Market Report Plastics - April 2009

Information about the market for plastics is being presented by:

bvse - Bundesverband Sekundärrohstoffe und Entsorgung e.V.

1. The market for primary plastics

With the daily update on 24th April came the following announcement by the Bavarian broadcasting station Bayerischer Rundfunk: surprisingly, the gloomy atmosphere in German companies has brightened up distinctly, according to the Business Climate Index of the German Institute for Economic Research (ifo). The index rose by one and a half points to reach 83.7 points. Company managers hold the view that both the current situation and the prospects for the next six months have improved considerably compared to the previous month - despite the fact that the Federal Republic of Germany is stuck in the deepest recession in its history.

The interim high for standard plastics in the primary market continues, despite insecure end-consumer markets and economic slumps. Price increases were pushed through twice, namely in February and March. Only the price quotes for PVC have remained unchanged. PE plastics show price increases by 50 - 80 /to. PP and PS have increased by 10 - 20 /to respectively. On the one hand, the package of measures to reduce the supply of goods has had an impact, and on the other hand, the price rises are explained by the increase in raw material costs.

According to the EUWID Price Watch the average March quote for the ten types of plastics listed below is 844 /to; thus it has increased by 30 /to compared to the previous month. The price index for standard plastics shows the following price quotes: LDPE film grade 850-910 /to, LLDPE film grade 840-900 /to, HDPE injection moulding 840-880 /to, HDPE blow moulding 840-880 /o, PS general purpose 790-850 /to, PS high impact 850-910 /to, PP homopolymer 770-850 /to, PP copolymer 820-900 /to, PVC tube grade 760-800 /to, PVC film/cables 800-840 /to. PET: In March PET from packaging was quoted at 1060 - 1120 /to, thus exceeding the previous month by 70 /to on average. This was the second price rise in a row. By contrast, the global demand for PET has slightly increased. The continuing good weather gives rise to an increase in the demand for plastics used in packagings and beverages.

On the London Metal Exchange (LME) price quotes have further stabilized. The quotes submitted here are average values based on LME purchase and sales prices. In week 17 the purchase prices of PP for May, June and July were at 850 US-$ respectively, whereas the May and June purchase prices of LLDPE were at 960 US-$ respectively. Thus May quotes for PP decreased by 10 US-$/to compared to the previous month, whereas those for LLDPE rose distinctly, namely by 85 US-$ /to. A stabilization or even a slight increase in the prices of standard plastics can be predicted on the basis of the LME quotes and the above-mentioned price rises.

2. The market for secondary raw materials

The markets for secondary raw materials have stabilized on the existing level and have not slumped any further. The secondary markets for plastics continued to be characterized by a difficult overall situation in March and April, i.e. by a low demand and - at the same time - a high supply as well as by competition with the market for primary materials. The opportunities for exports to the Far East have gradually improved, there being, above all, a demand for film. On the whole, exports to the Far East are thus distinctly more satisfactory than in the previous months. Due to the crisis some experts are already pointing to the future decrease in the amount of collected materials and to the low input for plastics processing and recycling; none the less, both the collectors' and the processors' stocks are still abundant. Despite the economic crisis, consumption in the private sector is satisfactory, so that the amount of collected materials can be regarded as sufficient.

2.1 EUWID Price Watch

The EUWID Price Watch for March has obviously only slightly changed compared to the previous month. No more than five price quotes for plastics have changed, viz. solely those for PE plastics. According to experts even high-quality regranulates and regrind only sell with difficulty. The exchange of secondary raw materials is stagnating throughout Europe, which holds true both for collected and for processed goods.

