Market Report Plastics - December 2010

Information about the market for plastics is being presented by:

bvse - Bundesverband Sekundärrohstoffe und Entsorgung e.V.

1. The market for primary plastics

The strong global demand for plastics is continuing, and it is even actually growing. If plastics consumption can be regarded as an economic indicator, there will be massive economic growth with respect to consumer products, trade and industry alike.In the EUWID Price Watch for November, the average prices rose for all standard plastics. The price stagnation reported in November has come to an end in December. At present, the demand for plastics is rising somewhat faster than plastics production can be expanded. In November 2010, the average price of the ten types of plastics listed below was 1287 /t. Thus the prices increased by 10 /t to 50 /t; only the quote for PVC was 10 /t to 20 /t lower. The following prices were quoted for the ten types of standard plastics: LDPE film grade 1310 - 1360 /t, LLDPE film grade 1270 - 1300 /t, HDPE injection moulding 1160 - 1200 /t, HDPE blow moulding 1160 - 1200 /t, PS crystal clear 1340 - 1390 /t, PS high impact 1410 - 1480 /t, PP homopolymer 1310 - 1350 /t, PP copolymer 1360 - 1400 /t, PVC tube grade 1120 - 1180 /t and PVC film/cables 1190 - 1250 /t. PET for packaging was quoted at 1350 - 1450 /t in November, thus exceeding the previous month's quote by 85 /t. The cost increases from October 2010 to November 2010 can be explained by the price rises for the precursor product paraxylene as well as the demand for PET, which is continually high in Europe and throughout the world. In the textile industry in particular there is a considerable demand for polyester fibre. The strong demand from the textile industry is expected to keep the PET quotes at a high level. Furthermore, PET bottles are increasingly being used as containers for wine and high-percentage alcoholic beverages.

From November 2009 to November 2010, the prices of LDPE rose by 19%, LLDPE by 27%, HDPE by 18%, PS by 39 %, PP by 30% and PVC by 17%. The prices of plastics precursors increased again in November. The winter has proved to be cold at the end of November and the beginning of December, which has boosted the overall demand for mineral oil products. The PVC prices are decreasing as a result of the decline in the building and construction industry. The plastics prices are expected to remain stable in December 2010 and January 2011.

2. The market for secondary plastics

The price level attained for secondary plastics has held its own; there is even a tendency towards slightly rising prices. The demand for input, i.e. bale goods for plastics recycling and plastics processing, continues to be high in December, too. Plastics recyclers and plastics processors are still trying to find additional input in December. Supply shortages in hollow bodies and regrind are being offset by the domestic demand for film. There is a tremendous demand for goods from plastics processing, i.e. after they have been washed, separated and agglomerated. The demand for recyclates has remained at a high and stable level. The increased virgin material prices are also boosting the prices of high-quality recyclates. Consumer- and industry-oriented plastics products are selling well. As a result of the continually high demand at all stages of the plastics chain, attempts at stabilising purchases and sales through the targeted expansion of or reduction in warehouse capacities have failed in December, too. Some experts expect the imminent winter doldrums to reduce prices in January and February. Information on the length of the winter break varies; however, on the whole, it is likely to be relatively short.

At present, the European domestic market is having an impact on the plastics quotes; the influence from China is less important. Experts expect the export demand to further decline in January and February as a result of the Chinese New Year celebrations. This is likely to lead to price reductions in the export business, which will keep input prices down. However, in December there have been very specific export enquiries from the Far East. The requests for plastics purchases from China are changing: on the one hand, the quality requirements are being increased; on the other hand, the demand for specific products is rising.

2.1 EUWID Price Watch

In November, the EUWID Price Watch showed slight price increases, namely of 10 /t to 30 /t. It is surprising to see that these price rises often only concerned the bottom price limit; however, this also led to an increase in the average prices. The rise in the bottom price limit also shows that the grades were assessed differently. The quotes for PVC post industrial and PVC regrind held their own. PP and PS only changed slightly. As the annual comparison from November 2009 to November 2010 shows, the step-by-step policy led to marked price increases.

As far as PE post industrial is concerned, the bottom price limit for regrind was increased by 20 /t to 30 /t in the EUWID Price Watch for November. The sales of PE regrind have been stable in December; however, they are expected to decline in the next two months. The following prices were quoted in November: HDPE mixed colours 420 - 540 /t, HDPE natural 520 - 650 /t, LDPE mixed colours 400 - 480 /t, LDPE mixed colours 520 - 650 /t, LDPE film grade mixed colours (K49) 220 - 270 /t and LDPE film grade natural (K40) 420 - 530 /t.

