Market Report Plastics - May 2009

Information about the market for plastics is being presented by:

bvse - Bundesverband Sekundärrohstoffe und Entsorgung e.V.

1. The market for primary plastics

The primary market for standard plastics can only be termed confusing, inconsistent, unedifying and unsatisactory in April. There were no discernible trends, and demand was low. Even though prices were rising, market participants were hesitant and adopted an attitude of wait and see. Whilst there was a low domestic demand, the export demand for certain types of plastics experienced a resurgence. Due to the lack of demand, the supply was further reduced by means of additional production plant closures.PE plastics show low price rises by 10 /to to 30 /to. PS shows a distinct increase by 50 /to to 60 /to. According to the EUWID Price Watch the average April quote for the ten types of plastics listed below is 844 /to; thus it has increased by 14 /to compared to the previous month. Hence, it still fluctuates within the normal range, meaning it cannot be assessed as an indicator of price rises. The price index for standard plastics shows the following price quotes: LDPE film grade 860-910 /to, LLDPE film grade 860-930 /to, HDPE injection moulding 820-910 /to, HDPE blow moulding 840-880 /o, PS general purpose 850-900 /to, PS high impact 900-960 /to, PP homopolymer 770-850 /to, PP copolymer 820-900 /to, PVC tube grade 760-800 /to, PVC film/cables 800-840 /to. PET: In April PET for packaging was quoted at 1070 1120 /to, thus exceeding the previous month by 5 /to on average. The demand for PET was on the decline over Easter. The global supply of PET continues to be very high. Despite this situation, PET prices are expected to rise further, as the price of the raw material paraxylene (PX) has distinctly increased by 90 /to in May. The demand is expected to be boosted further by the increase in the consumption of beverages during the summer months. Private consumption in this segment is satisfactory.

The EUWID Price Watch for April shows distinct price decreases in technical plastics. Solely the quotes for PMMA and PA 6 remain unchanged. The price decreases for all types of plastics range between 100 and 200 /to. In the first quarter the demand slumped considerably. So far developments in the second quarter have not proved to be more satisfactory. Nevertheless, a slight tendency toward an increase in demand can be discerned for May. The demand for technical plastics from the automobile industry increases due to improvements in production. The quotes for two months are: PMMA crystal clear 2440 2600 /to, ABS natural 1150 1400, ABS w/b 1230 1500, ABS mixed colours 1850 2150, PC crystal clear 2300 2400 /to, PC GF 2500 2600 /to, POM natural 2000 2050 /to, PA 6 natural 1900 2200 /to, PA 6 black 1900 2200 /to, PA 6 GF reinforced 2150 2400 /to, PA 66 natural 2100 2400 /to and PA 66 GF 2350 2650 /to.

On the London Metal Exchange (LME) price quotes remain more or less unchanged. The quotes submitted here are average values based on LME purchase and sales prices. In week 21 the purchase prices of PP for June, July and August were at 840 US-$, 850 US-$ and 860 US-$ respectively, whereas those of LLDPE were at 980 US-$ respectively. Further predictions on future price developments on the markets can and should currently not be made.

2. The market for secondary plastics

The April quotes for secondary plastics remain nearly unchanged compared to the previous month. The overall situation continues to be difficult, as long-term planning is hardly possible for plastics processors and plastics recyclers. Production plant capacities are either reduced over and over again or manufacturing facilities are temporarily closed down. While domestic and foreign demand fluctuate, there is a considerable supply of high-quality secondary raw materials. Recyclers are faced with competition from the primary market. Even though the situation in the export trade with the Far East has slightly improved, it is by no means stable, as there is a fluctuating and periodically strong short-term demand for various types of plastics from the Far East.

