed. Until May prices gradually increased, yet they declined again over the summer months. Since October, the markets have remained more or less stable. The 2012 December quotes were similar to those for December 2011. Recyclates from technical plastics were in great demand: the quotes for regrind proved to be relatively stable, whereas the prices of regranulates steadily declined.

The European domestic markets became increasingly important for plastics recyclers - or to put it differently: there was a relatively large supply of plastics from other European countries available to German processing companies. The German plastics markets became increasingly independent of the export trade with the Far East, where orders are placed very selectively, according to price and quality. The sale of processing input to the Far East faltered in part. Exports to the Far East were subject to tightened border controls. However, the destatis statistics show that the 2012 export trade with the Far East surpassed that of the previous year: for instance, Germany exported 605,000 tons of used plastics to the People´s Republic of China in the first three quarters of 2012 (as opposed to 522,000 tons in 2011), and 147,000 tons to Hong Kong (as opposed to 186,000 in 2011). The proportion of exports to Hong Kong considerably declined.

The December quotes: In the EUWID December Price Watch, the quotes for bale goods and regrind nearly held their own; in total, the prices of bale goods, regrind and regranulates declined only slightly, according to plasticker. According to EUWID, there were very few reports on fluctuations in the plastics markets in December, whereas plasticker reported that there had been a considerable demand for recyclates. The slight price rise in primary materials only had a minor impact on secondary materials.

2.1 EUWID Price Watch

The price changes indicated by EUWID in the December Price Watch were marginal. The prices of five quality grades changed by 10 €/t each. According to expert reports, some purchases of processing materials were made in December, to avoid a potential price rise in January. In December, the number of orders for film increased in the export trade with the Far East. The winter, which has been mild to date, led to the demand for PS and PVC building materials stabilising again at a lower level, subsequent to several downturns. As far as post-user PE is concerned, EUWID mixed film 98/2 is quoted at 390 - 420 €/t. Calmer PET markets: supply and demand were largely balanced in December with respect to PET bottles. There is a sufficient supply of bottles available to processors: since September, the price of PET has held its own in the EUWID Price Watch: PET transparent 340 - 400 €/t and PET coloured, 160 - 210 €/t.

2.2 plasticker price index

The quotes published by the plasticker internet platform on an hourly basis have been included in the tables below. However, the prices quoted merely reflect an interim situation rather than the final January listings. On 9 January 2013, the plasticker internet platform indicated an average price decline of 26 €/t relative to December 2012. Technical plastics prices increased by 86 €/t on average in January 2013.

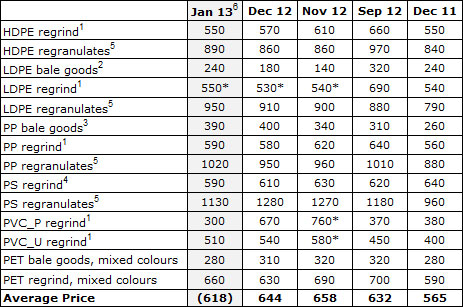

Standard plastics

The December quotes, with 644 €/t on average, fell short of those for November by 658 €/t. There was a considerable demand for standard plastics in December - despite the holidays. The December Price Watch showed slight price reductions of 10 €/t to 90 €/t as well as some select price rises, ranging from 10 €/t to 70 €/t. According to plasticker, the following price quotes changed by more than +/- 40 €/t compared to the previous month: PP bale goods + 70 €/t and PET regrind mixed colours, - 60 €/t.

The first forecast of the January quotes, whose final listings cannot be published until February, shows that the average price is likely to attain 618 €/t, which is an indicator of price decline. There has been a considerable demand for standard plastics in early January.

Table 3: Prices of standard plastics according to plasticker, quoted in €/t

*: Supply figures too low to attain statistical significance; 1: equivalent to the grade "post-industrial, mixed colours"; 2: equivalent to K49; 3: equivalent to K59; 4: equivalent to "standard, mixed colours"; 5: equivalent to the grade "regranulates, black", 6: forecast (likely to be amended by additional quotes)

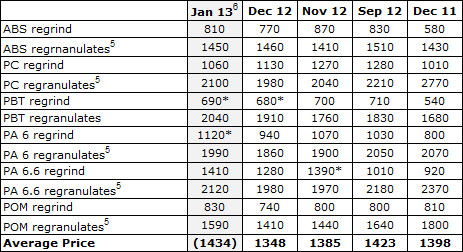

Technical plastics

In December, technical plastics prices declined by 37 €/t on average. There was a lot of fluctuation in the December Price Watch, with price rises ranging from 10 €/t to 150 €/t and price reductions ranging from 20 €/t to 140 €/t. Regranulates tend to hold their own, while regrind showed a tendency towards decline. The purchasing demand was on the decline in December. According to plasticker, the following quotes changed by more than +/- 70 €/t for: ABS regrind - 100 €/t, PC regrind - 140 €/t, PBT regranulates + 150 €/t, PA 6 regrind - 130 €/t and PA 6.6 regrind - 110 €/t.

The first forecast of the January quotes, whose final listings cannot be published until the beginning of February, indicates a price rise of 86 €/t on average. Technical plastics have been in great demand in early January.

Table 4: Prices of technical plastics according to plasticker, quoted in €/t

5: equivalent to the grade "regranulates, black". 6 forecast (may be amended by additional quotes)

No guarantee for any of the prices. All EUWID prices are quoted ex works. As a rule, the prices quoted refer to quantities in excess of 20 tons. The monthly quotes for secondary plastics, which are updated on an hourly basis, can be calculated using the price lists that are derived from the quotations published in the raw material exchange plasticker. The prices listed in this index are quoted with reservation - as the majority of the quotes submitted are not necessarily equivalent to the sales prices. Furthermore, plasticker does not distinguish between the following grades: transparent, mixed colours or colour-separated. Therefore, the information provided by plasticker may indicate different market behaviour than the prices quoted by EUWID.