plasticker-News

| 2010-03-31 |

|

AMI: New reports review thermoplastic compounding and concentrates demand in North America

|

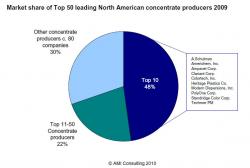

Two new reports from leading industry consultants AMI, highlight the recent development of the thermoplastics compounding industry in North America. AMI’s guide to the thermoplastics compounding industry in NAFTA is a comprehensive listing over 500 companies involved in the 13 billion pound NAFTA compounding industry. Since it last published the report in 2007, the industry has been through the worse recession in living memory which has seen a fall back in market demand in almost all sectors and a very different dynamic from that which existed in the early years of this millennium. This has led to financial challenges for all companies in the marketplace and a cutback in capacity and investment in the industry. Although the level of M&A activity and new investment has declined during this period there have still been opportunities for growth for some during this time. The more significant developments since AMI published their last edition of this report include Techmer PM acquiring Accel Color and thereby expanding its offering of custom color to the molding industry; Ingenia developing a new facility in Texas; A. Schulman acquiring the operation of ICO Inc. which gives them a significant global position in the supply of rotational molding powders; Teknor Apex acquiring the technical compounding business of Chem Polymer thereby expanding its participation in engineering polymer segments; and Alloy Polymers acquiring facilities from Ampacet for toll production of products. As in previous editions, the aim of this guide is to provide accurate and up-to-date information on all the compounding plants listed, whether independent or integrated into polymer production. This information has been compiled using AMI’s extensive knowledge of the industry on a global basis and not only provides a directory and listing of compounders within the NAFTA region, but also an overview and summary of the current status of the industry with information on the production of compounds and concentrates. The specific dynamics of the North American concentrates market are further detailed in the second edition of AMI’s report: "Corporate performance and ownership among thermoplastic concentrate producers – A review of North America’s 50 leading players." In the past several years there have been a number of significant changes in the industry structure as producers have sought to expand their product range or their geographic coverage. In addition to some of the changes mentioned above, other significant corporate changes include Breen acquiring the PVC coloring business of Teknor Color in March 2009 and Clariant acquiring the liquid color business of Ricon/Rite Systems in 2008. Ampacet has continued its expansion into custom color with the establishment of new investments in their DeRidder and Heath plants This move by Ampacet highlights another major strategic change in the industry which has been the move by larger concentrate producer which historically focussed on volume products, into smaller lot coloring. Techmer is an example of another which has been pursuing this strategy. As a consequence the color market has become much more competitive with a reduction in margins in many areas. AMI forecasts that the current economic downturn combined with a degree of maturity in the industry will see the process of plant closures and industry consolidation accelerating in the next 18 months as weaker companies go to the wall, while larger groups consolidate on a more limited number of manufacturing assets. There are approximately 130 companies manufacturing concentrates for the merchant market in North America. The three largest producers, all multinational in nature, have a cumulative market share of approximately 28% of the USD sales and 34% of the sales in volume. Ampacet remains the largest with its primary presence in commodity concentrates, although it has an increasing share of the custom color market derived from recent investments in this area. PolyOne is the second largest with a strong position in custom color as well as a moderate position in standard commodity grades. The third player is Clariant which is almost exclusively involved in custom color concentrates. More information: www.amiplastics.com |

Applied Market Information Ltd., Bristol, UK

back to news list back to news list |  back to top back to top |