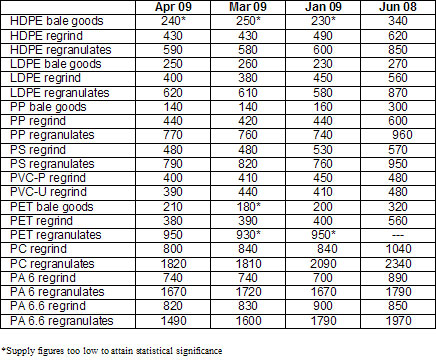

2.1 EUWID Price Watch

Only the quotes for post-industrial PE have changed in the EUWID Price Watch. The situation of the collecting-sorting-processing-recycling-trade/commerce chain has stabilized and, on the whole, slightly improved compared to the previous months. High-quality recyclates are on offer on the markets. Recyclates are selling slowly. There is, above all, a demand for PE and PET from the Far East. The input for plastics processing from trade and industry is on the decline.

The high demand for post-user PE from the Far East has a direct impact on price quotes. Price increases range between 10 /to and 50 /to: LDPE shrink film natural (E40) 260-350 /to, LDPE shrink film mixed colours (E49) 170-200 /to, LDPE stretch film natural (E70) --- /to, film transparent natural <70 mm 250-310 /to, film transparent coloured <70 mm 20-100 /to, LDPE farm film natural <70 mm (B40) --- /to. LDPE farm film black or white >70 mm (B41) 0-30 /to, mixed film (98/2) 290 310 /to, mixed film (90/10) 120-190 /to, mixed film (80/20) 100-150 /to, HDPE hollow bodies mixed colours (C29) 10-90 /to, HDPE regrind from crates colour-separated 400-450 /t and HDPE regrind from crates mixed colours 300-440 /to. The prices of film have recovered distinctly. In exports prices are set in accordance with daily trading. The prices of export goods are in the upper realm of the above-mentioned range of prices, or even exceed them by 10 to 30 /to.

The quotes for PP, PS and PVC have remained unchanged compared to the previous month: the PP markets are stagnating; they continue to be characterized by a weak demand and low sales. PS post-industrial wastes are quoted at slightly firmer prices. The demand for PS has stabilized. The market for PS recyclates has improved. There is a weak demand for PVC. The economic boost in the building trade within the framework of the German Economic Package II gives rise to hopes for PVC.

PET post-user: The EUWID quotes for PET continued to be suspended in April, as the market is undergoing a complete change. The situation in the PET segment continues to be difficult, although it has improved. The supply situation is satisfactory, and the domestic demand for PET is increasing. There is also a demand for PET in the export trade with the Far East. Above all, transparent PET is selling well. Transparent bottles are quoted at 170 210 /to, whereas mixed-coloured goods are quoted at 50 100 /to. Hence, PET quotes for transparent PET were increased by 30 /to, wherease those for mixed-coloured PET rose by 10 /to.

2.2 plasticker price index

The price quotes for secondary plastics can be calculated on the basis of plasticker (cf. www. plasticker.de). The prices listed in this index are quoted with reservation - as the majority of the quotes submitted are not necessarily equivalent to the sales prices. Therefore, the information provided by plasticker indicates distinctly different market behaviour than the prices quoted by EUWID. Nevertheless, the plasticker quotes are in line with the information provided by EUWID.

Standard plastics prices for April remained unchanged compared to the previous month. The first forecast of the current May quotes hardly shows any changes. Granulate prices have stabilized. The price level of the previous months has been maintained. The number of offers also continues to remain largely stable. The prices quoted for technical plastics in April also remained nearly unchanged compared to the previous month. Solely the price of PA 6.6 decreased again in April, namely by 110 /to.

The EUWID price quotes refer to bale goods or regrind. The given prices were quoted for business transactions between sorting plants and sales agents or the processing industry, as the case may be. As a rule, prices refer to quantities in excess of 20 to ex works. The prices attainable in trade can differ considerably from the indicated price range in both directions, depending on the grade of the type of plastic material quoted. The abbreviations used for some grades refer to the list of waste plastics published by the German Federal Association for Secondary Raw Materials and Waste Disposal (bvse)/Bureau of International Recycling (BIR).