Market Report Plastics - September 2009

Information about the market for plastics is being presented by:

bvse - Bundesverband Sekundärrohstoffe und Entsorgung e.V.

1. The market for primary plastics

This is the third price increase in a row to comprise all standard plastics. The price increases range from 20 to 80 /to in this case. In the EUWID Price Watch the average quote for the ten types of plastics listed below is meanwhile at 1036 /to; thus it has increased by 59 /to compared to the previous month. The price index for the ten types of standard plastics shows the following quotes: LDPE film grade 970-1040 /to, LLDPE film grade 970-1040 /to, HDPE injection moulding 960-1010 /to, HDPE blow moulding 960-1020 /to, PS general purpose 1070-1130 /to, PS high impact 1120-1180 /to, PP homopolymer 960-1030 /to, PP copolymer 1010-1080 /to, PVC tube grade 990-1050 /to und PVC film/cables 1030-1090 /to. The prices of PE (LDPE, HDPE, LLDPE) have also slightly increased by 20 - 50 /to, whereas the prices of PS, PP and PVC have risen more markedly, namely by 60 - 80 /to. The recent price increases are explained by empty warehouses and a limited supply. The reduction in supply is likely to continue to affect the markets in the next two months. However, there is already every indication of an upcoming economic recovery and thus of a distinct increase in the demand for plastics. Hence, it will be interesting to observe the way the increased demand is met. Therefore, the September quotes are likely to indicate further price rises. The prices currently quoted have attained the following percentages of last year's quotes: LDPE 64%, LLDPE 65%, HDPE 65%, PS 77%, PP 73% and PVC 95%.Technical plastics: The EUWID Price Watch for August indicates that the prices have ultimately stabilised at a low level. All price fluctuations ranged between 50 and 100 /to. PMMA und POM decreased by 50 /to on average, whereas the prices of ABS und PA increased slightly, namely by 50-100 /to. Thus the further decline in technical plastics prices could be stopped. The quotes for two months are: PMMA crystal clear 2150-2350 /to, ABS natural 1250-1350 /to, ABS white or black 1330-1450 /to, ABS mixed colours 1950-2100 /to, PC crystal clear 2150-2350 /to, PC GF 2350-2550 /to, POM natural 1800-2000 /to, PA 6 natural 1750-2100 /to, PA 6 black 1750-2100 /to, PA 6 GF reinforced 2000-2300 /to, PA 66 natural 2200-2400 /to und PA 66 GF 2450-2400 /to. The reductions in supply have also had an impact on technical plastics. The improved economic situation and the increase in primasry product prices are likely to lead to a price rise in October.

PET: In August PET for packaging from Western Europe was quoted at 1050 - 1200 /to; thus its price had increased by 60 /to compared to the previous month. Hence, PET could offset the decline in the quotes for the previous month. Nevertheless, the considerable global supply of PET has hardly affected the tense situation of PET. The price rise is explained by the increase in primary product prices.

The prices quoted on the London Metal Exchange (LME) have also increased. In week 37 the purchase prices of PP quoted for September, October and November were at 1125 US-$ respectively, wherease those of LLDPE attained 1220 US-$ respectively. Thus the September quotes for PP increased by 50 US-$ /to, whereas those for LLDPE rose by 30 /to. On the whole, the LME quotes indicate price stabilisation.

2. The market for secondary plastics

The situation of plastics recycling remains difficult. The steadily rising prices on the primary markets have not affected the secondary markets yet. The summer break has turned into the summer dolrums, i.e. the markets have proved to be calm - too calm. The markets have attained no more than a low turnover at all levels - i.e. both bale goods and recyclates. As a consequence, the quotes have remained nearly unchanged. Furthermore, businesses are reported to have closed down or to have filed insolvency petitions. Meanwhile the export trade with the Far East is also stagnating again, even though China is trying to keep its markets open to secondary plastics. However, the plastics markets now of all times provide the opportunity to purchase high-quality recyclates at favourable prices. A trend reversal towards an increase in turnover and higher profit margins is in sight as of October. The price rises on the primary markets are expected to affect the prices on the secondary markets as of November at the latest.

