Market Report Plastics - March 2013

Information about the market for plastics is being presented by:

bvse - Bundesverband Sekundärrohstoffe und Entsorgung e.V.

1. The market for primary plastics

The ifo Business Climate Index for trade and industry in Germany fell marginally in March – subsequent to having increased considerably in the previous month. The business previews were slightly less favourable compared to the month before. However, companies assessed their present business situation as being almost as favourable as previously. The German economy asserts itself in difficult surroundings by achieving a considerable domestic output. Export previews have deteriorated, but they continue to be positive.

The price rises in standard plastics attained in January could barely hold their own in February. Plastics purchasers still speculate that a decline in prices may occur in March and April. The demand for plastics is also restrained as a result of the continuing winter weather. In March the quotes for standard plastics nearly held their own. The EUWID Price Watch for February shows marginal price cuts of 5 €/t to 30 €/t on average in standard plastics. Only the quote for PVC rose by 10 €/t. LDPE film grade, HDPE and PP held their own. The average price of the ten types of plastics listed in EUWID is 1,470 €/t. Thus, the plastics price has decreased by 4 €/t compared to the previous month. In February, standard plastics in EUWID were quoted at: LDPE film grade 1440 - 1500 €/t, LLDPE film grade 1430 - 1480 €/t, HDPE injection moulding 1460 - 1530 €/t, HDPE blow moulding 1470 - 1540 €/t, PS crystal clear 1630 - 1670 €/t, PS high impact 1730 - 1780 €/t, PP homopolymer 1380 - 1470 €/t, PP copolymer 1430 - 1520 €/t, PVC tube grade 1170 - 1200 €/t and PVC film/cables 1270 - 1300 €/t. The PET markets continue to be under pressure because price setting is determined by excess supply.

Technical plastics: The demand for technical plastics is seasonally low. The EUWID Price Watch for February shows that the prices of some technical plastics, i.e. ABS and POM, rose slightly by 50 €/t in the lower price segment. PC and PC held their own. The quote for PMMA fell by 100 €/t in the lower price segment. In February, the technical plastics listed by EUWID were quoted at: PMMA 2400 - 2600 €/t, ABS natural 1800 - 2000 €/t, ABS white/black 1900 - 2100 €/t, ABS mixed colours 2500 - 2850 €/t, PC crystal clear 2500 - 2600 €/t, PC GF reinforced 2800 - 2900 €/t, POM natural 1900 - 2100 €/t, PA 6 natural 2350 - 2550 €/t, PA 6 black 2350 - 2550 €/t, PA 6 GF reinforced 2700 - 2800 €/t, PA 66 natural 2900 - 3000 €/t and PA 66 GF reinforced 3000 -3100 €/t . New impulses that are likely to boost the demand for technical plastics are expected to occur by the middle of this year.

2. The market for secondary plastics

In February, the quotes for secondary plastics developed independently of those for primary goods. According to the EUWID Price Watch for February, the prices of bale goods and regrind increased marginally; according to plasticker the prices of bale goods, regrind and regranulates remained almost unchanged compared to the previous month. Reports by EUWID say that the demand in standard plastics markets was restrained in February, while the demand was considered satisfactory by plasticker. Recyclers are trying to raise the prices of regrind and regranulates. The supply of mixed plastics in the European markets has increased because it is has become considerably more difficult to export these materials. However, the mixed plastics on offer are often of poor quality. Sources and collectors of used plastics can often considerably improve the quality grades of plastics by implementing simple measures.

There are still very tight border checks on exports destined for the People’s Republic of China. According to some traders, exports to the People’s Republic of China are no longer profitable. Tight border controls in collaboration with the Chinese customs authorities begin as early as in the European export harbours. On top of that, the goods are cleared once again on being imported to the People’s Republic of China. In nearly each case, poor quality is detected and rigorously rejected. The export requirements for importing plastics via Hong Kong have also been reinforced. Plastics are no longer transported to the People’s Republic of China through neighbouring third countries.

2.1 EUWID Price Watch

In February, the EUWID magazine often indicated a one-sided rise in prices in the higher price segment. Accordingly, good quality grades are in great demand and can attain correspondingly high prices. The price rises ranged from 5 €/t to 20 €/t. PVC and PS remained relatively stable.

The quotes for the four post-industrial PE quality grades rose by 10 €/t to 20 €/t. The following prices were quoted for post-industrial PE: HDPE mixed colours 470 - 650 €/t, HDPE natural 630 - 750 €/t, LDPE mixed colours 480 - 600 €/t, LDPE natural 630 - 720 €/t, LDPE film grade mixed colours (K 49) 250 - 330 €/t and LDPE natural (K 40) 450 - 520 €/t. The changes in post-user PE range from 5 €/t to 15 €/t. The following prices were quoted for post-user PE: LDPE shrink film natural (E 40) 440 - 520 €/t, LDPE shrink film mixed colours (E 49) 230 - 320 €/t, film transparent natural <70 m 395 - 430 €/t, film transparent mixed colours <70 m 80-160 €/t, LDPE farm film black/white >70 m 30 - 60 €/t, mixed film (90/10) 250-300 €/t, mixed film (80/20) 240 - 280 €/t, HDPE hollow bodies mixed colours (C29) 130-280 €/t, HDPE regrind from crates, colour-separated 650 - 800 €/t and HDPE regrind from crates mixed colours 500 - 600 €/t. Nota bene: the quotes for colour-separated HDPE regrind from crates increased by 60 €/t on average. The quotes for mixed film were close to those for 90/10 goods.

