Market Report Plastics - December 2009

Information about the market for plastics is being presented by:

bvse - Bundesverband Sekundärrohstoffe und Entsorgung e.V.

1. The market for primary plastics

The predictions of a quick economic recovery are being put into the proper perspective by the developments on the plastics markets, which show that the economic crisis is by no means over yet. Several interim highs in the plastics quotations make it impossible to predict the medium- or long-term economic trend. Global plastics production is still being markedly reduced by various measures.Even though there is a certain demand for standard plastics, this has attained no more than a low level. The Christmas and New Year period means that the global plastics markets will be calm right into February. Lateral shifts in the market are likely to result from stock replenishment. A trend reversal cannot be expected to occur in the next few months. The markets are likely to further consolidate, however, at a lower level.

According to the November Price Watch, the prices of all standard plastic quoted by EUWID have decreased, namely by 20 /t to 60 /t. The average price of the ten types of plastics listed below is at 1017 /t; thus is has decreased by 42 /t compared to the previous month. The following prices are quoted for the ten types of standard plastics: LDPE film grade 990 -1040 /t, LLDPE film grade 990 -1040 /t, HDPE injection moulding and HDPE blow moulding 980 -1020 /t respectively, PS general purpose 970 -1000 /t, PS high impact 1020 -1060 /t, PP homopolymer 990- 1040 /t, PP copolymer 1040 - 1090 /t, PVC tube grade 970 - 1010 /t und PVC film/cables 1030 - 1050 /t. Only the quote for PET for packaging has increased by 40 /t on average compared to the previous month; it is at 1100 - 1150 /t. The declining plastics prices are also explained by the decrease in precursor prices. Moreover, the further development of precursor prices ultimately depends on the crude oil price, too - and thus on global developments during the winter. Long cold spells lead to an increase in crude oil prices, which precursors follow with a certain time lag.

The quotes for Europe on the London Metal Exchange (LME) have remained stable. In week 51 the PP purchase prices quoted for December, January and February were at 1055 USD respectively. The LLDPE purchase prices quoted for December, January and February attained 1115 USD respectively. Hence, the December quotes for PP increased by 15 USD/t compared to the previous month, whereas those for LLDPE decreased by 15 USD/t.

2. The market for secondary plastics

The secondary plastics markets are under pressure, in particular as a result of the decline in the prices of primary plastics. Due to the predominance of export prices, it is difficult to set prices on the markets for secondary plastics. The export trade with the Far East has stabilised and is driving the markets. Domestic market prices are frequently set on the basis of the extent to which they deviate from the primary plastics prices.

Meanwhile, some processors are even complaining about the shortage of input. For instance, these processors criticize the fact that there is not a constant input of large, high-grade quantities. Above all, there is a shortage of high-grade amounts of plastics from trade and industry because the crisis has led to a decrease in production and turnover.

Furthermore, market shifts have led to relatively high quotes for post-consumer goods, in particular from Dual Systems. The plastics products intended for the construction sector and private consumption are selling well. A decrease in sales is expected to occur during the traditionally calmer Christmas and New Year period. The Chinese New Year festival might even lead to the winter break extending into February.

2.1 EUWID Price Watch

PE: The prices of PE post-industrial have changed only slightly. Bale goods have decreased by 10 - 30 /t. The quotes for LDPE regrind natural have decreased by 20 /t. The following prices were quoted in November: HDPE mixed colours 300 - 450 /t, HDPE natural 400 - 530 /t, LDPE mixed colours 250 - 400 /t, LDPE natural 330 - 430 /t, LDPE film grade mixed colours (K49) 130 - 220 /t und LDPE film grade natural (K40) 270 - 420 /t. The Price Watch for post-user PE is inconsistent; however, the quotes have ultimately proved to be stable. As a result of the demand from the Far East, film grade is quoted at a higher price. The prices have slightly increased; the price rises range between 10 and 25 /t. The price of LDPE shrink film has increased by 10 /t. Hence, the following quotes apply: LDPE-shrink film natural (E40) 300-360 /t, LDPE shrink film mixed colours (E49) 150 - 200 /t, film transparent natural < 70 ΅m 250 - 305 /t, film transparent coloured < 70 ΅m 20 - 70 /t, LDPE farm film black or white > 70 ΅m 10 - 30 /t, mixed film (98/2) 295 /t, mixed film (90/10) 170-190 /t and mixed film (80/20) 150-175 /t, HDPE-hollow bodies mixed colours (C29) 20 -100 /t, HDPE regrind from crates, colour-separated 440 - 520 /t and HDPE regrind from crates mixed colours 330-430 /t.

