Market Report Plastics - April 2013

Information about the market for plastics is being presented by:

bvse - Bundesverband Sekundärrohstoffe und Entsorgung e.V.

1. The market for primary plastics

Plastics producers and plastics processors are concerned about the long-term winter, which is said to have slowed down the economy. They are also lamenting the lack of market impulses. In March, moderate price rises in standard plastics were caused by even higher precursor costs. Plastics processors are concerned about the low demand for plastics from the packaging, automotive and building industries. Plastics purchasers are hoping for prices to decrease in April. Mineral oil prices have considerably decreased in April, which is also likely to lower the price of the subsequent plastics chain. Precursor prices in particular have markedly decreased in April. However, the building industry is likely to resurge in April and May, which will have a stabilising effect on plastics prices.

The EUWID March Price Watch shows slight price reductions in PE, namely by 5 /t to 15 /t on average. The price rises in PP, PS and PVC range from 10 /t on average to 40 /t on average. The increase in the quotes for PS and PVC indicate that a spring upswing is expected to occur in the building industry. The average March price for the 10 types of plastics listed by EUWID is thus 1486 /t. Hence, the plastics price has risen by 16 /t compared to the previous month. In March the following prices were quoted for standard plastics by EUWID: LDPE film grade 1440 - 1490 /t, HDPE injection moulding 1450 - 1530 /t, HDPE blow moulding 1450 - 1530 /t, PS crystal clear 1650 - 1700 /t, PS high impact 1760 - 1820 /t, PP homopolymer 1430 - 1500 /t, PP copolymer 1480 -1550 /t, PVC tube grade 1190 - 1220 /t and PVC film/cables 1290 - 1320 /t. Furthermore, the PET markets are under pressure because price-setting was determined by low demand and excess supply.

2. The market for secondary plastics

According to the EUWID Price Watch for March, the prices of bale goods and regrind nearly held their own. Plasticker shows that the prices quoted for bale goods, regrind and regranulates slightly increased compared to the previous month. In April there have been reports by EUWID and plasticker on a restrained demand for plastics. The amount of used plastics available to processors has been increasing. The proportion of mixed plastics in particular has remained stable because exports to China have become considerably more difficult. However, the quality grades of the mixed plastics currently on offer are often very low. Plastics recyclers are doing their utmost to rapidly expand their processing capacity.

In China itself, there is a considerable demand for plastics from international markets. However, Chinas Green Fence policy is having an impact, i.e. imports of used plastics are being strictly supervised. Poor quality grades are detected and rigorously rejected in nearly each case. The decline in plastics exports to the Far East, which has been felt for a long time, is now manifesting itself in statistical records, too, cf. s. www.destatis.de. True, in total, the proportion of plastics exports in Germany, which attained 1,485,300 tons (2011: 1,483,400 tons), remained stable in 2012; there was a particularly marked decline in plastics exports in the fourth quarter of 2012. However, the quantities of plastics imports to Germany, which attained 388,400 tons compared to 319,700 tons in 2011, rose markedly in 2012. Plastics exports to the Peoples Republic of China will continue to be on the decline in 2013; a trend reversal is currently not in sight.

2.1 EUWID Price Watch

In March the EUWID magazine showed price cuts in post-user PE. The price decreases affected the packaging plastics, which declined by 10 /t to 20 /t on average. The quotes for all other standard plastics held their own.

The prices of post-user PE changed as follows: film transparent natural <70 m 390 - 415 /t, film transparent mixed colours <70 m 40 - 160 /t, mixed film (90/10) 250 - 300 /t and mixed film (80/20) 240 - 280 /t. The price decline of 40 /t in mixed-coloured PE film is remarkable; the prices of the lower quality grades have even fallen by 50 per cent compared to the previous month.

Even though the demand for post-industrial PP is slightly higher than in the PE markets, the economic decline is felt here, too. The prices of PS and PVC have also remained stable in the case of these materials, the economic upswing that has occurred in spring is not yet perceptible.