PP post industrial: There was a relatively high demand for PP. The quotes for regrind rose by 5 €/t to 10 €/t on average, film prices held their own. The following prices were quoted: Film mixed colours (K 59) 130 - 300 €/t, film natural (K 50) 310 - 430 €/t, homopolymer mixed colours 430 - 610 €/t, homopolymer natural 620-750 €/t, copolymer mixed colours 430 - 610 €/t and copolymer natural 620 - 750 €/t.

As a result of the winter break, the PS and PVC markets have not really resurged so far. In April the boost in the building economy might lead to price rises. The prices of post-industrial PS nearly held their own in February; only the quotes for standard mixed colours, 500 – 650 €/t, for their part, increased by 10 €/t in the higher price segment. As regards PVC, the prices quoted for window frame regrind held their own. The quotes for the post-industrial quality grade PVC_U mixed colours, for their part, rose by 10 €/t in the higher price segment, reaching 480 – 590 €/t.

PET: Subsequent to having been described as „restrained“ in the previous months, the PET markets resurged in March. German processors can still buy bottles at favourable prices on international markets. The outflow of PET bottles to the Far East is lower than in the previous months. However, warehouse stocks are depleting in the various stages of the production process, which is further boosting the PET markets. The price rises occurring in the primary markets are having an impact on the prices of recyclates. According to some recyclers, there is a sufficient to good demand for PET recyclates. In February, the prices of deposable PET bottles rose: the quote for PET transparent then rose by 10 €/t on average, while the price of PET mixed colours increased by 15 €/t. The following new prices were quoted: PET transparent 370 - 420 €/t and PET mixed colours 200 - 230 €/t.

2.2 plasticker price index

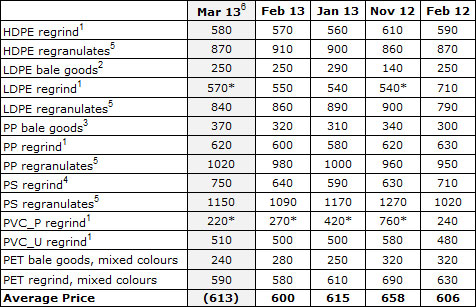

The plasticker internet platform publishes quotes on an hourly basis. However, the prices quoted merely reflect an interim situation rather than the final March listings. According to the data published by plasticker on 12 March 2013, the quotes for standard plastics and technical plastics nearly held their own compared to February 2013.

Standard plastics

The February quotes, which attained 600 €/t, were ultimately similar to those for January, which reached 615 €/t. This becomes particularly evident by subtracting the special effect of PVC_P: the quotes attained in February are then 625 €/t, while those reached in January equal 630 €/t. The prices of PVC_ P were given with reservation as the number of quotes submitted was too low. The price rises attained in February ranged from 10 to 50 €/t, while the price decreases reached 20 to 40 €/t. There was a considerable demand for standard plastics in February. According to the February Price Index, only PS regrind, the price of which increased by 50 €/t, showed a marked change compared to the previous month.

The first forecast of the March quotes, whose final listings cannot, however, be published until April, indicates that the average price will probably attain 613 €/t. Hence, the prices will remain almost unchanged. As yet, the March developments have shown that there is a considerable demand for standard plastics.

Table 1: Prices of standard plastics in plasticker, quoted in €/t

*: Supply figures too low to attain statistical significance; 1: equivalent to the grade “post-industrial, mixed colours”; 2: equivalent to K49; 3: equivalent to K59; 4: equivalent to “standard, mixed colours”; 5: equivalent to the grade “regranulates, black”, 6: forecast (likely to be amended by additional quotes)

Technical plastics

In February 2013, the prices of technical plastics fell short of those quoted in January 2013 by 38 €/t on average. In February there was a considerable demand for technical plastics. Within the range of 70 €/t defined below, the prices quoted in February remained stable, with price rises ranging from 30 €/t to 230 €/t and price decreases ranging from 20 €/t to 40 €/t. According to plasticker, the following price rises changed by more than +/- 70 €/t: PBT regranulates – 230 €/t and PA 6.6 regrind + 120 €/t.

The first forecast of the March quotes, whose final listings cannot, however, be published until early April, indicates price stability. To date, the developments in March have shown a heavy demand for recyclates from technical plastics.

Table 2: Prices of technical plastics in plasticker, quoted in €/t

5: equivalent to the grade „regranulates, black“. 6 forecast (may be amended by additional quotes)

No guarantee for any of the prices. All EUWID prices are quoted ex works. As a rule, the prices quoted refer to quantities in excess of 20 tons. The monthly quotes for secondary plastics, which are updated on an hourly basis, can be calculated using the price lists that are derived from the quotations published in the raw material exchange plasticker. The prices listed in this index are quoted with reservation - as the majority of the quotes submitted are not necessarily equivalent to the sales prices. Furthermore, plasticker does not distinguish between the following grades: transparent, mixed colours or colour-separated. Therefore, the information provided by plasticker may indicate different market behaviour than the prices quoted by EUWID.