PP: The PP prices have not changed. The situation on the post-user markets and the markets for post-industrial waste has not improved. PP follows the PE market trends. High-grade PE and PE regrind as well as regranulates are quoted at relatively favourable prices.

PS: The relatively stable PS prices are also fluctuating. Post-industrial waste has decreased by 20 /t. Decreasing virgin material prices as well as sluggish sales have led to a decrease in the prices quoted. Apart from that the prices are stable. The following prices were quoted in November: standard mixed colours 280 - 380 /t, standard crystal clear 380 - 480 /t, standard white 380 - 480 /t, high impact mixed colours 300 - 400 /t, high impact black 320 - 460 /t, as well as high impact mixed colours 400 - 530 /t.

According to the November Price Watch, the PVC quotes have not changed. The prices quoted on the PVC markets still prove to be stable. The demand for PVC is considered to be sufficiently high.

PET post-user: It is difficult to set prices for reuse system bottles. The actual European capacities for recycling and processing can only be assessed with difficulty. The bottle quantities are also determined by the export trade, the amounts of which are, however, fluctuating markedly. The trend of beverage bottles towards PET has not ceased, and this material continues to successfully replace glass and compounds. Even outside the summer, PET consumption has also attained a good level. Alongside PET bottles, PET is increasingly gaining in importance as a high-grade packaging material. The EUWID quotes for used returnable PET bottles nearly held their own in November: PET natural 200 - 230 /t and PET mixed colours 90 - 120 /t. Only PET natural shows an increase of 10 /t in the lower price range.

2.2 plasticker price index

The plasticker price index shows that the price development of standard plastics was inconsistent in November. The deviations peaked at - 70 /t to + 70 /t. On the whole, a slight trend towards declining prices can be discerned. The quotes submitted are slightly declining. The first forecast of the December quotes reveals that the prices are likely to stablilize at the same level as last month. The following price changes greater than/less than 40 /t can be reported for November compared to October: PP regranulates + 70 /t, PVC-P - 70/t, as well as PET regranulates + 60 /t.

Secondary standard plastics

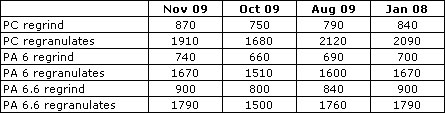

The prices of technical plastics increased markedly in November compared to the previous month. The losses incurred in the previous month were offset by this price rise. The quotes for regrind increased by 80 /t, whereas those for regranulates rose by 160 /t to 290 /t. According to the forecast of the December quotes, the prices are likely to rise further; however, this increase is lower.

Secondary technical plastics

*Supply figures too low to attain statistical significance

The quotes for secondary plastics, which are updated on an hourly basis, can be calculated using the price lists that are derived from the quotations published in the raw material exchange plasticker. The prices listed in this index are quoted with reservation - as the majority of the quotes submitted are not necessarily equivalent to the sales prices.Therefore, the information provided by plasticker indicates distinctly different market behaviour than the prices quoted by EUWID.

The EUWID price quotes refer to bale goods or regrind. The given prices were quoted for business transactions between sorting plants and sales agents or the processing industry, as the case may be. As a rule, prices refer to quantities in excess of 20 to ex works. The prices attainable in trade can differ considerably from the indicated price range in both directions, depending on the grade of the type of plastic material quoted. The abbreviations used for some grades refer to the list of waste plastics published by the German Federal Association for Secondary Raw Materials and Waste Disposal (bvse)/Bureau of International Recycling (BIR).