PET: PET bottle quantities in Europe were on the decline in the first quarter of 2013, too. This trend was counteracted by excess capacity in PET recycling. However, the lack of bottle quantities then led to many European plants producing at under 75 per cent of their capacity. Changes in PET bottle production caused bottle weights to be increasingly reduced. However, this only meant that PET recyclers, despite a marked increase in processing expenditure, made a lower turnover on materials. As a result of the market situation, the margins for PET recycling are, in part, no longer profitable.

Despite the slumps in primary goods, the developments in PET bottles indicate a small-step policy. For instance, in March the prices of disposable PET bottles increased again: the price of PET transparent then rose by 18 /t on average and PET coloured by 10 /t. The following new prices were quoted: PET transparent 390 435 /t and PET coloured 210 240 /t.

2.2 plasticker price index

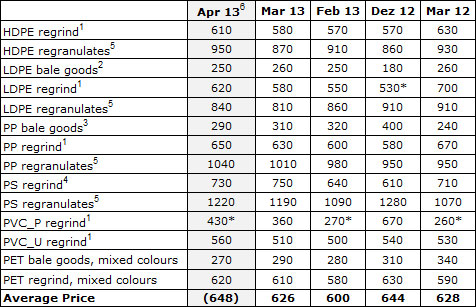

The plasticker internet platform publishes quotes on an hourly basis. However, the present market report shows the final monthly prices. The preliminary quotes previously accumulated are only represented during the reporting month in question, in this case for April 2013 these quotes merely reflect an interim situation which does not become definitive until the following month. According to the data published by plasticker on 16 April 2013, the quotes for standard plastics rose by 22 /t and those for technical plastics increased by 79 /t on average.

Standard plastics

The March quotes increased by 26 /t compared to February. The price rises ranged from 10 /t to 110 /t and the price decreases from 10 /t to 50 /t. The demand for standard plastics slightly decreased in March. By contrast, the seasonal plastics PS, PVC and PET resurged. Even though the quotes for PVC_P stabilised in March, it is not possible to compare them to the two quotes given in the two previous months, which were statistically insecure. According to plasticker the following price quotes changed by more than +/- 40 /t in March, as compared to the previous month: LDPE regranulates -50 /t, PS regind +110 /t und PS regranulates -100 /t.

The first forecast of the April quotes, whose final listings cannot, however, be published until May, indicates that the average price is likely to be 648 /t. Hence, plastics prices will increase once again, namely by 22 /t. To date, there has been a considerable demand for standard plastics in April.

Table 1: Prices of standard plastics in plasticker, quoted in /t

*: Supply figures too low to attain statistical significance; 1: equivalent to the grade "post-industrial, mixed colours"; 2: equivalent to K49; 3: equivalent to K59; 4: equivalent to "standard, mixed colours"; 5: equivalent to the grade "regranulates, black", 6: forecast (likely to be amended by additional quotes)

Technical plastics

The March quotes, which attained 1358 /t on average, are similar to those for February, which reached 1349 /t. In February, there was a sufficient demand for technical plastics. Price rises ranged from 20 /t to 1230 /t, while price decreases ranged from 20 /t to 60 /t. Since the record highs attained in January 2013, PBT prices have been steadily falling. According to plasticker the following quotes changed by more than +/- 70 /t in March: PC regrind + 80 /t and PC regranulates + 120 /t. In total, regranulates have been showing a tendency towards declining prices.

The first forecast of the April quotes, whose final listings cannot, however, be published until the beginning of May, predicts a price rise, namely of 79 /t on average. To date, there has been a sufficient demand for recyclates from technical plastics in April.

Table 2: Prices of technical plastics in plasticker, quoted in /t

5: equivalent to the grade "regranulates, black". 6 forecast (likely to be amended by additional quotes)

No guarantee for any of the prices. All EUWID prices are quoted ex works. As a rule, the prices quoted refer to quantities in excess of 20 tons. The monthly quotes for secondary plastics, which are updated on an hourly basis, can be calculated using the price lists that are derived from the quotations published in the raw material exchange plasticker. The prices listed in this index are quoted with reservation - as the majority of the quotes submitted are not necessarily equivalent to the sales prices. Furthermore, plasticker does not distinguish between the following grades: transparent, mixed colours or colour-separated. Therefore, the information provided by plasticker may indicate different market behaviour than the prices quoted by EUWID.