The market for PE post-industrial wastes at least attains a certain trading volume compared to other types of plastics. In March prices were stable in this market. The quotes for LDPE film mixed colours only changed by 10 /to. Hence, the March quotes are as follows: HDPE mixed colours 300-450 /to, HDPE natural 400-530 /to, LDPE mixed colours 250-400 /to, LDPE natural 350-450 /to, LDPE film mixed colours (K49) 160-240 /to and LDPE film natural (K40) 300-450 /to. PE post user prices are also stable. Solely the quotes for shrink film natural, film transparent mixed colours, farm film and mixed film have changed: LDPE shrink film natural (E40) 240-300 /to, LDPE shrink film mixed colours (E49) 170-200 /to, LDPE stretch film natural (E70) --- /to, film transparent natural <70 mm 220-270 /to, film transparent coloured <70 mm 10-80 /to, LDPE farm film natural <70 mm (B40) --- /to. LDPE farm film black or white >70 mm (B41) 0-30 /to, mixed film (98/2) 260 - 270 /to, mixed film (90/10) 130-170 /to, mixed film (80/20) 90-130 /to, HDPE hollow bodies mixed colours (C29) 0-80 /to, HDPE regrind from crates colour-separated 400-450 /t und HDPE-regrind from crates mixed colours 300-440 /to. According to experts the PE market is still characterized by a low turnover.

PP: The PP markets are stagnating; they continue to show a low demand and low sales. No price changes compared to the previous month.

PS: No price changes compared to the previous month, either. The stocks of PS goods are abundant; at least there is a slightly higher demand for them than for PP. The quotes for PVC have also remained unchanged. PVC goods mixed colours can only be sold with difficulty. The demand for PVC in the private building sector is still relatively stable. There is, above all, a demand for windowframes, which are used for building purposes.

PET post user: EUWID has suspended its PET quotes for three months, i.e. till the end of April, as the market is undergoing a complete change. The demand for PET is slightly increasing, which is to due the time of year. For example, transparent bottles are quoted at 140 - 200 /to, whereas mixed-coloured goods are quoted at 40 - 90 /to. Mixed-coloured goods only sell with great difficulty. Hopes for the PET market are based on the increase in primary material prices. Meanwhile imports of PET primary materials to Europe have been increased in order to meet the demand. The price increase in the primary market also gives rise to hopes for PET recyclates.

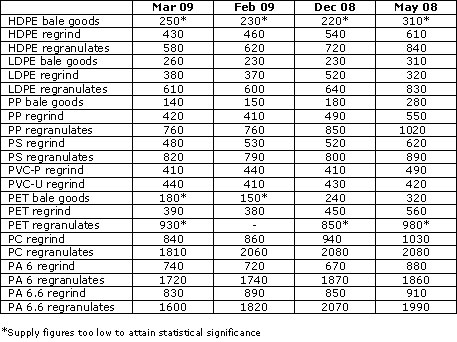

2.2. plasticker price index

The price quotes for secondary plastics can be calculated on the basis of plasticker (cf. www. plasticker.de). The prices listed in this index are quoted with reservation - as the majority of the quotes submitted are not necessarily equivalent to the sales prices.Therefore, the information provided by plasticker indicates distinctly different market behaviour than the prices quoted by EUWID.

From February 2009 to March 2009 standard plastics prices were reduced by 25/to on average. At first sight, the April quotes for standard plastics show consolidated prices or occasional price decreases by 10 /to. The following changes in standard plastics prices greater than/less than 40/to can be reported for March compared to February: PS regrind -50/to. The following changes greater than/less than 70 /to can be reported for technical plastics: PC regrind - 250 /to as well as PA 6.6 regranulates - 220 /to.

The EUWID price quotes refer to bale goods or regrind. The given prices were quoted for business transactions between sorting plants and sales agents or the processing industry, as the case may be. As a rule, prices refer to quantities in excess of 20 to ex works. The prices attainable in trade can differ considerably from the indicated price range in both directions, depending on the grade of the type of plastic material quoted. The abbreviations used for some grades refer to the list of waste plastics published by the German Federal Association for Secondary Raw Materials and Waste Disposal (bvse)/Bureau of International Recycling (BIR).