Market Report Plastics - March 2011

Information about the market for plastics is being presented by:

bvse - Bundesverband Sekundärrohstoffe und Entsorgung e.V.

1. The market for primary plastics

At present it is absolutely impossible to predict the impact that the political changes in the Arab states and thus the threefold disaster in Japan will have on the mineral oil prices. In week 10 the mineral oil price exceeded its previous record high of USD 114/barrel. On 16 March 2011 mineral oil was quoted at USD 107/barrel. The extent to which the above-mentioned changes will influence plastics production and processing is uncertain.

Plastics prices are still rising considerably. The markets for standard plastics and technical plastics are showing marked price increases. These price rises can be explained both by the increased precursor costs and by the continuously high demand. In March the demand for mineral oil, which has decreased due to the improved weather conditions, is likely to have a mitigating effect on precursor costs and thus on plastics prices. The latter will also be boosted by the continuously increasing demand for plastics. In the first quarter of 2011 the demand for plastics has thus been continuously rising. Furthermore, the building and construction industry is expected to soar after the winter break. Potential supply shortages, which are being caused by the reduced production of plastics, might also have a price-boosting effect. Over the past few months there has been a partial shortage in the global supply of plastics; this is also due to the production changeovers implemented by plastics manufacturers: several production plants have been temporarily closed down or are being technically reviewed. The prices of plastics are therefore likely to further increase in March and April.

In February the fourth price rise in a row led to an average quote of 1442/t for the ten types of standard plastics listed below, thus exceeding the previous month's price by 36/t. The price rises in PE and PP ranged between 20 /t and 40 /t; the quotes for PS increased by 70 /t to 120 /t, whereas those for PVC rose by 10 /t to 30 /t. The following prices are listed for the ten types of plastics in the EUWID Price Watch: LDPE film grade 1490 - 1530 /t, LLDPE film grade 1410 - 1450 /t, HDPE injection moulding 1340 - 1370 /t, HDPE blow moulding 1340 - 1370 /t, PS crystal clear 1580 - 1610 /t, PS high impact 1660 - 1710 /t, PP homopolymer 1460 - 1500 /t, PP copolymer 1510 - 1550 /t, PVC tube grade 1170 -1220 /t and PVC film/cables 1260 - 1310 /t. The prices of PET also continue to rise: PET for packaging was quoted at 1620 -1700 /t in February, thus exceeding the previous month's quote by 110 /t.

According to the EUWID Price Watch there have been continuous price rises in technical plastics since December 2009. In February 2011 the quotes for all technical plastics increased again. The prices soared markedly, namely from 100/t to 250/t! The considerable demand, which is accompanied by an insufficient supply and increasing precursor costs, is even likely lead to further price increases. In the EUWID Price Watch for February technical plastics were quoted at: PMMA crystal clear 2550 - 2650 /t, ABS natural 1950 - 2150, ABS white/black 2050 - 2250 /t, ABS mixed colours 2650 - 3000 /t, PC crystal clear 3050 - 3250 /t, PC GF 3350 - 3450 /t, POM natural 2300 - 2400 /t, PA 6 natural 2400 - 3600 /t, PA 6 black 2400 - 2600 /t, PA 6 GF reinforced 2750 - 2850 /t, PA 66 natural 3200 - 3400 /t and PA 66 GF 3300 - 3500 /t.

In the first three months technical plastics have already shown a higher return on the price rises than the stock exchanges! The considerable material costs for processing standard plastics and technical plastics are slowing the economy down insofar as liquidity is bound in companies, and insofar as only part of the high purchasing prices may, under certain circumstances, be passed on to the products - and, what's more, with a certain time lag.

2. The market for secondary plastics

The high demand from the primary markets continues to boost the secondary markets. The demand for recycled plastics is booming. However, the plastics recyclers are also suffering from the considerable input prices, as has been described above for virgin materials. Plastics are thus much too valuable to become subject to expensive waste incineration - irrespective of their origin! The recyclers are searching for sufficient high-quality input for plastics recycling and plastics processing. Recyclates are selling well in these markets. Compared to virgin materials, the quotes for recyclates and regenerates/compounds are very favourable.

The demand from the Far East for European plastics grades has not attained the previous months' level in February and March. At present experts in Asia assess the purchasing situation as having considerably improved for virgin materials and recyclates, which is why the demand for goods from Europe is decreasing. There are even indications that the demand for PET from the Far East is on the decline.

2.1 EUWID Price Watch

In February the EUWID Price Watch showed marked price increases in secondary plastics; these price rises ranged from 10 /t to 100 /t. Four price reductions were quoted for exports, namely for film grades, which decreased by 10 /t.

As far as PE post industrial is concerned, the February Price Watch showed price increases in regrind of an average 50 /t. The quotes changed as follows compared to the previous month: HDPE mixed colours 500 - 650 /t, HDPE natural 600 - 750 /t, LDPE mixed colours 450 - 600 /t, LDPE natural 600 - 750 /t and LDPE film natural 480 - 550 /t.

The post-user PE grades showed both price increases and price reductions. The quotes for film grade decreased slightly, namely by 10 /t, as the demand from the Far East is on the decline. The price of regrind from crates rose by 100 /t: LDPE shrink film natural (E40) 450 -500 /t, film transparent natural < 70 ΅m 350 - 390 /t, mixed film (80/20) 170 - 215 /t, mixed film (90/10) 230 - 260 /t, mixed film (98/2) 350 - 390 /t, HDPE hollow bodies mixed colours (C29) 180 - 330 /t, HDPE regrind from crates colour-separated 600-800 /t and HDPE regrind from crates mixed colours 550 - 650 /t.