The prices of post-user PE are reported to have changed, too. The prices of hollow bodies and regrind from crates are reported to have risen by 10 /t to 20 /t. Even the quotes for film have increased. There are attempts at balancing supply shortages in hollow bodies and regrind by increasing the demand for film. The following prices were quoted in November: LDPE shrink film natural (E40) 430 - 480 /t, : LDPE shrink film mixed colours (E49) 220 - 290 /t, film transparent < 70 ΅m 380 - 410 /t, film mixed colours < 70 ΅m 80 - 130 /t, mixed film (90/10) 240 - 280 /t, mixed film (80/20) 180 - 240 /t, HDPE hollow bodies mixed colours (C29) 120 - 270 /t, HDPE regrind from crates colour-separated 520 - 630 /t and HDPE regrind from crates mixed colours 430 - 510 /t.

PP: Post-industrial waste is still in great demand in the PP market. Even though regrind is selling well, it is stable in prices. The quotes for bale goods have risen by 20 /t. The following prices were quoted in November: PP film grade mixed colours (K 59) 100 - 200 /t, PP film grade natural (K 50) 320 - 370 /t, homopolymer mixed colours 400 - 500 /t, homopolymer natural 450 - 650 /t, copolymer mixed colours 400 - 500 /t and copolymer natural 450 - 650 /t. The quotes for PP in the post-user area attained record levels as Duales System Deutschland GmbH/DKR intervened in market developments. Furthermore, drastic changes in quantities can be obvserved. Quantities that are independent of the systems are disappearing from the market.

PS: PS shows market consolidation. The quotes for two grades, namely standard crystal clear (500 - 580 /t) und high impact white (530 - 730 /t), have increased in the lower price range. PS recyclates are still in great demand in December.

PVC: PVC has held its own. There is still a considerable demand for PVC products. However, the decline in the construction industry, which is caused by the winter, will reduce PVC prices in January and February.

PET post user: The trend towards PET continues. The supply of PET bottles is considerable in the winter, too. However, bottles are also in great demand at all levels, namely on the domestic markets and in the Far East. Furthermore, the increased primary prices are further pushing the bottle prices up. In addition, the textile industry is boosting the demand for PET. In November, the PET quotes rose by 20 /t. The EUWID prices of used and disposable PET bottes are still at record high levels; they are quoted as follows: PET transparent 410 - 460 /t and PET coloured 230 - 280 /t. From November 2009 to November 2010, the prices of transparent PET bottles rose by 109% and those of coloured PET bottles by 121%. However, pressure on the European PET recyclers and PET processors is increasing due to these prices. A trend reversal is not in sight for PET in the next two months.

2.2 plasticker price index

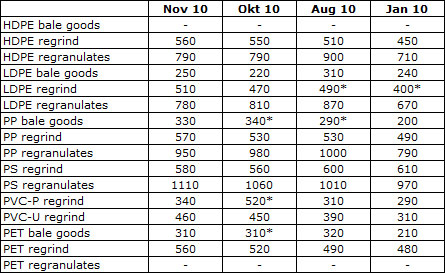

The evaluation of the data from the plasticker price index for November shows a tendency towards slightly rising prices for the standard plastics quoted, namely according to the motto "Two steps forward, one step back". Regrind is quoted at a higher price, whereas the quotes for bale goods have remained more or less stable and the prices of regranulates are inconsistent. The quotes fluctuate between - 30 /t and + 50 /t. As far as standard plastics are concerned, the November quotes for PS granulates increased by 50 /t compared to the previous month. The forecast of the December quotes shows that the trend described above will continue. The prices of PET regranulates are quoted at approximately 1000 - 1250 /t.

Secondary standard plastics

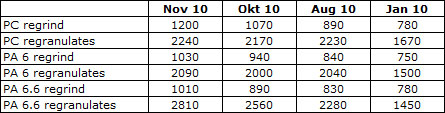

According to the plasticker price index for November, technical plastics have attained record prices. In plasticker, technical plastics are quoted at markedly higher prices, which have increased by 70 /t to 250 /t. The following price changes of greater than 70 /t can be reported for October compared to the previous month: PC regrind 130 /t, PA 6 regrind 90 /t, PA 6 regranulates 90 /t, PA 6.6 regrind 120 /t and PA 6.6 regranulates 250 /t. The forecast of the December quotes shows price stabilisation. To modify the advertising slogan for a herbal tonic produced in Germany: "Technical plastics recyclates - never before have they been as valuable as they are today."

Secondary technical plastics

*Supply figures too low to attain statistical significance

The quotes for secondary plastics, which are updated on an hourly basis, can be calculated using the price lists that are derived from the quotations published in the raw material exchange plasticker. The prices listed in this index are quoted with reservation - as the majority of the quotes submitted are not necessarily equivalent to the sales prices.Therefore, the information provided by plasticker indicates distinctly different market behaviour than the prices quoted by EUWID.

The EUWID price quotes refer to bale goods or regrind. The given prices were quoted for business transactions between sorting plants and sales agents or the processing industry, as the case may be. As a rule, prices refer to quantities in excess of 20 to ex works. The prices attainable in trade can differ considerably from the indicated price range in both directions, depending on the grade of the type of plastic material quoted. The abbreviations used for some grades refer to the list of waste plastics published by the German Federal Association for Secondary Raw Materials and Waste Disposal (bvse)/Bureau of International Recycling (BIR).