2.1 EUWID Price Watch

PE: The quotes for PE post-industrial waste remained unchanged in August. Solely the price index for PE post-user shows some variation. The reduction in the supply of PE film led to slight price rises of 10 - 20 /to compared to the previous month, viz. for film transparent natural <70 mm 300-335 /t, film transparent coloured <70 mm 20-100 /t, mixed film (98/2) 300-335 /t, mixed film (90/10) 180-210 /t und mixed film (80/20) 160-180 /t.

PP: The PP markets reflect the development of the PE markets. Here prices have also remained unchanged. Even though the turnover of PP could be slightly stabilised, it did not attain the level expected last month.

PS: The PS market has recovered slightly; however, this econonomic revival is rather modest despite the distinct resurgence of the primary market. Hence, the price quotes have remained unchanged compared to the previous month.

The quotes for PVC have also remained unchanged compared to the previous month. There is no indication of a market recovery.

PET post user: PET is no longer subject to frequent fluctuations. The expected summer boost has not materialised yet. The competitive PET market ultimately seems to be undergoing a complete change - from a supply-driven market towards a demand-driven market. EUWID is reported to have resumed price quotation in its Price Watch since July. In this restructured price index the reuse system bottle grade PET transparent is quoted at 190 - 225 /to, whereas PET mixed colours is quoted at 90 - 120 /to. EUWID expressly points out that the new quotations do not reflect the previous grades and prices any longer.

2.2 plasticker price index

This time the plasticker price index gives rise to hope. At least the supply figures still indicate some market fluctuation and demand. In August the prices of standard plastics held their own. The fluctuations ranged from - 80 to + 80 /to. In August, however, some specific price corrections were downward; these decreases ultimately indicate a consolidated market, in which supply and demand determine market behaviour. The first forecast of the September quotes suggests further price stabilization with a tendency towards price increases in all types of plastics. Hence, the price quotations for July, August and September reveal a steady upward trend.

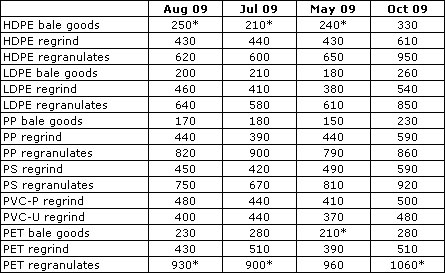

The following price changes greater than/less than 40 /to can be reported for August compared to July: LDPE regrind + 50 /to, LDPE regranulates + 60 /to, PP regrind + 50 /to, PP regranulates - 80 /to, PS-regranulates + 80 /to, PET bale goods - 50 /to, PET regrind - 80 /to.

Standard plastics

Technical plastics show considerable price increases in regranulates, which exceed last month's losses. The forecast of the September quotes reveals slight price rises, viz. by 35 /to on average. The following price increases greater than/less than 70 /to can be reported for August compared to July: PC regranulates + 450 /t, PA 6-regranulates + 140 /t and PA 6.6 regranulates + 260 /t.

Technical plastics

*Supply figures too low to attain statistical significance

The quotes for secondary plastics, which are updated on an hourly basis, can be calculated using the price lists that are derived from the quotations published in the raw material exchange plasticker. The prices listed in this index are quoted with reservation - as the majority of the quotes submitted are not necessarily equivalent to the sales prices.Therefore, the information provided by plasticker indicates distinctly different market behaviour than the prices quoted by EUWID.

The EUWID price quotes refer to bale goods or regrind. The given prices were quoted for business transactions between sorting plants and sales agents or the processing industry, as the case may be. As a rule, prices refer to quantities in excess of 20 to ex works. The prices attainable in trade can differ considerably from the indicated price range in both directions, depending on the grade of the type of plastic material quoted. The abbreviations used for some grades refer to the list of waste plastics published by the German Federal Association for Secondary Raw Materials and Waste Disposal (bvse)/Bureau of International Recycling (BIR).