PP: The PP market is still undergoing a change: on the one hand, the increased prices and the considerable demand for virgin materials are having an impact here; on the other hand, the massive interventions of Duales System Deutschland GmbH (DSD) in the secondary markets are showing their effects. As far as plastics processing is concerned, there has also been an increase in the material shifts towards PP. Prices have risen by an average 41 /t: film mixed colours (K59) 130 - 300 /t, film natural (K50) 350 - 450 /t, homopolymer mixed colours 450 - 600 /t, homopolymer natural 550 -750 /t, copolymer mixed colours 450 - 600 /t and copolymer natural 550-750 /t.

PS: The primary market trends towards price rises and supply shortages are also having a rather direct impact on the secondary markets for PS. In the Price Watch for February, the PS markets showed price rises of 68 /t on average. PS was quoted as follows: standard mixed colours 500 - 650 /t, standard crystal clear 550 - 700 /t, standard white 530 - 700 /t, high impact mixed colours 540 - 710 7t, high impact black 530 - 710 /t and high impact white 620 - 840 /t.

PVC: The prices of PVC are also rising, namely by 44 /t on average. These price increases range between 30 /t and 60 /t. PVC post-industrial is quoted at: PVC_P transparent 450-550 /t, PVC_P mixed colours 400 - 500 /t, PVC_U mixed colours 450 - 530 /t and tube grade mixed colours 400 - 530 /t. Windowframe regrind is quoted at: windowframe regrind white 580 - 710 /t, windowframe regrind mixed colours 450 - 530 /t and single-shade white 700 - 830 /t. The beginning of the boom in the building industry is likely to further boost the PVC prices.

PET post user: The success story of PET processing in Germany is about to come to an end. The purchasing prices are soaring out of reach for PET processing, which is assessed as being a model and key driver of plastics processing and recycling. In addition, there is still a high demand for materials, which can hardly be met by the amount of bottles remaining in Germany. Hence, processing capacity is being closed down or sold. Furthermore, the rising primary prices are continually pushing up the quotes for used PET bottles. In February the EUWID quotes for transparent and coloured PET increased by 50 /t each. The prices of used and disposable PET bottles are climbing from one peak to the next. PET is quoted as follows: PET transparent 510 - 580 /t and PET coloured 320 - 400 /t.

2.2 plasticker price index

As far as standard plastics are concerned, the monthly price indices for quoting HDPE bale goods and PET regranulates have been removed from the plasticker internet platform as there are not sufficient statistically relevant quotes.

In February the plasticker price index showed stable or slightly declining prices, whereas the latter have increased markedly in March. According to the price index the number of quotes has continued to rise. In February the eight price reductions in question ranged from 20 /t to 100 /t, whereas there were three price rises of 20 /t to 30 /t. Regrind was quoted at a stable or higher price, while the quotes for bale goods and regranulates decreased slightly. According to plasticker the prices of the following grades changed by more than +/- 40 /t in February 2011: LDPE regranulates by -9 0 /t, PET regrind by -100 /t and PS regranulates by +90 /t. In March the prices are likely to rise by 81/t on average! Thus the majority of standard plastics will probably attain the record levels of the summer of 2010. The quotes in plasticker indicate a reduction in trade during the Chinese New Year's celebrations (cf. the decline in the PET quotes for February).

Table 2: Comparison between various types of standard plastics (according to plasticker)

The plasticker internet platform extended the price index for technical plastics in February, which has resulted in the quotes for ABS, PBT and POM being indicated there now.

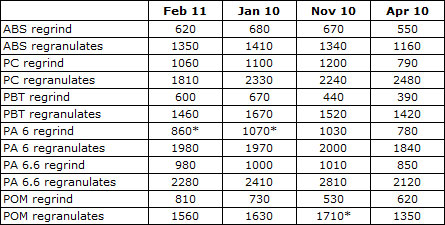

According to the plasticker price index the quotes for technical plastics decreased in February, whereas they have risen again in March. In February the prices decreased markedly, namely by 70 /t for PBT regrind, by 110 /t for PBT regranulates, by 520 /t for PA 6 regrind, by 130 /t for PA 6.6 regranulates and by 70 /t for POM regranulates; only the quote for POM exceeded the previous month's price by 80 /t. In March the quotes are likely to rise by 91 /t on average.

Table 3: Comparison between various types of technical plastics (according to plasticker)

*Supply figures too low to attain statistical significance

The quotes for secondary plastics, which are updated on an hourly basis, can be calculated using the price lists that are derived from the quotations published in the raw material exchange plasticker. The prices listed in this index are quoted with reservation - as the majority of the quotes submitted are not necessarily equivalent to the sales prices.Therefore, the information provided by plasticker indicates distinctly different market behaviour than the prices quoted by EUWID.

The EUWID price quotes refer to bale goods or regrind. The given prices were quoted for business transactions between sorting plants and sales agents or the processing industry, as the case may be. As a rule, prices refer to quantities in excess of 20 to ex works. The prices attainable in trade can differ considerably from the indicated price range in both directions, depending on the grade of the type of plastic material quoted. The abbreviations used for some grades refer to the list of waste plastics published by the German Federal Association for Secondary Raw Materials and Waste Disposal (bvse)/Bureau of International Recycling (BIR).